We saw this one coming a mile away: Apy.center was what is known as a “rug pull.” Investors saw the rug pulled out from under them, and, unless you were one of the early ones, your money is pretty much gone.

So…what happened?

Step One: The Recruitment

It launched sometime early in the morning Friday, October 2, as a yield farm on steroids. In the interest of public service — we should note that we’ve done a few experiments like this during our three years blogging here — we decided to gamble what amounted to a family fast food meal on the Uniswap Pool behind $CAPY. We were also investing in a platform that was roughly 12 hours old.

We were 12 hours too late.

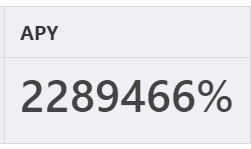

Here was the interest rate promised when we got in:

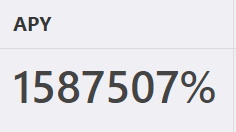

And here was the interest rate just two hours later:

Step Two: The Contract’s 72-Hour Rule (i.e. The Setup)

This is where everyone who was recruited into this fast-growing pool saw stars in their eyes: your money is locked for 72 hours. You can’t get any of the gains out til then, so you have no choice but to watch and wait and hope and pray that the rug won’t get pulled out from under you.

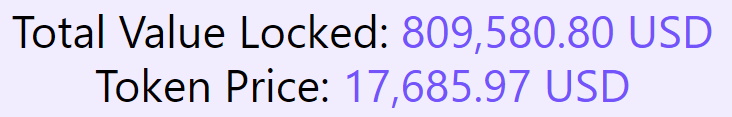

New money was indeed flowing in, to the tune of a half-million TVL (total value locked) by Saturday morning (36 hours after launch).

One of the fastest-growing Telegram channels we’ve ever seen served as an additional recruitment tool, with more money flowing in and, at around the same time of the above snapshot, interest rates promised that were still huge.

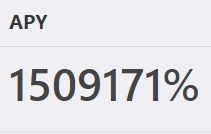

The clock/time bomb was ticking, but Sunday still saw huge POTENTIAL returns:

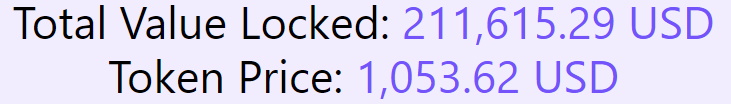

With the first investors just a few hours away from being able to take their investments out, it was just a matter of time. Here’s a TVL snapshot from Sunday evening, US Central Time:

And here’s this morning’s post-rug-pull TVL snapshot (we slept in til 6:15, since we were powerless to stop any movement; our funds were locked so the only potential gains, all on paper, weren’t real):

AND, just moments ago, 9:25 a.m. Central Time in the US:

What Have We Learned?

Chasing quick returns? That’s human nature. Looking at nutty interest rates that seem impossible, you may have succumbed to the masses: “I want some of that.”

The creators of this mystery coin set it up in such a way that, while the code appeared to be air-tight, there was no possible way to make any money unless you were one of the first users. No one in their right mind was going to hold onto their gains for any longer than they had to, and the new money that went in was obviously going to pay the old money that was in first. The first few investors — who were likely also the creators of this coin — played psychology, word-of-mouth marketing, and the lure of insane, out-of-this-world returns to get new investors on board fast enough to ensure that maybe the first 5 investors were getting mass profits.

It’s a classic Ponzi scheme.

Again, DYOR, and Don’t Be Surprised if You Get #REKT.

Be careful out there, folks.

Leave a Reply