Okay, folks. It’s time. First, the disclaimer:

We don’t provide individual advice. Past performance is not indicative of future results. Seek professional investment, financial, and legal advice before investing in any asset, let alone cryptocurrencies, which are a brand-new, emerging class of assets. Read our recommendations and take them with a grain of salt, do your own research to back up your investments, and be prepared. Use this site at your own risk.

Now that we’ve scared you, here’s our post.

We gotta admit that this is a rather fun universe we’re entering here. Part dot-com boom (before the bubble), part options trading when it was just invented. And part gambling, because, let’s face it, some of these ICOs and emerging cryptocurrencies are like playing the lottery or playing roulette.

That being said, though, the idea of creating an entirely new form of money, based on computing power and solving code and a lot of stuff that’s way over the heads of mere mortals – well, that’s just plain thrilling.

So, as we jumped head-first into the pool with this post, we tried to think of the particulars that could make these coins actually go crazy in the market. Some of this is going to be a little too techno, and some of it is going to be real-world. All of it is mere speculation: I can’t see the future.

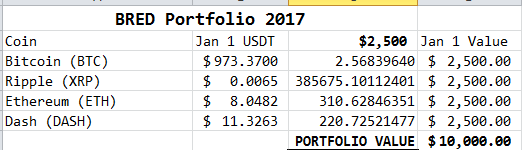

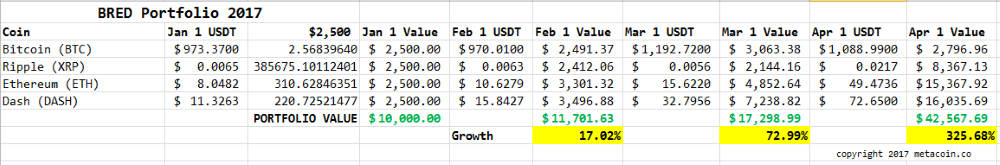

But if you take our “BRED Portfolio” post as an example of our ability to be soothsayers, we might be on to something here. (If you had invested in the BRED Portfolio on April 1, you’d be up 12.08% in just three weeks.)

Enough background. Let’s dive in: Four Coins that Could Quadruple By This Time Next Year.

#1: Litecoin

The first-ever #subway restaurant accepting #LTC! And soon there will be more. Make #Litecoin great again! @SUBWAY @SatoshiLite @slushcz @ pic.twitter.com/idpiV5hl8i

— Oldrich Peprla (@OldrichPeprla) April 21, 2017

That does it for me. Seriously, though, once you’re starting to see a coin used side-by-side with Bitcoin, you now know it’s got real-world functionality.

Litecoin (LTC) is about to hit its fourth birthday, and it’s actually well below, on a USDT basis, its all-time high of $50.27 a coin (achieved in November of 2013). It’s that factor first and foremost on our list of reasons why this coin could quadruple by this time next year.

Volume of late has been huge – 9-figures worth traded a couple times in April – but its utility, to the tune of transactions per day in the thousands (more than double the number of Dash transactions, per this chart), tells us that the coin is actually being used out there in the wild.

Over the weekend, the LTC/BTC pair was trading at .01 to .012-to-1 – support kept the price above .01 pretty much all day on Saturday. This is another good sign.

Expect volatility, though – I’d hazard a guess that it may bounce around in the .009 to .01 range for awhile. That’s a good price to jump in at.

Mandatory mention of Segwit here. LTC is moving toward Segwit. Segwit is important. Let’s all talk about Segwit!

Disclosure: We’re long Litecoin at the present moment.

#2: Dogecoin

Yeah, I can’t believe it either. A coin named after an Internet meme…you CANNOT be SERIOUS? Dogecoin. I’m serious.

DOGE had more than 10,000 transactions in the past 24 hours – more than Litecoin; third in the rankings behind Bitcoin and Ethereum – and its market cap is $50m+. So it’s legitimate.

What really jumped out to me? The average transaction value. It’s pretty low ($310 or so) when compared with others; the median transaction of around $3.28 tells me that people are using this coin as a Venmo substitute. (Whether that’s true or not, I don’t know. But I’m guessing fewer lattes are purchased and more random paybacks and IOUs are covered with this one.)

Dogecoin trades around 35-38 Satoshi of late. Its all-time low is 15. I see more mainstream use in its future. I wouldn’t be shocked to see it in the 60s in a month or so.

#3: Digibyte

Did we mention Segwit above? We did. Here’s a link to the latest on Digibyte Segwit activation.

Did we mention Segwit above? We did. Here’s a link to the latest on Digibyte Segwit activation.

To the layman, this means little, but to those in the know, here’s the general consensus:

- Segwit is important; its adoption will drive the price of the coin adopting it higher

- It may never happen with Bitcoin, it might happen with Litecoin

- It looks imminent with Digibyte.

Place your bets: with a current market capitalization of less than $10m, do you think the bargain hunters will start shopping for the coin that is the first to activate Segwit? Honestly, quadrupling might be a lowball estimate. We’d accumulate anywhere in the low 100 Satoshi range.

Disclosure: we’re long Digibyte right now.

#4: Bitcoin

Didn’t see THAT one coming, did ya?

Didn’t see THAT one coming, did ya?

Let’s assume that Bitcoin stays around $1200 USDT, giving it a market cap of right around $20B. Now, let’s also assume that Bitcoin becomes the word synonymous with all digital currency, crytpocurrency, and altcoins (even though it’s NOT an altcoin), sorta like “Kleenex” brand facial tissue is everyone’s word for facial tissue.

I was going to say that there’s all sorts of crazy economic stuff going on in the world, but heck, I’d focus on two things that should drive the value of Bitcoin way up in the next 12 months:

- Brexit

- The tenuous state of the EU and the Euro

Now, that might get folks moving toward the US Dollar – which is a fair guess – but if you factor in the dicey nature of the US economy and the role of the Federal Reserve in money printing…do you think the masses will want to start putting their money into the US Dollar? Especially when an infinite supply of dollars could, technically, be printed?

Do you think a $5,000 price point for one Bitcoin is out of the question?

Disclosure: We are currently long Bitcoin.

Additional notes: we do not make any trades in any of the listed coins here for 24 hours after the date we publish this report.