You don’t really think we’re gonna make it, do you?

Internet sub-cultures are a wonderful thing. Sometime last year, a combination of NFT purveyors and OG crypto traders started to adopt the phrase “gm” as a means of wishing each other “Good Morning.” It’s really a fine line here. Do it right — simply use the two letters, don’t use capitals, don’t repurpose the General Motors logo — and you’re part of the crowd. You’re Shiv and Tom in the screenshot below. Happy. Complete. Enjoying a good time. Celebrating life.

Do it wrong and you’re Kendall Roy, the punch line of the joke everyone but you is in on. (Watch the video. Cringe with us.)

Shoehorning a Succession reference into a blog post notwithstanding, “gm” evolved and “WGMI” was added shortly thereafter — at least by my measurement of the timeline, which could be off a hair, don’t hold me to it, DYOR and all that — to underscore the optimism that the crypto and NFT communities bring to the world. We’re Gonna Make It.

OR “Ain’t No Stopping Us Now,” as both McFadden and Whitehead reminded us sometime around 1979*.

We’re Gonna Make It! The optimist is on board: crypto is the future! NFTs are adding value to the economy and giving artists new life!

The pessimist reads the asterisk below.

* IIRC, the song was adopted by the 1979 Baltimore Orioles as their answer to the 1979 Pittsburgh Pirates’ choice of “We Are Family” by Sister Sledge. The Pirates came back from a 3-1 deficit to defeat the Orioles in the 1979 World Series; I won 50 cents off my Dad.

Which Brings Us to Our Point: NGMI

Shortly after either learning about the WGMI acronym or reading about the untimely demise of Messrs McFadden and Whitehead, new lingo was created: NGMI. Not Gonna Make It.

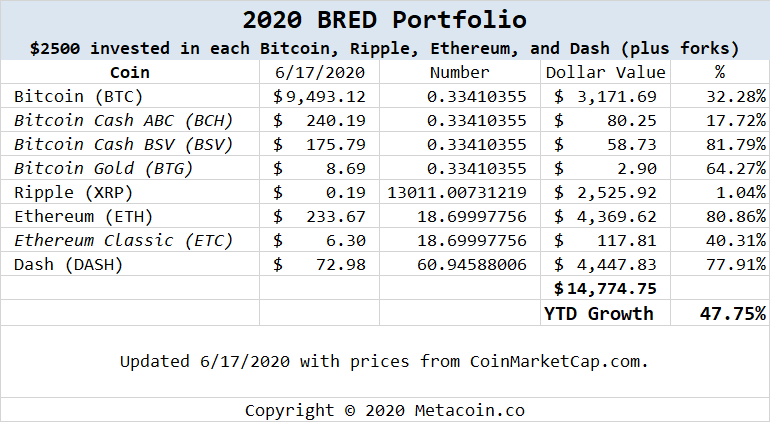

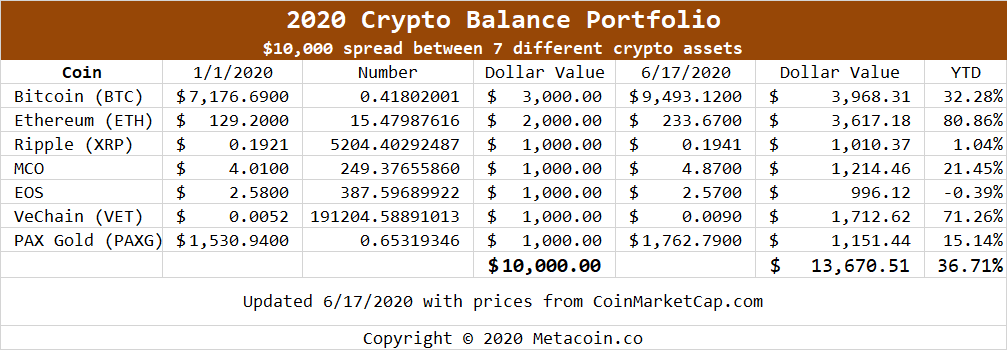

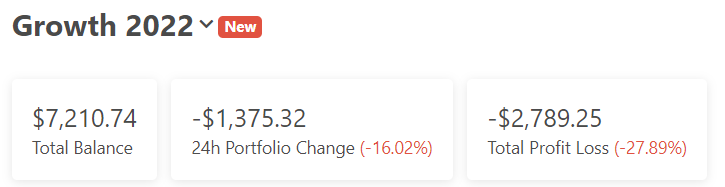

Egads! That kinda stinks, right? We launched the Growth Portfolio a couple weeks back on this here site and our goal was to give you, Gentle Reader, a basket of those coins that can give you the best opportunity for potential success. Big coins, mid-sized coins, up-and-comers that are taking advantage of the NFT-based web3 economy: it’s all there!

And it’s getting pummeled, as is everything else.

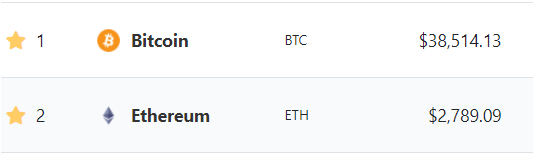

BTC is below $40,000, ETH has dropped below $3000. The end is nigh!

This Blog Post’s Title Is Tongue-in-Cheek

We really don’t know how to make sense of this market the past couple weeks. Our own holdings are down nearly a third since the beginning of the year. We won’t even begin to call a bottom, or else we’ll look like this guy.

Or we could guess that this guy (below, Fed chair Jerome Powell) will bring new people to crypto writ large through the Fed’s (possible) creation of something called “digital cash:” this is one of those “CBDCs” being bandied about in other countries.

We also *could* start talking about new NFT developments — seems like everyone is getting in on the action, right? — and see that the challenges to OpenSea from Crypto.com and Coinbase probably say we’ve only just begun.

Our Point: Don’t Give Up Just Yet. Or Do Give Up.

In any event, here are a couple concepts to embrace:

- Do Your Own Research. “DYOR” is one of the acronyms we use often around here. Don’t rely on us to tell you what to do. Sniff out a few other folks, check into CT (“Crypto Twitter”) and find out what people are talking about.

- Experiment. We’ve gotten in early on a couple coins. We’ve also blown it on a couple, too. (Our stake in this one, for instance, was purchased when the price was about 80 cents each.) And we’ve created a series or two (or three) of NFTs, with limited success. But, again, we’re not afraid of experimentation.

- Enjoy the Ride. The main reason yours truly is involved in this space is because he finds it bloody fascinating. Not every project is going to be eye-catching to you, not every token launch is going to make sense, and not every bit of lingo is going to be clever. If it’s not fun, then maybe it’s not for you?

gm

Keep at it. Or become a monk.

We’ll be here either way.