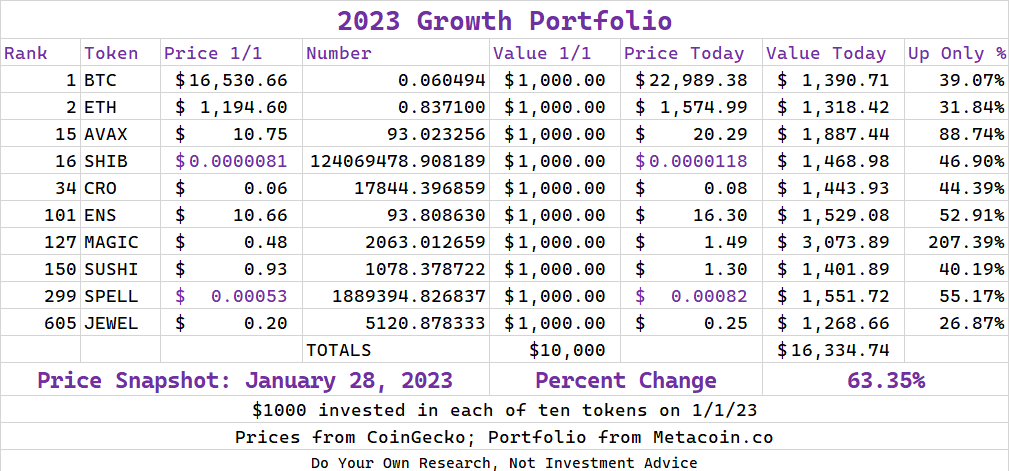

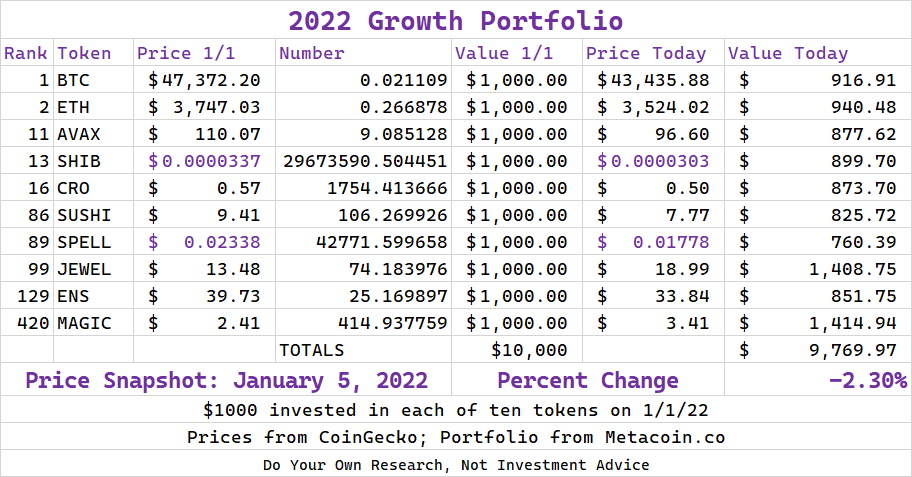

The cryptocurrency landscape is evolving at breakneck speed, making 2025 an exciting yet challenging year for investors. With blockchain technology continuing to expand its reach into financial services, gaming, supply chain management, and even artificial intelligence, the opportunities are vast. Whether you’re a seasoned crypto investor or just entering the space, understanding where to put your money can make all the difference. Here’s a detailed look at the 10 best crypto investments for 2025.

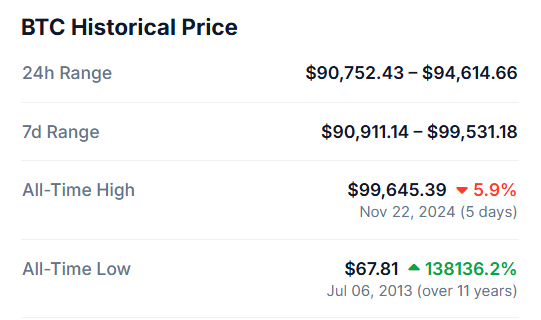

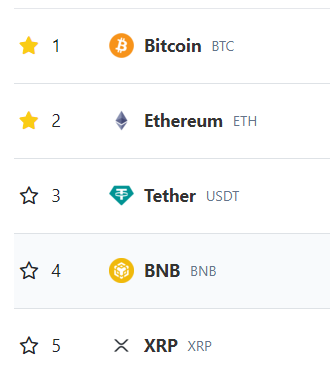

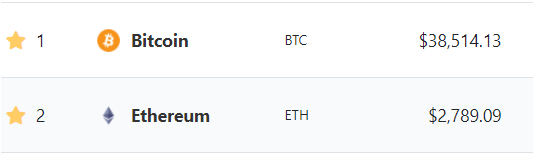

1. Bitcoin (BTC)

Market Outlook: Despite the emergence of thousands of altcoins, Bitcoin remains the king of cryptocurrencies. As the most widely adopted and secure digital currency, it continues to be a safe haven for both institutional and retail investors.

Why Invest:

- Deflationary asset with a capped supply of 21 million BTC.

- Increasing adoption as “digital gold.”

- Hedge against inflation.

Risks:

- Regulatory scrutiny.

- Energy concerns related to mining.

Verdict: Bitcoin remains a cornerstone of any balanced crypto portfolio.

2. Ethereum (ETH)

Market Outlook: Ethereum is the leading smart contract platform and the backbone of decentralized finance — known widely as “DeFi” — and NFTs.

Why Invest:

- Successful transition to proof-of-stake (PoS) in 2022 with Ethereum 2.0.

- Expanding Layer 2 ecosystem (e.g., Arbitrum, Optimism).

- Massive developer community and continuous innovation.

Risks:

- Competition from other smart contract platforms.

- Scalability concerns.

Verdict: Ethereum’s dominance in DeFi and smart contracts makes it a solid long-term investment.

3. Solana (SOL)

Market Outlook: Known for its high throughput and low transaction fees, Solana has quickly risen to prominence as a top competitor to Ethereum.

Why Invest:

- Lightning-fast transactions (65,000 TPS).

- Strong ecosystem for DeFi and NFTs.

- Backing from major investors and partnerships.

Risks:

- Outages and technical vulnerabilities.

- Centralization concerns.

Verdict: Solana’s performance improvements and growing ecosystem make it a compelling choice for 2025.

4. Polkadot (DOT)

Market Outlook: Polkadot aims to create an interconnected blockchain ecosystem where different chains can securely communicate with each other.

Why Invest:

- Pioneering interoperability between blockchains.

- Parachain auctions drive demand for DOT.

- Strong backing from a passionate developer community.

Risks:

- Complex technical design.

- Intense competition in the interoperability space.

Verdict: If interoperability takes center stage in the crypto world, Polkadot is poised to thrive.

5. Cardano (ADA)

Market Outlook: Cardano is a peer-reviewed blockchain platform with a focus on sustainability, scalability, and security.

Why Invest:

- Focus on academic research and rigorous testing.

- Continuous upgrades (e.g., Hydra scaling solution).

- Commitment to decentralization.

Risks:

- Slower development pace compared to competitors.

- Questions around adoption and ecosystem growth.

Verdict: Cardano is an appealing investment for those who prioritize research-backed innovation.

6. Chainlink (LINK)

Market Outlook: Chainlink is the leading decentralized oracle network, enabling smart contracts to interact with real-world data.

Why Invest:

- Essential for DeFi, NFTs, and other blockchain applications.

- Partnerships with industry leaders across finance and tech.

- Expansion into staking and hybrid smart contracts.

Risks:

- Dependence on broader blockchain adoption.

- Increased competition in the oracle space.

Verdict: As a critical infrastructure piece, Chainlink’s role in the blockchain economy makes it indispensable.

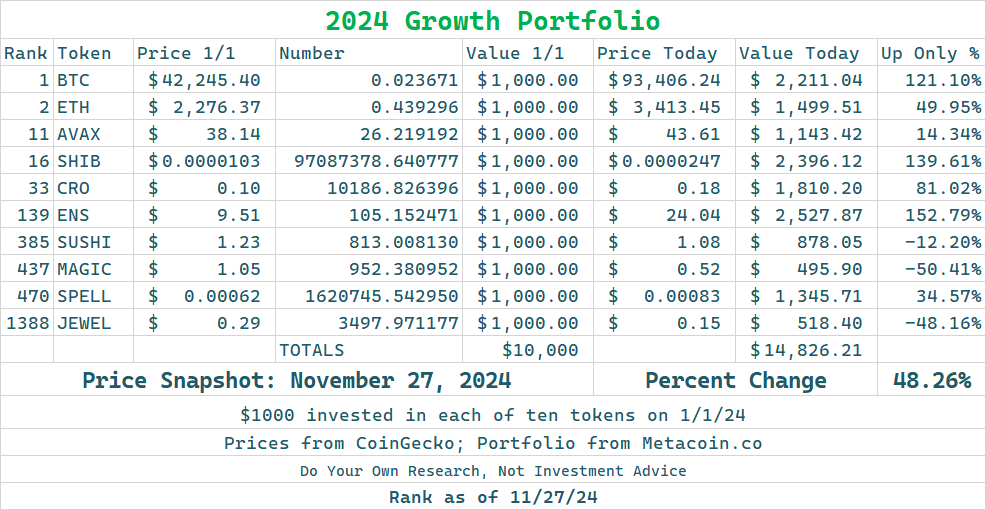

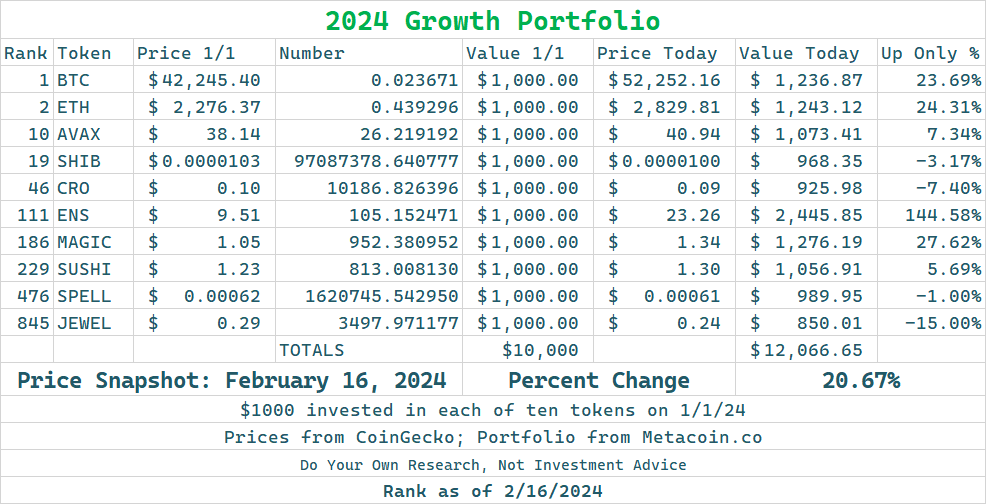

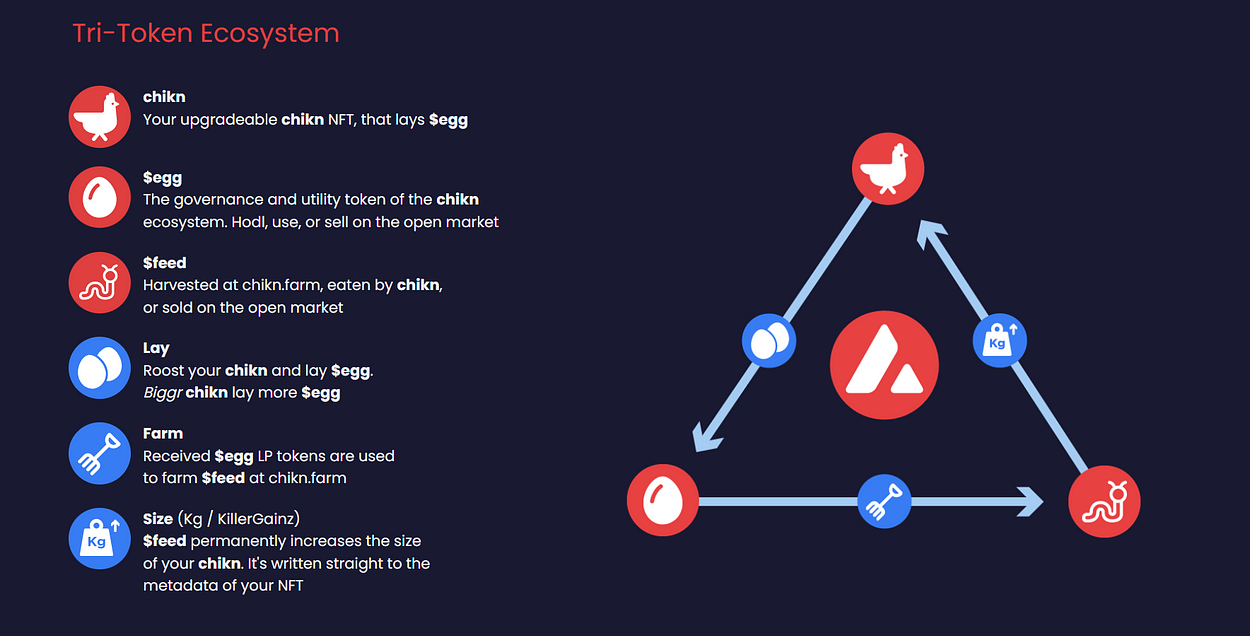

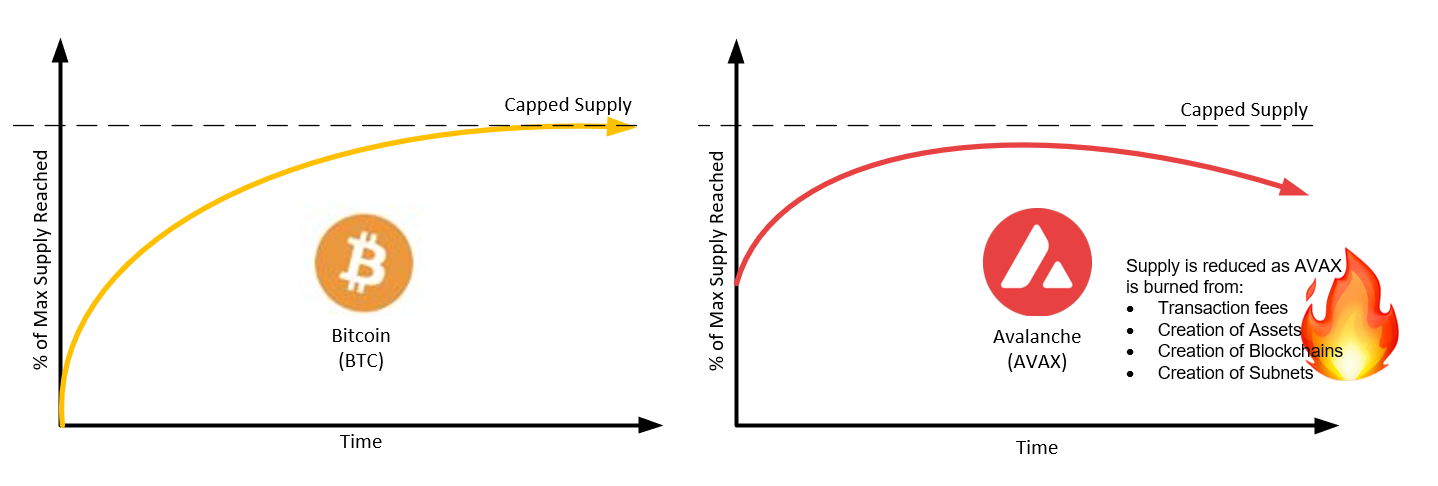

7. Avalanche (AVAX)

Market Outlook: Avalanche has positioned itself as a fast, scalable smart contract platform with a strong emphasis on interoperability.

Why Invest:

- High-speed transactions and low fees.

- Subnet architecture allows for customizable blockchains.

- Robust ecosystem growth in 2024.

Risks:

- Competing with other Layer 1 solutions.

- Potential regulatory challenges.

Verdict: Avalanche’s innovative approach to scalability positions it as a major contender in 2025.

8. Cosmos (ATOM)

Market Outlook: Cosmos is often referred to as the “Internet of Blockchains,” aiming to create an interconnected blockchain network.

Why Invest:

- Unique focus on interoperability and cross-chain communication.

- Strong developer ecosystem.

- Introduction of liquid staking and new governance features.

Risks:

- Competing with Polkadot for interoperability dominance.

- Slower ecosystem growth compared to Ethereum and Solana.

Verdict: Cosmos remains a top choice for investors betting on a multi-chain future.

9. Arbitrum (ARB)

Market Outlook: As a leading Layer 2 solution for Ethereum, Arbitrum aims to improve scalability and reduce fees while maintaining Ethereum’s security.

Why Invest:

- Rapid adoption by DeFi protocols and dApps.

- Strong transaction volume and user growth.

- Clear roadmap for further decentralization.

Risks:

- Dependency on Ethereum’s performance.

- Competition from other Layer 2 solutions.

Verdict: With its proven scalability improvements, Arbitrum is a solid bet for Ethereum believers.

10. Polygon (MATIC)

Market Outlook: Polygon has transformed from a simple Layer 2 solution to a comprehensive ecosystem for building scalable dApps.

Why Invest:

- Strong ecosystem partnerships (e.g., Disney, Reddit).

- zkEVM rollout enhances security and scalability.

- Proven track record in onboarding major Web3 projects.

Risks:

- Competition from newer Layer 2 solutions.

- High reliance on Ethereum.

Verdict: Polygon’s consistent growth and innovation make it a top-tier investment for those looking to bet on Ethereum’s scaling solutions.

Final Thoughts

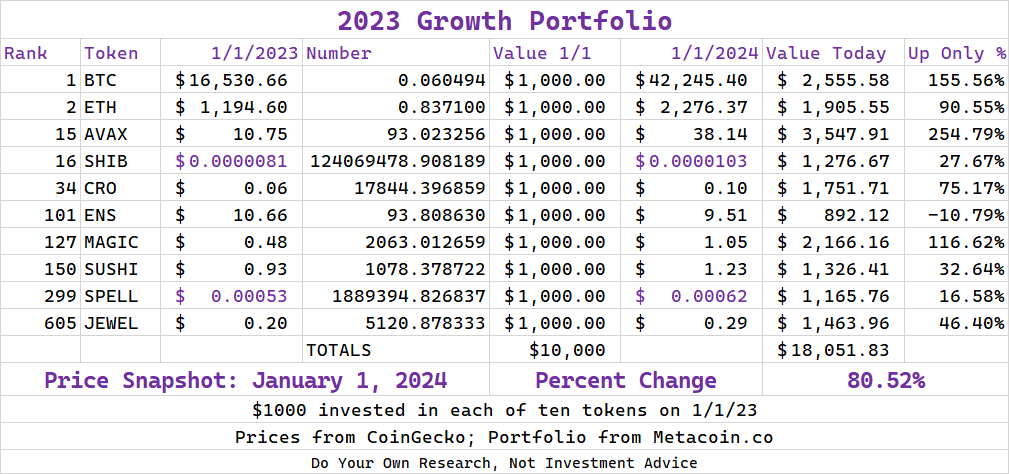

The crypto market in 2025 will likely be shaped by both technological advancements and regulatory developments. Bitcoin and Ethereum remain foundational investments, while platforms like Solana, Avalanche, and Arbitrum present high-growth opportunities. Projects focusing on interoperability, such as Polkadot and Cosmos, cater to the growing demand for seamless blockchain communication.

Before making any investments, it’s crucial to conduct thorough research, stay updated with market trends, and assess your risk tolerance. Diversifying your crypto portfolio across different use cases—from DeFi to interoperability—can help mitigate risk and maximize potential returns. As always, only invest what you can afford to lose and consider consulting with a financial advisor.