Continuing our series — which we’ll cross-post on the SHTF Megapost — talking about the craziness of the economy. Two pieces to this one: first, we take a ChatGPT-led approach (they did most of the writing, we do the editing) to the concept of “Too Big To Fail” banks.

Second: we share a link to a very recent (March 25) video where Glenn Beck interviews David Sacks to talk about…looks around…everything.

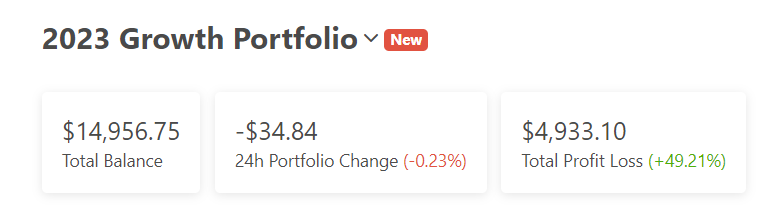

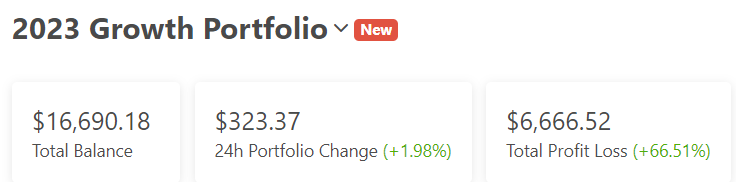

The BLATANT SPONSOR LINK HERE is from Binance.us. You get a bonus and so do we if you make a qualifying purchase.

What Makes a Bank ‘Too Big To Fail’

We took to AI, specifically ChatGPT, with the following prompt…

Explain in a 1000-word post why the US Federal Reserve can help stop Global Systemically Important Banks (GSIBs) from going under, and how to best keep the mid-sized and regional banks from failing, too.

So we did a little light editing, and the following is what the computers spit out.

What Is a GSIB?

The Global Systemically Important Banks (GSIBs) are large financial institutions that are considered too big to fail. The failure of such institutions could have a catastrophic impact on the global economy, as they are intertwined with other financial institutions and industries. The US Federal Reserve plays a crucial role in preventing the failure of GSIBs and ensuring the stability of the financial system. In this post, we will discuss the role of the Federal Reserve in preventing GSIBs from going under and how it can also keep mid-sized and regional banks from failing.

The Federal Reserve, also known as the central bank of the United States, is responsible for conducting monetary policy, supervising and regulating banks, and maintaining the stability of the financial system. One of the most important tools that the Federal Reserve has in ensuring financial stability is its ability to act as a lender of last resort. This means that in times of crisis, the Federal Reserve can lend money to financial institutions that are facing liquidity problems and prevent them from going bankrupt.

The Federal Reserve has a number of mechanisms in place to prevent the failure of GSIBs. One of the most important is the Comprehensive Capital Analysis and Review (CCAR) program, which evaluates the capital adequacy of large financial institutions. The CCAR assesses whether GSIBs have enough capital to withstand adverse economic scenarios, such as a recession or financial crisis. The Federal Reserve can then require these institutions to increase their capital if it determines that they are not adequately prepared for such scenarios.

Another mechanism that the Federal Reserve has in place is the supervisory stress testing program. This program assesses the resilience of GSIBs to potential shocks in the financial system. The stress tests evaluate how GSIBs would perform under different economic scenarios, including severe recessions and financial crises. This enables the Federal Reserve to identify potential weaknesses in the institutions’ risk management practices and take steps to address them.

In addition to these mechanisms, the Federal Reserve also has the ability to provide emergency loans to financial institutions in times of crisis. During the 2008 financial crisis, the Federal Reserve provided emergency loans to several large financial institutions, including Goldman Sachs and Morgan Stanley. These loans helped prevent these institutions from going bankrupt and prevented a catastrophic collapse of the financial system.

What About the Mid-Sized Banks?

While the Federal Reserve has been successful in preventing the failure of GSIBs, it is also important to ensure the stability of mid-sized and regional banks. These institutions may not be as systemically important as GSIBs, but their failure can still have a significant impact on local economies and communities.

To prevent mid-sized and regional banks from failing, the Federal Reserve has implemented a number of measures. One of these measures is the Community Reinvestment Act (CRA), which requires banks to meet the credit needs of the communities in which they operate. The CRA encourages banks to provide loans to low- and moderate-income individuals and businesses, which helps to support local economic development.

The Federal Reserve also conducts regular supervisory examinations of mid-sized and regional banks. These examinations evaluate the financial health and risk management practices of these institutions. If the examinations reveal weaknesses in these areas, the Federal Reserve can require the institutions to take corrective action.

In addition to these measures, the Federal Reserve has also taken steps to promote diversity and inclusion in the banking industry. The Federal Reserve believes that a diverse workforce can help promote better decision-making and risk management practices in financial institutions. The Federal Reserve has established diversity and inclusion committees and initiatives to promote these values in the banking industry.

Summary

In conclusion, the US Federal Reserve plays a crucial role in preventing the failure of Global Systemically Important Banks (GSIBs) and ensuring the stability of the financial system. The Federal Reserve has a number of mechanisms in place, including the Comprehensive Capital Analysis and Review (CCAR) program, supervisory stress testing, and other tools to help avoid catastrophe.

Glenn and David

Wrapping It All Up…For Now

A couple thoughts:

First up, OMG, Deutsche Bank is apparently in trouble. It’s somewhere near the top of the GSIB list.

Second, also OMG, Glenn’s interview with David is really something. Probably a little scary, too. Worth a watch.

Third, revisit the original SHTF posts for a crypto-ish take on what to potentially do next.