Thus began an email that arrived – as if on cue – about an hour ago. It doesn’t quite matter that they were talking about a completely different subject; it was from one of the scores of services I subscribe to and it is so a propos to what has gone on this morning.

Prices of Bitcoin, Ethereum Drop…

But why?

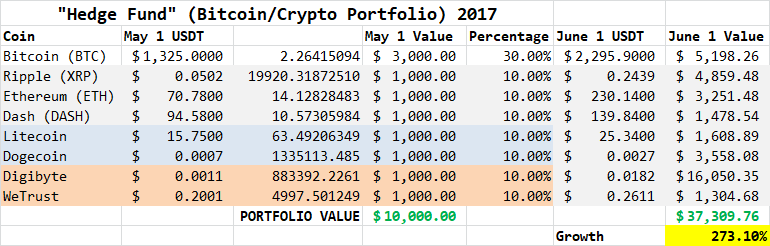

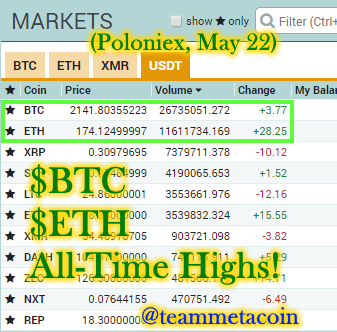

Just last week, I was mentioning on Steemit that I saw a real possibility for Bitcoin to hit $5000 and Ethereum to hit $400 (again, it was already there once) by the end of Labor Day weekend. It seems, though, that China had other ideas.

China Says NO to the ICO

This is not totally surprising – China rumors have been out there for a few weeks, and what looked like a coming crackdown at the beginning of the weekend turned into an actual crackdown early this morning, as Chinese regulators – SEVEN OF THEM – said that ICOs were, in fact, illegal under Chinese law.

We can’t explain it as well as Coindesk can, so go check out their article.

This impacted Bitcoin because it’s the main currency that lots of people use, or are chasing, or have as the basis of their portfolio.

This impacted Ethereum because it seems to underpin the vast majority of ICOs and “token sales” – so of course it would drop.

This Will Impact Your Portfolio…

Just how much it will impact your portfolio remains to be seen, and depends upon how much China exposure you have, too.

For instance, one of our favorite new exchanges is Binance, and its BNB coin/token powers the exchange. BNB has been on a little bit of a roller coaster, and our own holdings have gone from 19,000 Satoshis up to 60,000 Satoshis (and then some) then back down into the 12K range today, before trading at 21,000 or so as we write this.

SIDEBAR: Here’s a REFERRAL LINK to a new exchange coming called Altcoin Exchange. Worth checking out, as you can potentially share in the trading fees if you refer enough users.

We’re prepared to weather this particular storm, but you may not be so inclined.

What About Other Altcoins?

Pick your poison: every coin on Poloniex’s list is down…except for BURST.

It might look like a bloodbath – and maybe it IS a bloodbath – but now we’re back to the point of this article…

This could be that buying opportunity you’ve been waiting for.

Ripple? 4685 Sats. (“Sats” is short for “Satoshis,” in case you’re wondering. And a “Satoshi is .00000001 Bitcoin.)

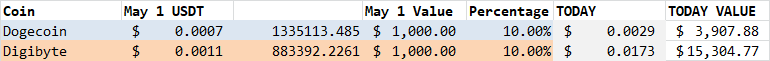

Digibyte? 420 Sats.

Bitshares? 2725 Sats.

It’s possible – possible, but Do Your Own Research – that these coins could be in ranges that they may not be in ever again. If you read up on each project and spend enough time on the forums, you could possibly convince yourself that any one of these coins might be poised for a rebound, and taking off for heights unknown.

Place Your Bets (and Hedge Them)

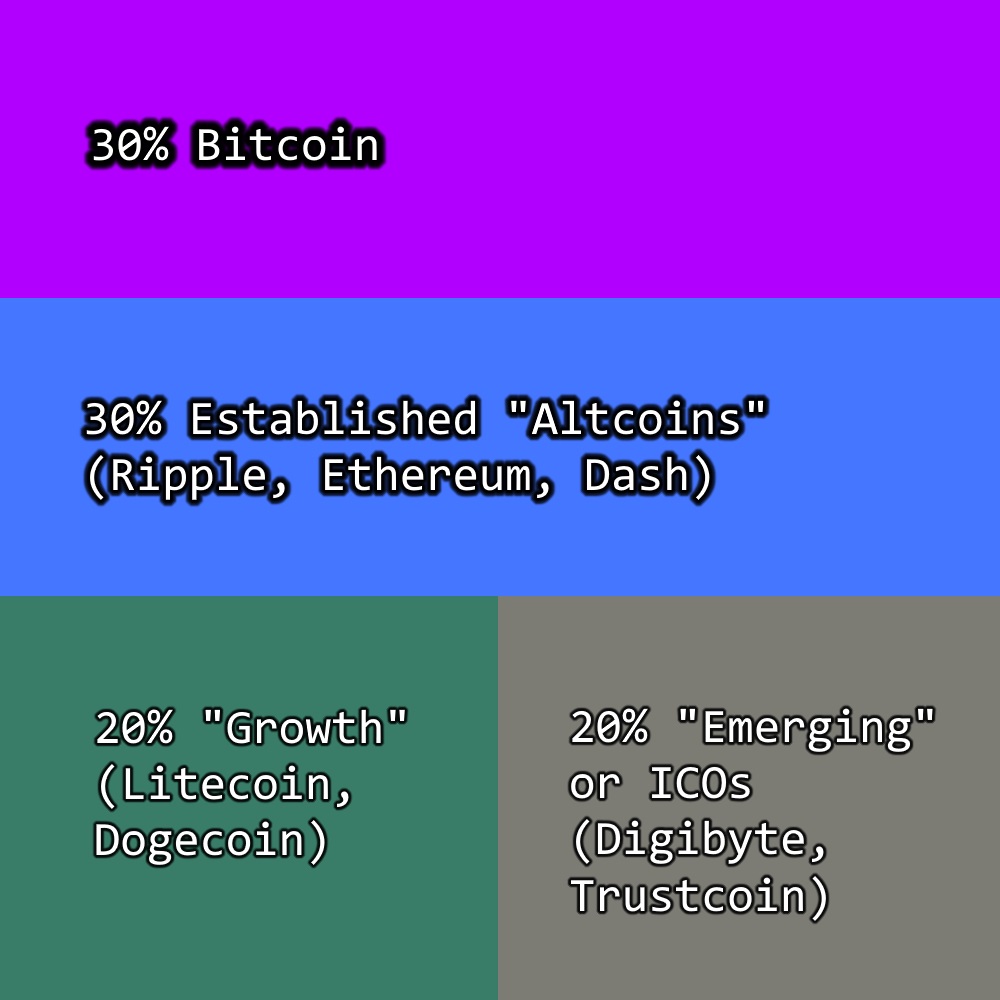

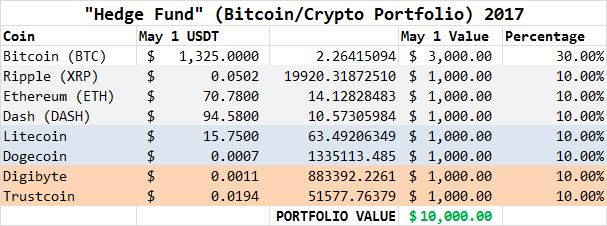

We have, since day one here, advocated spreading your risk around. It’s one of the reasons that we recommend the Passive Income Platforms like Bitconnect (AFFILIATE LINK over there) and Control Finance (another AFFILIATE LINK).

It’s also why we recommend having your coins on several exchanges if you’re trading, and storing them somewhere like a Trezor (AFFILIATE LINK) or in another cold storage solution if you aren’t.

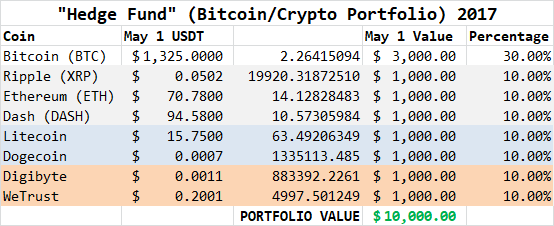

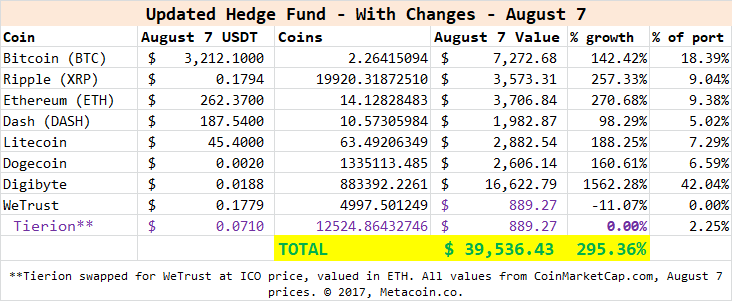

AND it’s why, once you get started (usually with Coinbase – hey, whaddya know, another AFFILIATE LINK over there!), it’s never a bad idea to have your holdings spread out between multiple coins with multiple uses. (It could be one reason why the BRED Porftolio has done so well this year: four different coins, each with four different use cases.)

Is THIS the Buying Opportunity YOU Were Waiting For?

It could be. In any event, if you’re looking for a time to get off the sidelines and into the action, this might be that time.