If you’re looking for a bright spot, any bright spot, where do you look? Darn good question. We don’t know, either. But here are a couple things to help. Maybe.

It’s Not as Bad This Morning as It Was Overnight

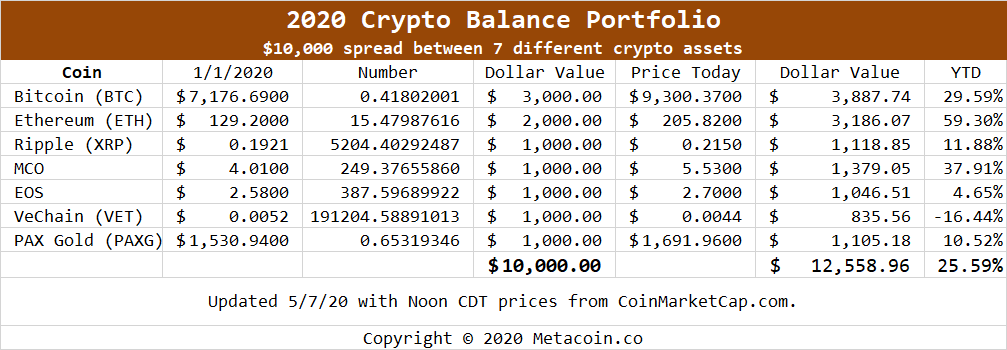

Behold, the numbers from the 2022 Crypto Growth Portfolio. The columns next to price are (first) 1-hour change and (second) 24-hour change.

Sell in May and Go Away has been replaced by “buy stuff an hour ago, watch it go up 5% on average, then sell it all and buy some foodstuffs.”

BTW, your $10,000 investment in the 2022 Growth Portfolio is now…$6702.

At Least You’re Not LUNA or UST

(If you are holding one of those or you’re part of the teams behind those…scroll on to the next subhead. Trust us.)

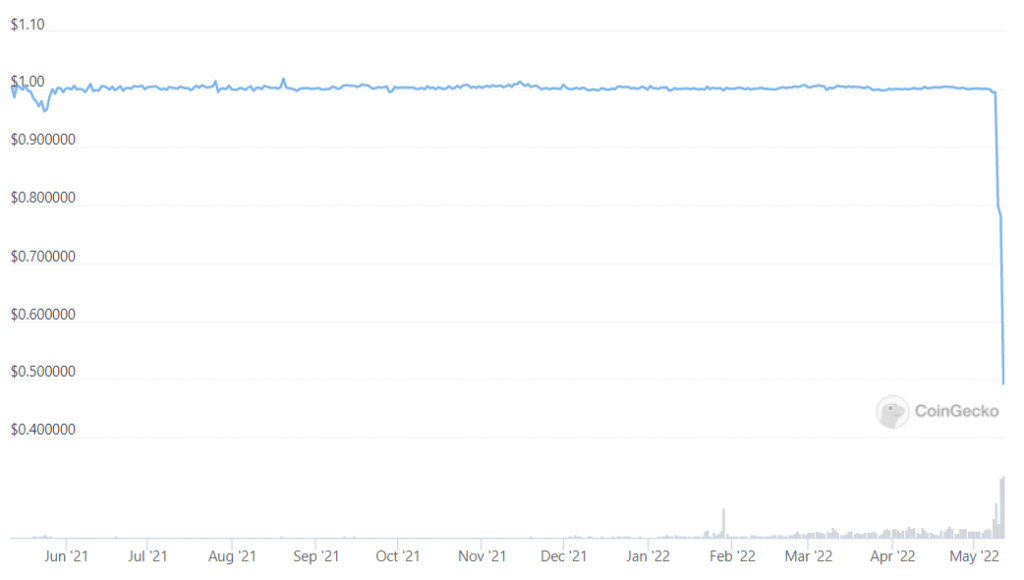

Here’s a chart of what happened overnight to UST.

This is after yours truly thought they had somewhat kinda righted the ship after sorta kinda having one of those weird days the other day.

Still, this is a coin that is pegged to the US Dollar and uses something called “an algorithm” to keep its price at $1.00 Or so we thought; but, as a wise man once told me, sometimes the quants get it wrong.

360 days of being thisclose to $1 each. And then the rug gets pulled. It’s Soros-level market manipulation (Learn more about that here: Soros.) It’s not done.

Below you’ll find a 24-hour price chart for $LUNA, which backs $UST.

Then There’s $COIN

Oy. Coinbase is having a rough go of it, eh? Much will be discussed about the company’s growth — whether too much too quick or the post-IPO blues — but it’s really a yikes moment.

(We won’t even mention the infamous “Jim Cramer Albatross” rating the stock a buy all the way up to $475.)

Carnage, Carnage Everywhere

The bubbles are popping left and right; not just in crypto. Used-car marketplace Carvana has laid off 12% of its staff. While you’d *think* this has something to do with inflation and used-car demand, you’d be slightly right but actually way wrong.

This is about that “Irrational Exuberance” that the Fed warned us about back before they became a meme.

At Least Inflation Is Better, Right?

The narrative machine has kicked in already: it slowed (from 8.5% last month, but that’s year-over-year) but it actually went up (0.3% month-to-month). And Gasoline isn’t bad because the index fell, but energy prices went up year-over-year.

Now What?

“RETVRN” is a common cry among trads on Twitter. Better days ahead if we go back to what better days were like before. Or something like that.

Good luck.