We’re a few weeks past the GameStop Short Squeeze Apocalypse. Bitcoin has gone from $28,000-and-change on New Year’s Eve to north of $40,000. Altcoins seem to be flying off the shelves. Decentralized Finance is also on fire — if you pick the right one, natch — and the “degenerates” might be having their day.

So…what next?

Here’s some potential calm for the coming storm: a few ideas that, while they’re not financial advice and you need to DYOR (Do Your Own Research), could help you successfully hedge against the coming storms.

1. Just Buy and Hold Bitcoin

We’re reminded of a couple of conversations we’ve had recently with this little nugget of advice; both of the convos centered around “how do I get started?”

Bitcoin is…well…Bitcoin. If it’s not the centerpiece of a portfolio, that’s fine; but it’s also the core concept behind every single coin anyone uses. Without it, no crypto.

Ignore the fact that there’s a guy with a Twitter handle of “@russian_market” and somehow he got a blue checkmark — which gives him some sort of authority, right? — and take a look at his Bitcoin prediction for 2021.

Also consider the fact he may be smoking something.

[TIME FOR A CLEARLY MARKED AFFILIATE LINK: Get some BTC, or other crypto, on Coinbase here. We’ll both get a bonus with a qualifying purchase.]

But, if our Russian friend thinks Bitcoin is doing a 5- or 6x this year, shouldn’t we look down the list and…and…

2. Ethereum Is on Fire

If you’ve followed this space for a few years, one of the things you have learned is this: without Ethereum, crypto apps don’t work. In addition to being a currency unto itself — and one that’s trading at around $1800 as of this writing — on pretty much any of the app-centered parts of crypto, you absolutely have to have “gas” to operate. That gas is ETH. Without ETH, no trades on Uniswap, no liquidity pools on any other #DeFi app, and no yield farming to speak of.

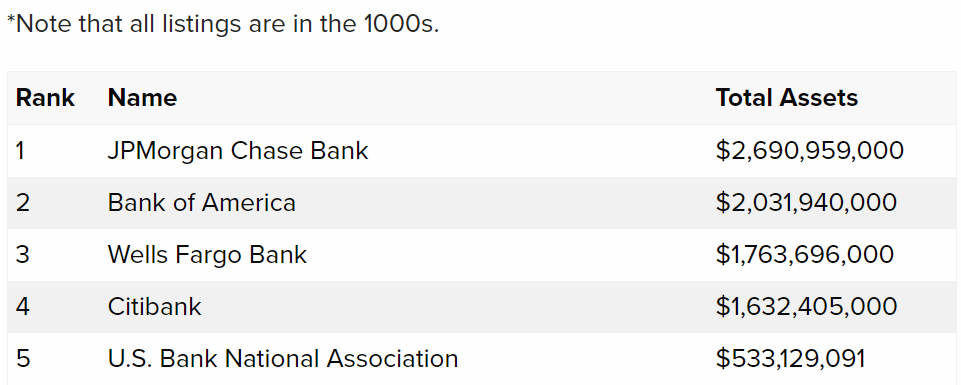

Even if you don’t understand any of that previous paragraph — and, let’s face it, most of that is Greek to the everyday Joe — realize this point: Bitcoin’s market cap is inching towards $1T, and BTC is four-and-a-half times that of ETH; ETH is NEARLY TEN TIMES AS LARGE as the next crypto coin (Cardano, ticker of $ADA). Ethereum is big, it’s very important to the crypto economy, and it is not going away.

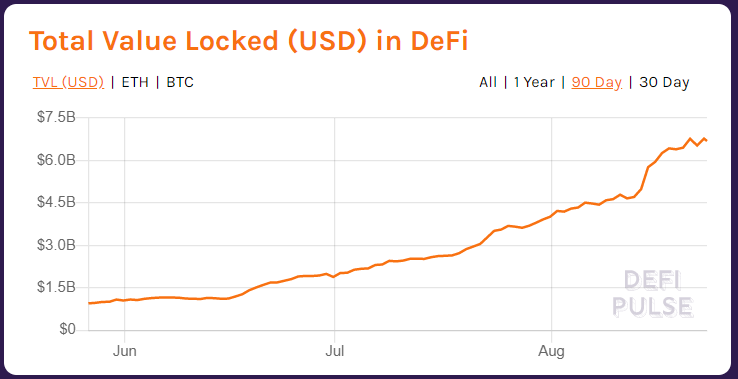

3a and 3b. #DeFi Building Blocks

We’ve made a few mistakes here — without a “warts and all” approach, we don’t think this site would have lasted, actually; we’d rather you read up on the $50 we blew on some crypto app than invest in it yourself and lose your own money — and a couple of those mistakes are related to two trades we made with Decentralized Finance (“DeFi”) coins that have caught fire.

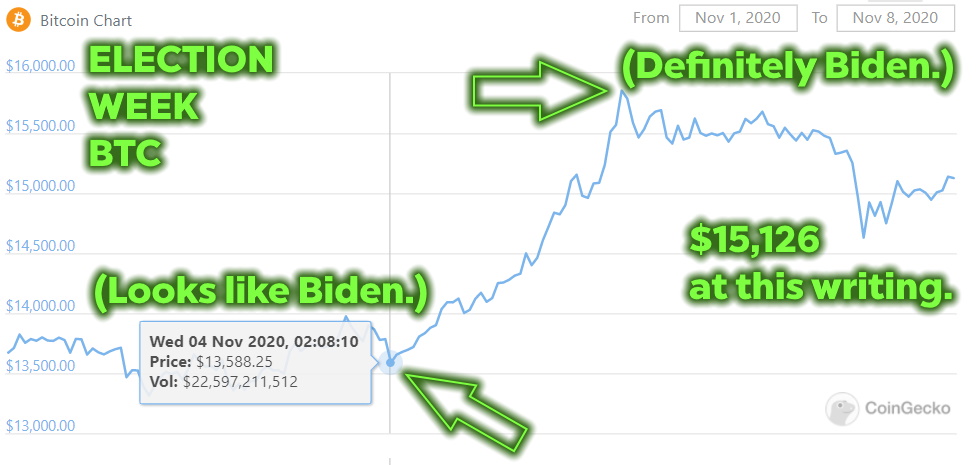

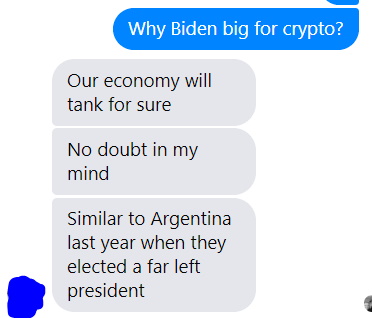

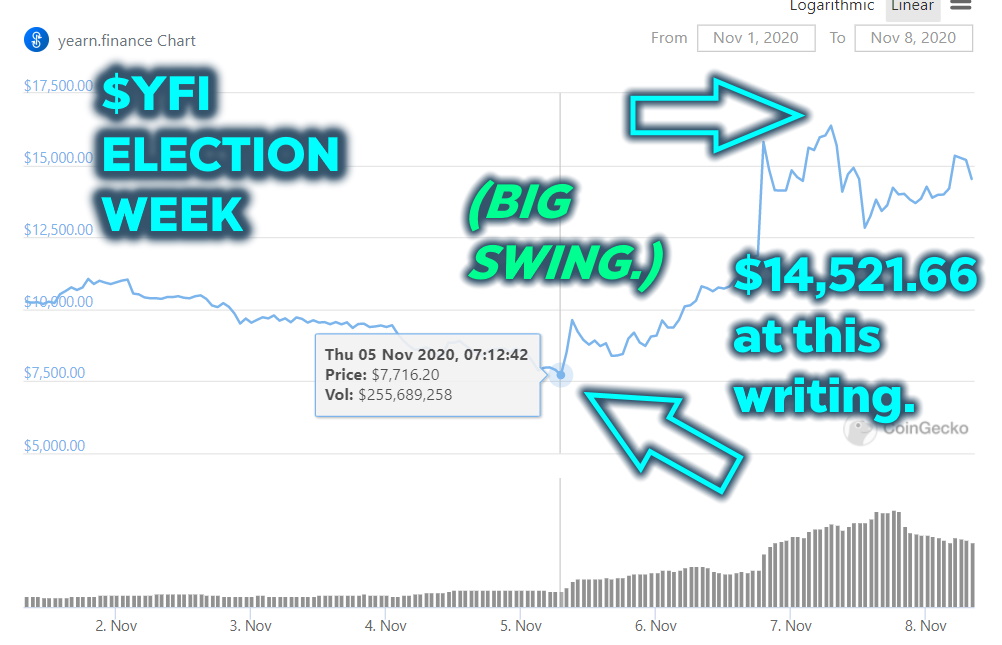

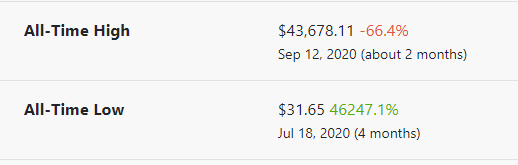

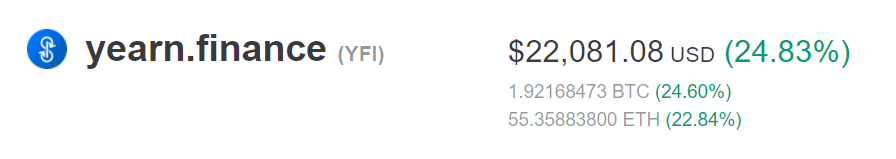

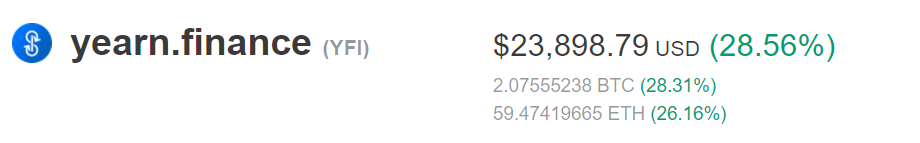

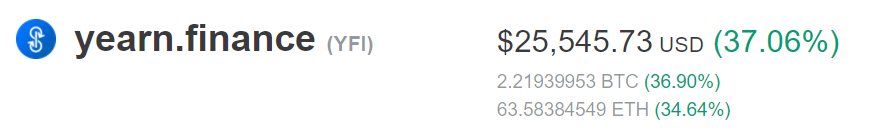

First, item 3a. Yearn.finance is $YFI and, defying logic (er, “DeFi-ing logic”), had you gotten in on the ground floor — or, more accurately, the basement; only really truly early adopters got this price — you could conceivably have turned a grand into $1.4M.

A more accurate description of the “woulda, shoulda, coulda” factor here is that you may have gotten in on perhaps the first or second floor of this high-rise. Our own experience had us taking a chance (by “taking a chance” that means a hundred bucks or so) on YFI when it was priced at $2000 to $3500. So we’re still doing okay. But…

3b.: Uniswap. $UNI. This beaut was an airdrop. Last year, the UNI team decided that the best way to get users on board with its coin was to gift it to ANY account that had used the platform. The airdrop gave 400 coins (or so, as one of ours got a few more than 400) that were valued at around $3 each. We hodled some, sold some others, and it has turned out nicely, hovering above $20 for most of this week. (TBH, though, the fact we sold some a couple weeks ago does irk us more than a little.)

4. Take a Chance on These?

We added a question mark because — AND AGAIN DO YOUR OWN RESEARCH — you are more likely to lose your entire stake in any of these coins than you are to make mad bank (as the kids say).

If you want a couple ideas, though, here goes:

Sushi ($SUSHI), which forked from Uniswap, has done well this year (currently trading in the low teens).

Dogecoin ($DOGE) is the love of folks like Elon Musk; it’s also projected by the Russian guy up there to go up at least 10x this year.

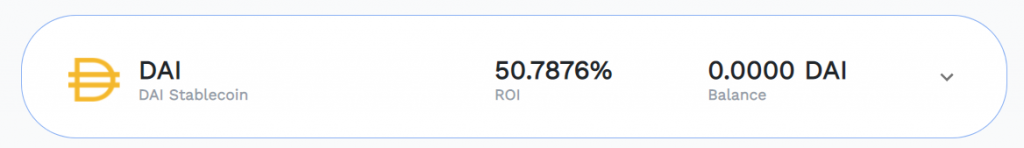

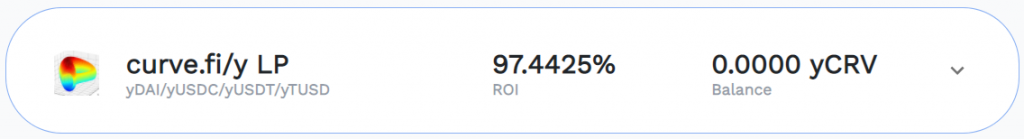

Kimchi ($KIMCHI) was thought to be dead — and may actually BE dead, in that there don’t seem to be any active developers still working on the project; this is called a “Rug Pull” and we explain it a little more in this post — but it is still throwing off triple-digit APY.

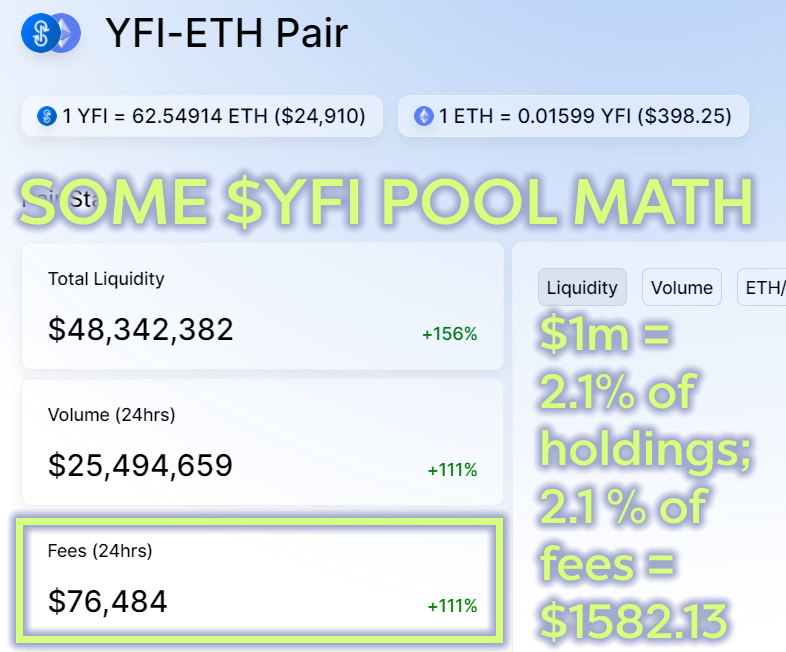

N.B. on pools such as KIMCHI: not only are pools like these highly risky, these interest rates will fluctuate wildly; you’re betting that KIMCHI stays stable (it has been ranging from $0.0002 to $0.0004 for the past few months) and that you don’t get totally whacked with growth of the other coin you pool it with. If one of the coins goes way up while the other stays at roughly the same value, you’ll be kinda okay; if one goes up and the other goes way down, you’re going to have some “impermanent loss” from the coin that doesn’t grow. We explain more here:

And A Final Few Notes:

We hope this post gives you a few ideas about how to maximize your investments. We need to share a couple other things here:

- Past performance (DUH) is not indicative of future results.

- DO YOUR OWN RESEARCH.

- None of this is financial, legal, or tax advice.

- Of the coins mentioned above, we own small positions in the following: $BTC, $ETH, $UNI, $YFI, $SUSHI, and $KIMCHI.