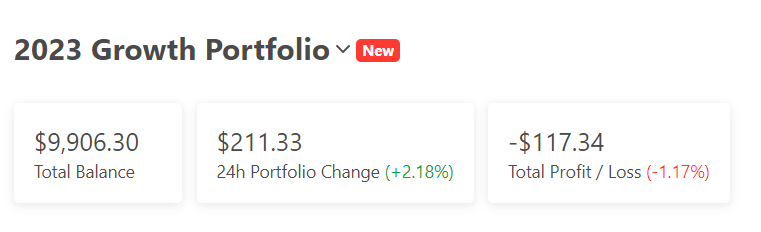

So far so good for the 2024 Growth Portfolio.

Here we are, on the way to another wacky crypto year. And things are looking…up.

If you’re new here, welcome! We write about crypto and trends and investments and the attempt to make sense of it all. We’ve been at it, off and on, for (checks notes) NEARLY SEVEN YEARS! (Here’s our very first post: 5 Things to Watch During the Tournament.)

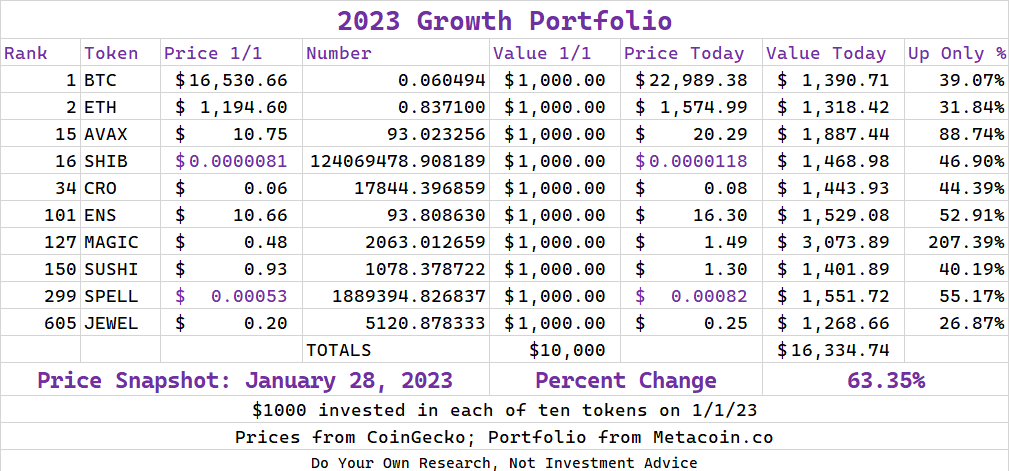

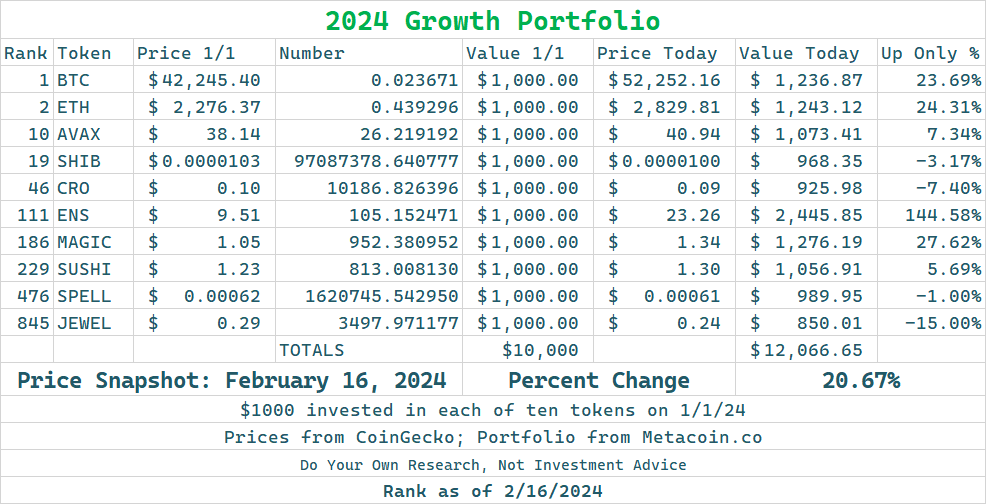

And one of the things we do here is create hypothetical portfolios that you can use to hedge your bets. (DO YOUR OWN RESEARCH. NOT INVESTMENT ADVICE.) We’ve done so for a few years now and we have had some fun with it; our Growth Portfolios have been the most interesting to follow. 2022 was the first one and, after a few tweaks here and there, we’ve settled on a decent mix of Traditional Crypto (BTC, ETH), Platforms (AVAX), DeFi (SUSHI) and some others (see below). 2023 did pretty, pretty well.

How Bout 2024?

Some thoughts on what’s here…

Bitcoin Is Very Much Alive

Story time: Back in my high school speech team days, there was a competitor who was talking about the “Peace Corps” but pronouncing it “Peace Corpse.” When she yielded to questions, one smarty pants in the audience asked “Is the ‘Peace Corpse’ alive or dead?” Her response: “Oh it’s very much alive!”

Bitcoin, too, having been declared dead more often than…well, insert whatever thing here…is on a tear so far in 2024. Up 23.69%. We’ll take it.

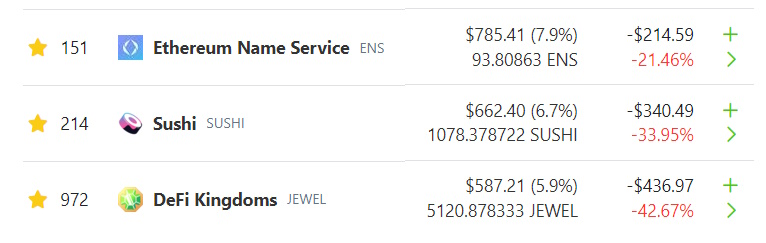

If You Bought ENS, You’re Enjoying a Ride

Ethereum Name Service is rocking AND rolling, but last year it…didn’t really rock. Or roll. Unless rolling downhill is a thing.

Timing is everything, though: quite a few folks, we would surmise, just didn’t sell after it imploded, hoping for a return to glory. And, with an all-time high north of $83, it’s going to take a while to get back there.

What is $MAGIC and Why Is it the Leader?

We’ve written about MAGIC before. MAGIC could be part meme coin, part…something else. Honestly, it’s a gaming coin and that’s where we’re kinda…huh? So we don’t know enough about it and the Treasure.lol website — YES IT HAS A DOT-LOL DOMAIN — but we will admit the game looks cool and it was fun a couple years ago to watch it go from next to nothing to 6 bucks.

(Then we watched it go back down again. Sigh.)

But, lo and behold, it’s 2024 and it’s the leader among our portfolio, up 27 percent. Yay, MAGIC!

Anyway, There’s Your Portfolio

Again, do your own research. These are ideas, and some of them could eventually drag your portfolio down.

Go get ’em!