If you have a hard time keeping up with the latest in crypto, fintech, or any of the other things that keep the economy moving, join the club. It seems like just yesterday we were all sharing a laugh over the Crypto Winter and lamenting how we could have gotten so many ICOs so wrong.

Then, out of nowhere, comes “DeFi.” “Decentralized Finance.” Sure, it’s Bitcoin, but it’s not, because it’s different, and decentralized, and it’s another term that you’ll pretend to understand and nod in agreement when you hear about and then move on to something else.

WELL, SOMETHING ELSE IS HERE. IT’S LIQUIDITY.

It’s Not Your Grandfather’s Liquidity

If you want to read a debrief on what is meant by these “liquidity pools” that are de rigeur now, go here: Coindesk Liquidity.

If you want *my* take on these liquidity pools, read on.

Did I Mention I’m Clueless?

I decided to jump into the pool — double entendre was intentional there — by learning what I could about a site called Yearn.Finance. $YFI is like the other liquidity pools in that meet many of these criteria:

- New (with many having launched in the past few months)

- Mysterious (names like “Compound” or “Ampleforth“

- Volatile (see screener below)

- And in Beta with warnings that “in Beta” means “could get rekt”

How it works…in theory: you lend your coins into a pool and then those who need liquidity borrow and your pool lends your coins out at interest and you also get a share in the trading fees and it’s all dependent on algorithms and a number of variables, including whether or not there’s a need for the underlying assets and whether or not there’s a palatable interest rate and…

Liquidity in Action!

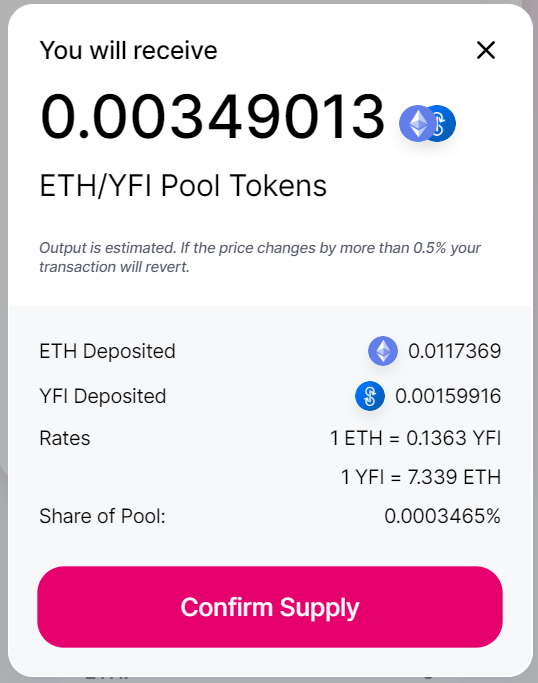

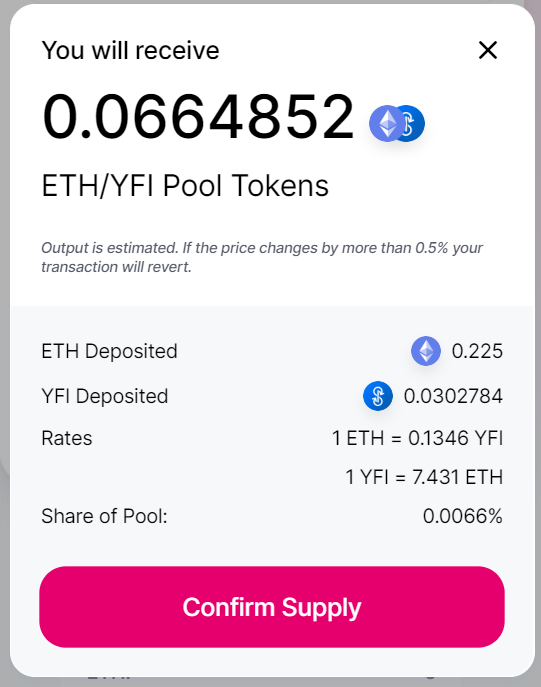

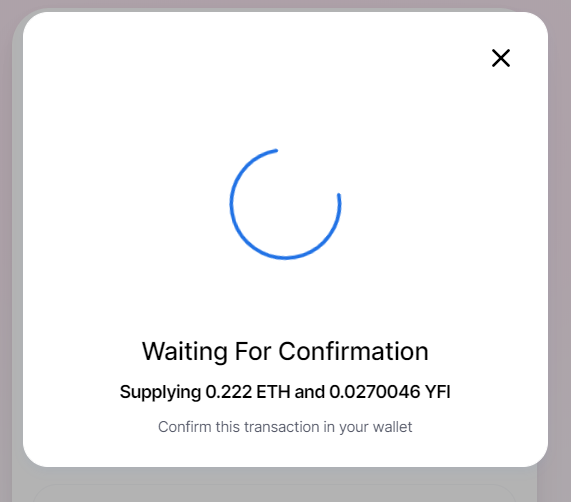

The above screenshot is, thank goodness, not the price at which I purchased YFI. I went to KuCoin to buy some and then…it failed. I tried again and…failed again. Finally there was success at something like $2000 a coin. Next:

I was the proud member of a Liquidity Pool and will now be printing money like Chairman Powell. Right?

Your Guess Is As Good As Mine

This is a serious FOMO game, as far as I can tell. Stories suggest large “whales” are making upwards of 50% a month on their deposits. Several hundred percent a year — or the equivalent — can be yours if you know what you’re doing, if your timing is right, and if the prices of these random liquidity pool tokens continue to give you the thrill ride of a lifetime.

Or not.

Once again, like everything in crypto, do your own research. You could lose everything. This isn’t investment advice.

And if anyone knows what is REALLY going on, let me know.

Final Warning:

I really fear these may be like some of the passive income “high yield” schemes we’ve seen on these pages. Which is why this small experiment is, indeed, small.

We’ll keep you posted.

(So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.)

(So if you think “Hey, I’ve got a great idea…” they’ve already checked that particular box.) Rates start at 7.7% and you can have your money in as little as five days.

Rates start at 7.7% and you can have your money in as little as five days.