Since *everyone* is jumping on the “IT’S A BULL MARKET” bandwagon of late, we thought we’d take a step back for a half-second.

Sure, the trappings of a bull market are there: the quick runs northward, the new entrants, the “OMG HODL” chants. And the $11,000 mark sure is nice.

SO – SHAMELESS PLUG – AND CLEARLY MARKED AFFILIATE LINK: get some crypto over at Coinbase, will ya?

But the real purpose of this here post is…playing the long game. Which means doing a couple things — beyond the HODL moments everyone will tell you about, or the “put 1% of your overall net worth into crypto” that the experts will hit you upside the head with — that might not payoff for months or even years. That’s okay. Time to play the long game with us.

**Let’s be as blatant as possible with this warning: do your own research. Your experience will vary. Not a substitute for investment advice or legal advice. You are on your own — we are just sharing information.**

Long Game Idea 1: Megacryptopolis

I shared my predictions with my buddy Von Likenstien from VRUoT. I was most curious about my timeline, as I said that Megacryptopolis (NOTE: THAT’S AN AFFILIATE LINK) was going to be huge BUT it’s going to take a year.

Did he agree? And how does Megacryptopolis compare with Decentraland — that other interesting land-grab style virtual world game that became rather large a couple years back?

“The big difference,” he told me, “is that, instead of depending on novice programmers to build the system, MCP3D is a complete, robust system. Plus, its economy is closer to that of the Sims.” Taxation is another element that is well thought out in MCP3D, according to Von.

From my perch: I am really new to the virtual world thing, and I never really played the Sims. Nor did I get on board with whatever that virtual world was several years back (must have been huge, right? I forget the name). But there’s something intuitive about the virtual world of Megacryptopolis. And the idea of millions of Chinese users having access to the game on their mobile phones this fall is extremely compelling.

Time Horizon: Probably a Year.

Long Game Idea 2: NFT Artwork and Collectibles

This idea isn’t just one site to visit, it’s an entire concept: Non-Fungible Token (NFT) Artwork and Collectibles.

This particular subject came up when Von and I were trading notes about CryptoSkulls — likely because he sent me a message and said “get on this, bro.” So I did, and ended up with my very own CryptoSkull.

When I asked Von about my CryptoSkull, here was his response:

OpenSea is where a lot of these things get traded, and the fact that it’s a non-fungible token means that it’s really tough to counterfeit.

As always, with these types of things, you’ll use a tool like Metamask and your ETH will be safe (provided you keep track of your seed phrase and guard everything rather diligently).

Beyond CryptoSkulls, there are CryptoKitties and even the pets that come as part of your Citizen packs on Megacryptopolis.

Time Horizon: Immediate (ish*) to Two Years

*the reason we said “ish” up there is that, if you want to trade these things and try to make a buck or two, you most certainly can. OpenSea is one place to do trading — but it’s sorta thinly traded right now.

Long Game Idea 3: ENS

Ethereum Name Service is more than just a new top-level domain for the web. In fact, the TLD component is coming later — a year and a half away, according to Von — because the real reason behind ENS is to allow people to send crypto (Ethereum and ERC-20 and ERC-721 tokens) to each other without having to type out a really long address.

Here’s a long address from one of my accounts:

0xD0f4c9280D87ae84c2590164FA089487615Fb1c8

And here’s an ENS “shortener” for it:

jaimedimon.eth

(Yes, I know that Jamie Dimon spells his name “Jamie,” this misspelling was done for a variety of reasons, mostly for humor.)

Some of the domains are already trading, and it’s highly possible that big banks will want their own ENS, for defensive reasons and also to get into the crypto game easily.

Time Horizon: Immediate (flipping/trading) to Two Years

Long Game Idea 4: Urbit

When Von told me about this one, he said “it might blow your mind.” Honestly, it kinda did.

The primer on the Urbit site will tell you more — and it is quite clever — but it’s likely you may not totally understand exactly what they are doing here. (I sure didn’t at first glance. Or at second glance. I’m getting there, though…)

TL;DR from the site: it’s a completely different network of computers, of the internet, of the web. It has the potential to change the world of the web as you know it.

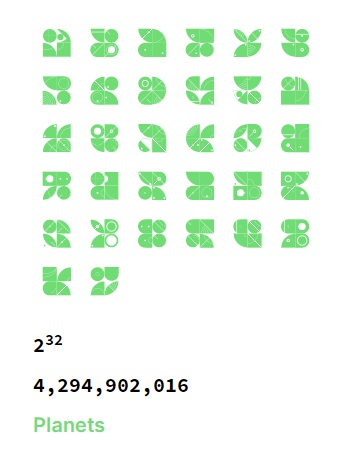

Galaxies are the big hubs — there are a small number of them — then stars, then planets (the addresses on which you build what appears to be your own personal server and bot machine thing). (Again, I’m not a programmer — so I’m trying to translate this from technical into not-so-technical.)

(If you believe the naysayers: this whole idea has taken forever and hasn’t gone anywhere in a dozen-plus years, so why bother.)

Me? I figured (again thanks to Von) that the thing I should do is at least get one of these limited-edition planet things and see what happens. Because there won’t be a ton of them; and each one not only has its own unique name (ours is ~larwyn-tadlen) but its own SYMBOL.

In any event, this one won’t take off for some time — but, in case it does, we’ve at least been part of one of the early land grabs. The network effect here might mean that we’re A FEW YEARS from these things taking hold and being used by the masses. Still, for what was an inexpensive investment for now (less than a cup of coffee), it’s possible that you could see one of those symbols on the cover of a magazine at an airport with the caption of “you could have bought this for two dollars in 2019, now it’s worth a million.” (That year could be 2049, though.)

Time Horizon: Five years, at least.

So there you have it: ideas for you to play the long game with. Some may seem out there, tougher to grasp than the “buy gold” or “have you heard about pork bellies?” ideas of yesteryear. A chance for you to start playing the long game.

Welcome to the brave new world of blockchain startups, where ideas range from the straightforward to the esoteric to the “what IS that?” Different angles toward distributed ledger technology, different industries impacted, and different levels of buzz, all in one emerging, exciting, and sometimes downright crazy industry.

Welcome to the brave new world of blockchain startups, where ideas range from the straightforward to the esoteric to the “what IS that?” Different angles toward distributed ledger technology, different industries impacted, and different levels of buzz, all in one emerging, exciting, and sometimes downright crazy industry. (So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.)

(So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.) Rates start at 7.7% and you can have your money in as little as five days.

Rates start at 7.7% and you can have your money in as little as five days.