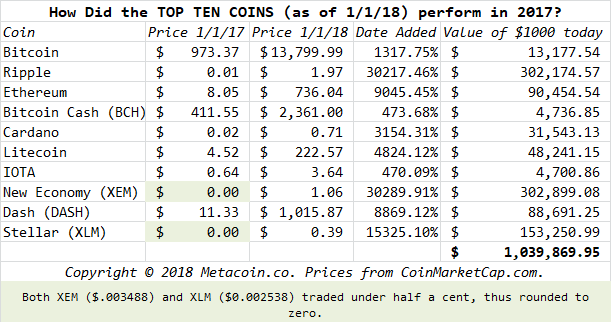

Some crypto assets had staggering gains in 2017, that’s for sure. If you want to play the “woulda shoulda coulda” game, you could do it with a good chunk of any of the top 10 – or even a good chunk of the top 100 – assets on CoinMarketCap.com.

Yes, we know – to have invested in the Top 10 coins of 2017, you would have had to (1) correctly guess which ones would enter the Top 10 and (2) in the case of IOTA and Cardano, know that they were going to exist before they existed.

When we created the BRED Portfolio, we decided to take four coins that were already in use, but we did backdate the portfolio to 1/1/17. So we spent pretty much all of 2017 asking ourselves “WHY DIDN’T WE ACTUALLY DO THIS???”

BRED 2017 Recap

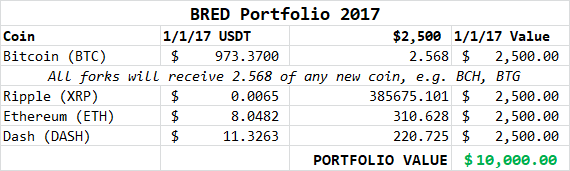

Simple enough, we wanted to diversify but we didn’t feel we needed to diversify that broadly. So we created a hypothetical portfolio that included $2,500 invested in each of the four currencies (ones that didn’t just make for an easy acronym, but also were selected for a reason):

- B – Bitcoin. Well, duh. Also, it’s really the centerpiece of cryptocurrency; whether or not it retains its dominance in 2018, we’re not sure.

- R – Ripple, whose XRP currency aims to beat out SWIFT as the interbank transfer protocol.

- E – Ethereum. Most of those token sales were built on Ethereum’s smart contract concept.

- D – Dash. We thought then that it was the most consumer-friendly coin; it may still be (though Litecoin and some others might be on its heels).

With an equal amount allocated – and then a similar number of each Bitcoin Cash and Bitcoin Gold added after the forks – we ended up with something that looks like this.

You Could Be Backing a Truck Up Now

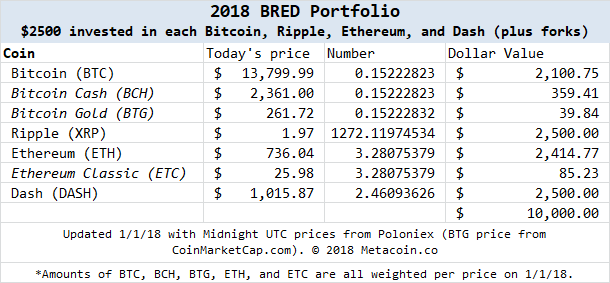

The next question: whether your 2018 could be as good – or better? – if you went with this portfolio strategy for the year. We’ve decided, for this blog, to track two BRED portfolios: as opposed to retiring BRED from last year, we’ll keep it going, but also add BRED 2018.

First, the 2017 Allocation.

Next, how we’d allocate a brand new BRED portfolio.

We promise to continue talking about this – and one of the things we’re working on is holding ourselves to a “buy and hold” mantra on some of our portfolio.

Not all of it, because we do have to be ready to chase altcoins that might pop, or to move into some of the larger coins – like the Top 10 above – that might be poised for another breakthrough.

What about you…what’s on your list for 2018 crypto investments?

Leave a Reply