To say that Do Kwon — the man behind $LUNA and $UST and the precipitous drop of both this past week — is a bit of a pariah might be the understatement of the year. It’s time, then, to launder his reputation.

On the website Ordinary Times, Dave recently shared his “Own The Narrative” framework in the context of student loan forgiveness. We put together a list of 8 rules — guidelines? concepts? — for owning the narrative, and we showed how the plan could unfold. Other real world issues took precedent in the various news cycles, but we think the framework still makes sense.

We mention that because we’re watching Do Kwon’s Reputation Laundering take place in real time (Sunday Morning, CDT in the USA), and we’re going to see which of the rules he’s applying already.

We’ll have to re-order these rules for today’s Reputation Laundering, but we’ve found half of them already being employed.

Be The Name Dropper (Rule 5)

We think Laura Shin is one of the top journalists working in crypto today. She certainly has the industry bona fides and has a popular podcast with thousands of listeners. You could argue that there is no better choice to go live with than Laura.

This is exactly what Do Kwon is doing right now. It’s “Name Dropping,” but raised to the nth degree. I’ve been watching for 40 minutes already at 9 a.m. Central Time.

If you are in reputational trouble, you need to associate with someone like Laura, and you need to do so quickly.

Start at the Finish Line (Rule 1)

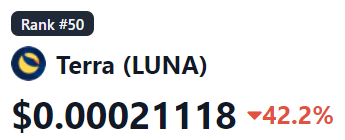

“UST will repeg and LUNA $1 per LUNA next Week.” That is a bullish “Finish Line” statement. It is not very believable right now — if your coins drop to the tune of the below graphic, telling us that you’re going to be on the medal stand isn’t something we can bank on.

This morning’s price also tells us how unrealistic this is.

This works hand in hand with another of the rules…

Make Hubris Your Friend (Rule 3)

To get to $1, $LUNA needs to go up not 5, not 50, but 5000 times from here. Meanwhile, Mr Kwon is on the podcast smiling while talking about things like Korean crypto crashes. (9:10 a.m. Chicago time.)

Use Malleable Definitions to Your Advantage (Rule 6)

The definition of “stablecoin” is probably the most malleable one in modern crypto. These coins — they started this whole mess — are supposed to be pegged to real US dollars (or another similar asset) that is then backed by a cryptocurrency equivalent. In other words, if I put the stablecoin up on a blockchain platform, and it’s worth $1, I should then use my Bitcoin to buy US Treasurys or another stable asset. Questions have come up for the last few years about just how much of the asset is parked somewhere with other coins; but where the Do Kwons of the world got into trouble was using their own algorithmic magic AND their own crypto asset as the “stable” asset backing the token.

1 UST equaled 1 USD until it really didn’t, because, instead of having $10,000 in US T-bills to back $10,000 in UST, they had $10,000 of their own coin. It was ready for an exploit, and, if you want a primer on how that went down, watch this video from two months ago.

This Is the Most Egregious Crime

The worst Reputation Laundering crime is being committed, and it’s not any of the above rules, is this:

THIS IS A SCAM. Do not do this. Never send crypto to anyone with the hopes of getting more crypto back.

How NOT to Launder Your Reputation

Since it’s crypto, and it’s perceived to be the Wild West, and Mr Kwon is out in Singapore and is from Korea and has the perception of a world-traveling vagabond, his moves are not surprising.

And they are completely, totally, 100% awful.

He’s torching the reputation of his own coins, his own projects, and his own name in real time. The rest of the industry will have a ton of work to fix this.