Here’s yet another post with a couple blatant caveats: (1) THIS IS NOT INVESTMENT ADVICE and (2) NOBODY KNOWS WHAT’S GOING ON.

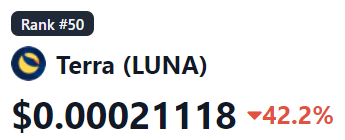

We’ve had a couple weeks here in CryptoLand. You name it, it’s down. Take our 2022 Growth Portfolio: a hypothetical $10,000 investment with $1,000 each in ten different crypto assets. Thank God it’s only hypothetical.

It was a bloodbath. It still is kinda sorta a bloodbath, in that nobody knows if BTC saw the bottom, or if ETH’s move to Proof of Stake (known colloquially as “The Merge”) is going to be all that, or if stablecoins will stabilize.

And whether or not you’re better off throwing darts.

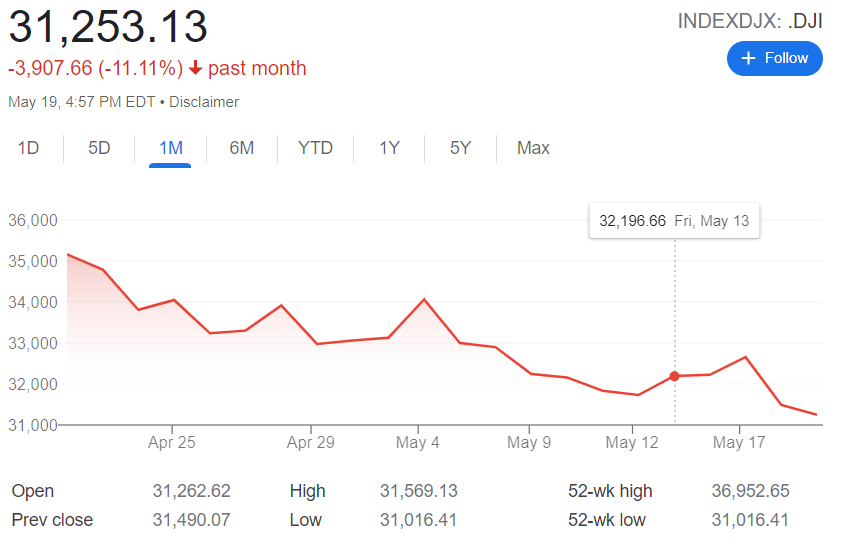

At Least the Stock Market Is Okay, Right?

Let’s answer the question in the meme with a screenshot.

The problem, though, is that to keep propping up the stock market, The Fed is going to need to thread the needle on interest rates. Too much of an increase and the stock market tanks. Too little of an increase and you can’t catch up with inflation.

So you’re painted into a corner because the stock market is so important to everyone’s 401(k) plan and the inflation rate — which is caused, DUH, by ALL THAT PANDEMIC MONEY PRINTING — is so important to everyone’s standard of living that it really REALLY stinks to be Jerome Powell right now.

Now, Let’s Talk Inflation. Cue Karen Carpenter…

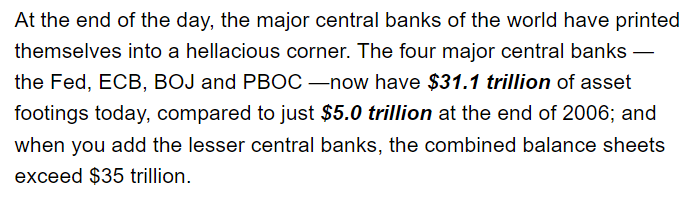

As David Stockman — President Reagan’s former Budget Director, native Midwesterner (shout-out to Michiana!), and future guest on my YouTube channel (call me!) — told us on Doug Casey’s Dispatch a couple weeks ago, we are collectively screwed. And it’s mostly thanks to central bankers.

That part about J-POW having a rough job is not an understatement; the corner we have been painted (printed) into is troublesome. Investors don’t know which assets to invest in, and the average Joe is more worried about real-life things like gas prices or the cost of food.

So…What DO You Buy?

We follow a few financial people on Twitter, on YouTube, and elsewhere. We’re nailing Jell-O to a tree here.

Here’s Joe from Heresy Financial, telling us (SPOILER ALERT) that Treasurys might be the way to go. Here’s another YouTuber — one we found from typing in “where to invest 2022” into the YouTube search bar, then going with the first one we found from the month of May — suggesting individual stocks. And here’s CNBC, taking a break from its “How This [NUMBER] Year-Old [JOB DESCRIPTION] Made [LARGE AMOUNT] By [ZAGGING WHEN EVERYONE ELSE ZIGGED AND/OR INHERITING MONEY]” template (shown here) to give us a whole host of ideas of where to invest in an inflationary environment.

Feel free to grab any of these ideas and batten down the hatches, right?

We’d refer you back (AGAIN) to our series called SHTF. Volume 1 is here and Volume 2 is here. But these are *mostly* crypto-related ideas (with a break for some precious metals and cash on hand). And that isn’t even guaranteed, if the last few weeks are any evidence.

TL;DR: See Elmo

Buckle Up. Good Luck.