Here’s why you’ll see some interesting things happening on the crypto markets.

EOS – June 2 Election of Block Producers

It’s a process that we’ve endeavored to understand here and we’re not totally there yet; but, suffice it to say, there’s about to be a whole lot of interest in what happens with EOS.

Why? Well, the crypto project that Dan Larimer is behind has a unique process where its users vote for the “Premier League” of 21 companies that become “block producers.” These “BPs” are incentivized with EOS tokens to keep the system running. (We’ve met a couple of the BP candidates in our crypto journey. If you want to learn more, suggested sites to check out include Block.one, EOS42, EOS New York, and EOS Canada. (Heck, there’s even a BP candidate in Oklahoma.)

The election – voting is also rather complicated – takes place on June 2, though the votes won’t be tabulated for a few days. Then, the continued jockeying begins – those that are in the top 21 need to stay in the good graces – so their systems can’t fail. If they do, 100 backups are ready to take their place.

It’s the culmination of a year-long EOS ICO: and it’s probably going to mean some serious movement – up, down, and sideways – in the cost of the EOS token.

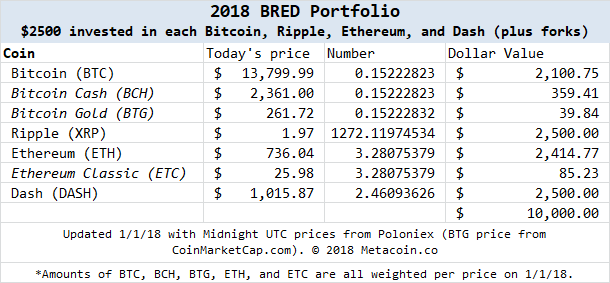

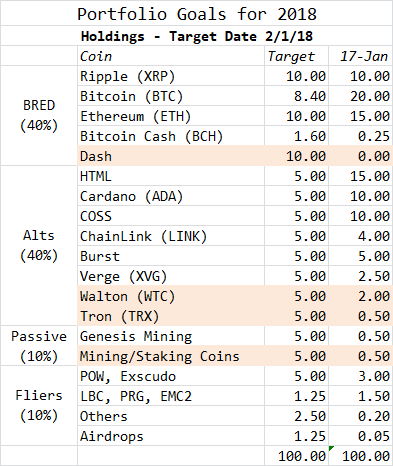

(Thanks to CoinMarketCap.com for the above chart.) Right now, we’re looking at a 30-day price range of $10.77 to $19, with the price holding steady around $12 or $13 the past couple days. But the math behind (1) becoming a block producer and (2) the ecosystem and the apps being worked on will probably drive speculators into the market this week. And next. And beyond.

No price predictions here – and DYOR, we don’t provide legal or investment advice – but don’t be surprised to see some extremes.

EON – Exscudo Could FINALLY Launch

Delays in projects are inevitable, and the Exscudo ICO didn’t raise a TON of money, so it’s not completely surprising to have seen this one stall a couple times. However, the developers shared the latest update on their Slack channel and…

It appears that the Exscudo exchange will launch by the end of the month. Which gives them a few days. We’re holding on.

We got interested in this project a year ago, invested a tiny amount in the ICO, and helped out with the bounty program. So we’re a little invested in its success. Fingers crossed.

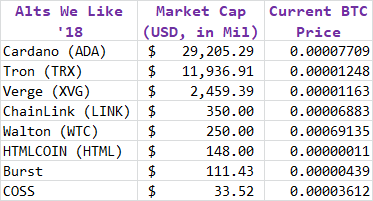

ADA – Cardano Has Been AWFULLY Quiet

Here’s the all-time chart.

On January 3, ADA traded at $1.22. It’s now trading at 18 cents. That could mean that the market was frothy at the beginning of the year, and now it’s a lot less so. It could also mean…well, it was a new project then – launched last fall – and maybe it’s still getting its sea legs.

Could it be the Ethereum killer? Maybe, maybe not.

Is it trading at a deep discount? Quite possibly.

And Two Projects We Helped/Are Helping With…

Quick update on both POW and Empowr.

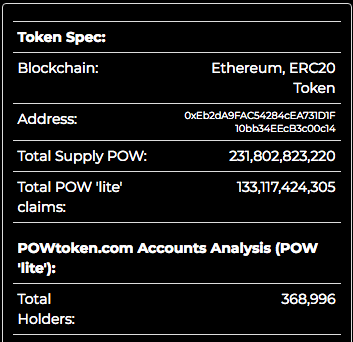

First, POW – they put the brakes on their latest developments to fix some system issues. So it’s thinly traded and the “bridge” that will let those who claimed tokens using their Facebook credentials move them over to the Ethereum blockchain was paused while they worked in the background. There’s confidence from the developers, though.

While we’re still bullish on the possibilities, we did pause our firm’s work with them in the interim.

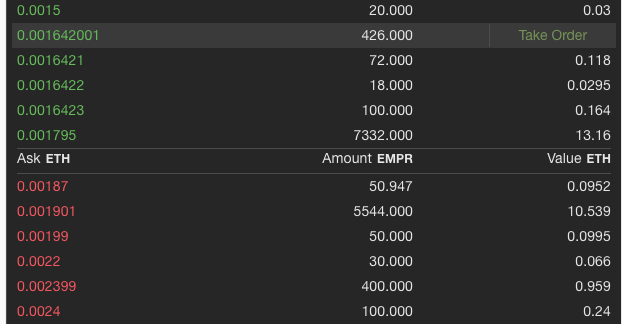

Empowr is currently trading on an exchange called Token.store. The price has stabilized as of late; but, like POW, it’s still really thinly traded.

With the downward movement this past week of Ethereum shares – dropping into a low-$500 range – each Empowr coin (EMPR) is worth about $1.30.

You earn coins on their system by engaging with other users on a site that looks a little like Facebook; but, it’s less intuitive, so if you do sign up, take advantage of the tutoring on the site from the “Success Coaches.”

Dave from Metacoin remains on the advisory board of Empowr. A project with some potential.

We predict a wild couple weeks on the crypto markets. Buckle up!