What happened in crypto and blockchain? Let’s take a look.

The first quarter of 2025 has been a pivotal period for the cryptocurrency industry, marked by significant developments that have reshaped the landscape. From groundbreaking regulatory initiatives to major corporate ventures, the crypto ecosystem has experienced a dynamic and transformative start to the year.

1. Establishment of the U.S. Strategic Bitcoin Reserve

In a landmark move, President Donald Trump signed an executive order on March 6, 2025, officially establishing a U.S. Strategic Bitcoin Reserve. This initiative aims to diversify the nation’s financial assets and position the United States as a leader in the digital currency space. The reserve will be primarily funded by Bitcoin assets already seized and held by the federal government, estimated to be around 200,000 BTC. This move underscores the administration’s commitment to integrating cryptocurrencies into the national financial framework.

2. Formation of the SEC Crypto Task Force

On March 21, 2025, the U.S. Securities and Exchange Commission (SEC) convened the inaugural meeting of its Crypto Task Force. Led by Republican SEC Commissioner Hester Peirce, the task force aims to explore the applicability of existing securities laws to digital assets and consider the need for new regulatory frameworks tailored to cryptocurrencies. This initiative reflects a shift towards a more accommodating regulatory environment under the current administration, aligning with President Trump’s pro-crypto stance.

3. Launch of Major Stablecoins by Prominent Financial Institutions

The stablecoin market witnessed notable expansions with significant players entering the arena:

- World Liberty Financial’s USD1: Backed by Donald Trump and his sons, World Liberty Financial announced plans to introduce USD1, a stablecoin fully backed by U.S. treasuries, dollars, and cash equivalents. Aimed at facilitating secure cross-border transactions for institutional investors, USD1 is set to be issued on both the Ethereum network and Binance’s blockchain.

- Fidelity Investments’ Stablecoin Initiative: Reflecting the growing mainstream interest in digital assets, Fidelity Investments disclosed that its digital asset division is testing a dollar-pegged stablecoin. While specific details and a launch timeline remain undisclosed, this move signifies Fidelity’s commitment to integrating cryptocurrency solutions into its financial services.

4. BlackRock’s Introduction of a Bitcoin ETP in Europe

BlackRock, the world’s largest asset manager, expanded its cryptocurrency offerings by launching its first Bitcoin exchange-traded product (ETP) in Europe. Domiciled in Switzerland and listed across major European exchanges, the ‘iShares Bitcoin ETP’ provides institutional and retail investors with regulated exposure to Bitcoin, marking a significant milestone in the mainstream adoption of digital assets.

5. Market Volatility and Investor Sentiment

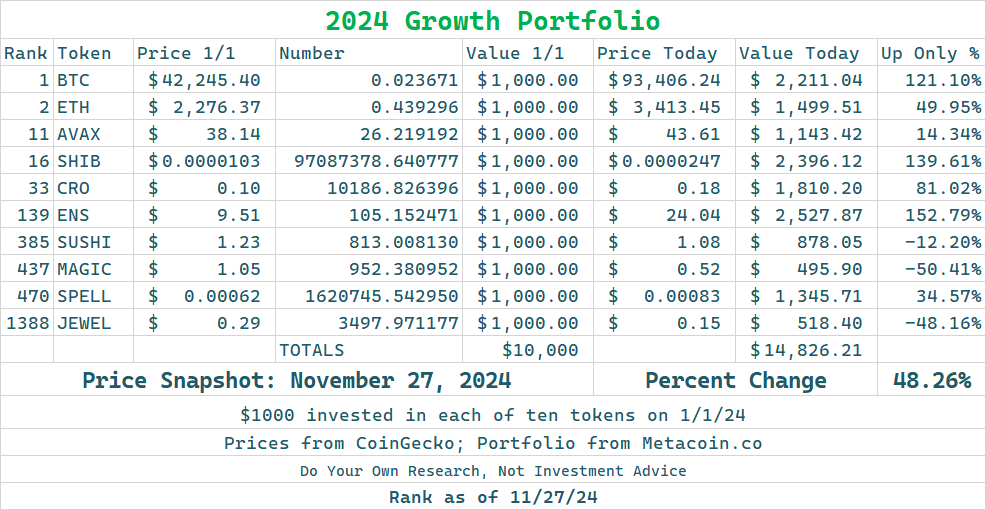

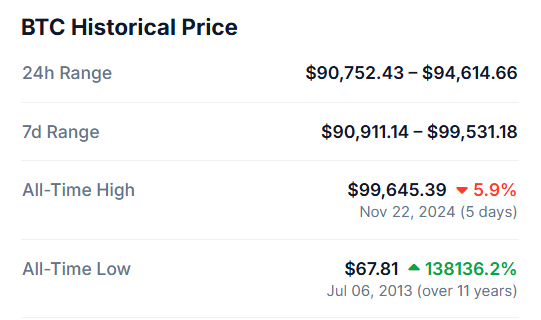

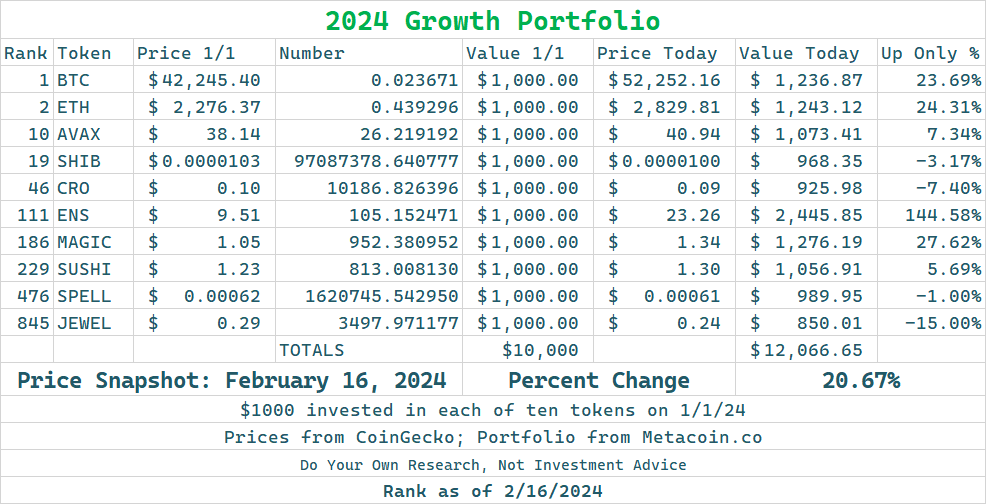

The cryptocurrency market experienced considerable volatility during this quarter:

- Market Downturn: The market faced one of its most challenging quarters, with Bitcoin’s price declining from $65,000 on January 1 to $42,000 by March 31, marking a 35.38% decrease. This downturn has been attributed to various factors, including profit-taking, regulatory uncertainties, and macroeconomic conditions.

- Proliferation of Crypto Tokens: As of March 2025, the number of crypto tokens surpassed 37 million, with projections suggesting this figure could reach 100 million by year’s end. This exponential growth underscores both the innovation within the space and the challenges investors face in navigating an increasingly crowded market.

6. Argentina’s $LIBRA Cryptocurrency Scandal

In February 2025, Argentina faced a significant cryptocurrency scandal involving President Javier Milei’s promotion of a meme coin named $LIBRA. The coin’s value surged following Milei’s endorsement but subsequently plummeted, leading to allegations of a “rug pull” scam and substantial losses for investors. This incident has sparked political turmoil and raised concerns about the need for greater oversight in cryptocurrency promotions by public figures.

7. Legislative Developments and Industry Advocacy

The crypto industry has been proactive in shaping its regulatory future:

- Congressional Engagement: A new congressional working group on cryptocurrency regulation has been established, reflecting the industry’s growing political influence and the government’s commitment to fostering a balanced regulatory environment.

- State-Level Initiatives: Texas is considering legislation to incorporate Bitcoin into its state reserves, building on its leadership in Bitcoin mining and signaling a broader acceptance of cryptocurrencies at the state level.

8. Technological Innovations and Research

Advancements in technology continue to drive the crypto industry’s evolution:

- AI Integration in Crypto Portfolio Management: Research has been conducted on leveraging large language models (LLMs) for automated cryptocurrency portfolio management. This approach aims to enhance investment strategies by utilizing AI to analyze multi-modal data and make informed decisions, reflecting the convergence of artificial intelligence and blockchain technology.

Conclusion

The first quarter of 2025 has been transformative for the cryptocurrency industry, characterized by significant regulatory advancements, institutional adoption, market fluctuations, and technological innovations. As governments and financial institutions continue to engage with digital assets, the crypto ecosystem is poised for further integration into the global financial system. However, incidents like Argentina’s $LIBRA scandal highlight the ongoing need for robust regulatory frameworks to protect investors and ensure the sustainable growth of the industry.