Behold, today’s update on the BRED Portfolio – a combination of Bitcoin, Ripple, Ethereum, and Dash and all their forks. When we first talked about it, the idea was an index fund of sorts – set it and forget it – with the goal of spreading out your risk and exposing your portfolio to four of the biggest coins.

Spreadsheet time: here’s what it all looked like moments ago. Note that we took $10,000 and divided it among each coin/token equally; in the case of the forked coins, weighting it based on market cap of each on 1/1/18. (That’s how you arrive at a negligible amount of Bitcoin Gold.)

Not very flattering, huh. Especially when you compare it to all the hubbub here around this ground-breaking (yet simple) portfolio idea and how it performed in 2017. You can read about that over here.

But, Should We Stick With It?

I think part of the theory here is that the market as a whole will move up and down, and these coins will track with the market per se. So it’s highly unlikely that 2018 would bring jaw-dropping returns like 2017 did, unless there’s some huge shift in sentiment. And it’s also unlikely that any of these coins will “go out of business” in 2018; though a huge pullback in any one of them COULD happen (if there’s a “black swan” type of event, maybe).

What probably makes sense – and, again, DYOR stands for “Do Your Own Research, so we’re not responsible here for successes or failures in your investments; please consult your advisors and don’t forget to pay your taxes! – might be a couple of portfolio approaches, spreading the risk out a little more but also taking advantage of some fire-sale coins that still have potential. (And having some flexibility to do ICOs, too.)

Maybe An Alt Portfolio, Too?

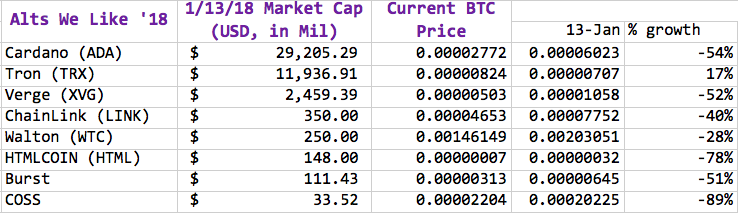

We talked about these earlier in the year – and all but TRX are down, with some down considerably.

There are two ways of looking at this: one is that they’re mostly duds. The other? Gems that pulled back with the rest of the market and are (at least right now) deeply discounted.

But Don’t Spread Yourself Too Thin, Either

What makes for a good “basket” approach? 10 coins? 20? 40? That’s up to you – 40 probably sounds a bit much; but there’s also a need to be able to put a little of your portfolio into coins that are new, unproven, “fliers.”

In any event, given where we are now vs. where we were last year, there’s probably some time to look around and see what’s actually out there and prepare your portfolio for any sort of froth by diversifying.

Good luck!