There used to be an adage in finance and investments that you’re best investing in those things you understand. This is why, as the (possibly apocryphal) story goes, Warren Buffett bought Dairy Queen: he understood ice cream and the franchise model, and “got” the concept immediately.

Warren Buffett is also old.

These days, the markets are dominated by Robinhood investors, by youngsters with a dollar and a dream, and by speculators hoping that Hertz will go up from pennies to dollars simply because pennies are cheap and dollars aren’t.

The Market #DeFi -es Logic

That’s deliberate, what we did with the subhead: logic is possibly defied by the decentralized finance market, colloquially known as #DeFi. Decentralized platforms — coins? tokens? businesses? not sure WHAT to technically call them — have entered the market and gone from zero to OMG in a few short months; one of these #Defi #Darlings (yearn.finance, or $YFI) has rocketed from 800 bucks to $13,000 in four weeks.

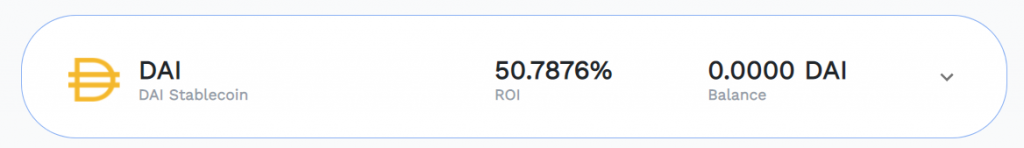

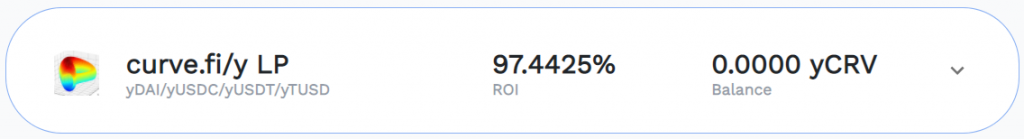

The screenshot above is from the Yearn website, and, specifically, the “Vault” tool on the page, where you can upload you coins — above is a DAI Stablecoin — and leave them there and make 50% interest. Right?

As we told you a couple weeks back — here’s the post on the Liquidity Machines Going BRRRRR — we were brand new to the concept of “yield farming,” and “liquidity machines,” and “stablecoin lending,” and interest rates that are straight up fire.

We had a couple ideas in a subsequent post (The Oldsmobile of the Crypto Market) for platforms that *could* catch fire; but, in the same breath where we told you to “do your own research,” we were doing our own research.

And we’re still not sure how it all works.

However, we have picked up a couple of things — and we thank a couple of power-DeFi users, who we’ll talk about later — so we thought we’d share some of the knowledge here.

First, Think About Your Bank

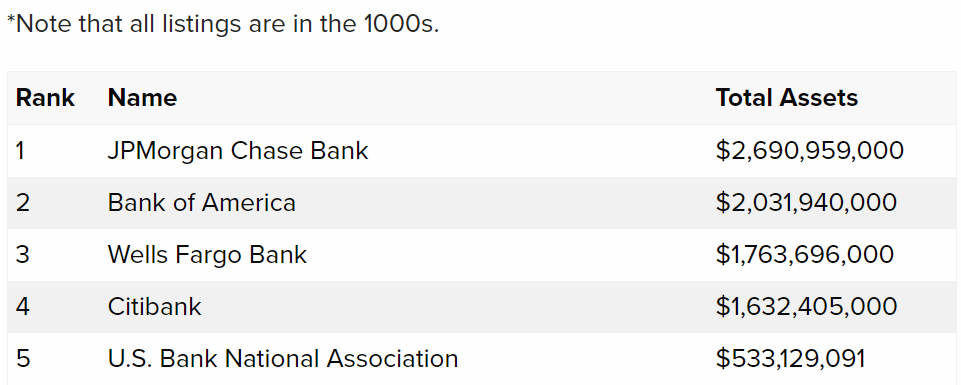

It’s actually quite fun to think about this Defi space as the equivalent to a bank: if you want to break into the top tier of banking in the US, you need to have trillions of dollars in assets. Like this, from a chart from MX.com, showing the top 5 banks.

Obviously, this counts your money and my money and everybody else’s money in this list; lots of deposits, lots of withdrawals, and maybe a few mortgages and certificates of deposit and car loans and…the list goes on.

The banks above make their money from interchange fees — the tiny percentages charged for transactions — or from banking fees — gee, why does my bank charge me $5 monthly just to keep my money there? — or from the margin spread between what they lend at and what they pay in interest.

(A truism from community banking way back when was the “3/6/3 Rule:” Pay 3% in interest on savings, charge 6% in interest on loans, and be on the golf course by 3:00.)

These days, you need a lot of money in your vaults — I mean on a ledger somewhere, because it’s all a line entry on a computer spreadsheet — to really make it as a bank.

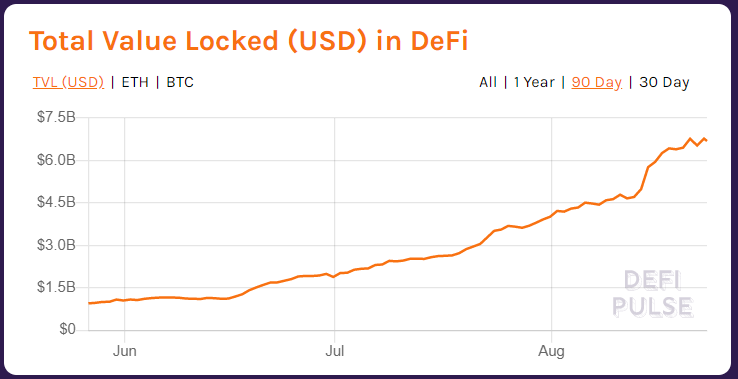

So, if we want to compare banking to Defi, how do we do it? Probably with a metric called “TVL,” or “Total Value Locked.”

We’re Just Getting Started

The website Defipulse.com has a great chart of where the industry stands when it comes to how much value is locked up in these decentralized finance platforms. Hint: It’s the top of the first inning and the pitcher hasn’t even faced the leadoff hitter yet.

Locked and Loaded?

Hardly enough is locked to even be ready to begin to just start to think about scratching the surface: $6 billion is nothing to the big boys or even the not-so-big boys. So it’s still really early.

Again, this is not financial advice, do your own research, and don’t invest more than you can afford to lose; but if you’re ready to start learning, we highly recommend resources from a chap called “Defi Dad.” One of his videos, on the site “Bankless,” is below.

Top of the First…Who’s the Leadoff Hitter?

If we’re just getting started and we think about this as the top of the 1st inning in a nine-inning game — and we think about DeFi as the visiting team playing against the Big Banks — we need a leadoff hitter. We need our Rickey Henderson.

For the uninitiated, Rickey Henderson was a baseball Hall of Famer who led off the first inning for his team by hitting a home run 81 times. Second-best on the list, Alfonso Soriano, did it 54 times.

(Dexter Fowler led off the top of the first with a home run in Game 7 of the 2016 World Series for the Cubs, but I digress.)

Anyway, if we’re going with our Rickey Henderson in this space, it has to be $YFI.

If you want to learn more about Yearn.finance, we suggest checking out this site: learnyearn.finance. They’re bullish as heck about the coin itself, and — while encouraging you (like we will) to “do your own research” — they make the case that the price of $YFI is possibly way undervalued.

The Flippening (Kinda) and Warren Buffett

Hey, let’s get back to Warren for a hot second as we wind up this post. One share of Buffett’s Berkshire Hathaway is $311,000. He hasn’t split the stock and doesn’t plan on splitting the stock.

Earlier this week, the price of $YFI exceeded the price of $BTC; while it’s not a “flippening” in that the market cap of YFI is dwarfed by the market cap of BTC, it’s still a psychological victory.

And, with the total number of YFI tokens capped at 30,000, with no more ever to be minted and 99.87 percent of the tokens circulating, if Yearn’s market cap were to get to 1 billion, that implies a price of $33,333.33 per token.

Bullish Case

If you aren’t convinced that we’re early in Defi, we suggest you check out the resources we’ve listed, do your own research, and strap yourself in.

In any event, DeFi is just getting started.

Speaking of getting started…

Here are a couple CLEARLY MARKED AFFILIATE LINKS, in case you want to buy a little of crypto to get into the game:

Crypto.com has a good chunk of the coins and you can tie them to their debit cards, which are pretty nifty;

And Coinbase.com will also get you started and is simple to use.

Both give bonuses to us with qualifying crypto purchases, and those bonuses help us keep the lights on, so to speak.