Breaking news from last night on Poloniex might have some highly negative implications for some altcoins. Specifically, this announcement, which caused more than a shock on the Poloniex exchange:

Breaking news from last night on Poloniex might have some highly negative implications for some altcoins. Specifically, this announcement, which caused more than a shock on the Poloniex exchange:

On May 2, 2017, the following will be delisted: BBR, BITS, C2, CURE, HZ, IOC, MYR, NOBL, NSR, QBK, QORA, QTL, RBY, SDC, UNITY, VOX, XMG.

Whoa! That’s quite the list.

Pretty much all of the coins on that list went down big time; this is to be expected, since Polo is the largest exchange and traders could very easily assume that these delistings were a vote of “no confidence.”

QED: QORA

This chart will show you how one particular altcoin, the thinly traded QORA, was impacted.

Disclosure: we owned small amounts of QORA and – crazy enough – we were able to liquidate quickly and still have a (TINY) profit on the overall trade. (Because we accumulated QORA during drops over the past couple months.)

Disclosure: we owned small amounts of QORA and – crazy enough – we were able to liquidate quickly and still have a (TINY) profit on the overall trade. (Because we accumulated QORA during drops over the past couple months.)

But, TBH, this news does not bode well AT ALL for QORA, and here’s why: it’s only listed on one other exchange. CCEDK is a Danish exchange that we have just learned about…this morning, when researching where else QORA can be traded. (We checked yesterday on Bittrex and Bitfinex and, well, nada.)

If you use Twitter as a judge, the lack of tweets from QORA also doesn’t do them any favors. And a whopping 10 BILLION coins outstanding means that the coin, which trades as of this writing (08:00 in the US Midwest) at 3 Satoshi, has a market cap of ~$378,000 US.

Will other coins fare any better?

Oddly enough, we were working on a different blog post yesterday afternoon, using VOX as an example. Here’s a screenshot that we took in the middle of the day, before everything went south.

At the time of this screener, we held VOX and it was trading at around 3100 Satoshi. It has now dropped to 960 or so. It likely won’t come back; though the Voxelus platform looks interesting, it’s tough to find anywhere else you can trade the coin.

As Always: Buyer Beware

The reason for the delisting is likely that these aren’t very liquid coins. Hint: if you’re rarely cracking the top 20 or so coins, you’re not on anyone’s radar, and you’re not part of even an occasional pump-and-dump, well, that doesn’t bode well for your long-term trading prognosis.

And if you’re not widely used, either, that’s a pretty bad sign. QORA’s market cap puts it barely in the top 200, but not significant enough to register with the masses.

If you were buying these coins hoping for a pop, that’s okay. But, if the long-term fundamentals weren’t there in the first place, delisting amounts to ripping off the band-aid on a gigantic flesh wound.

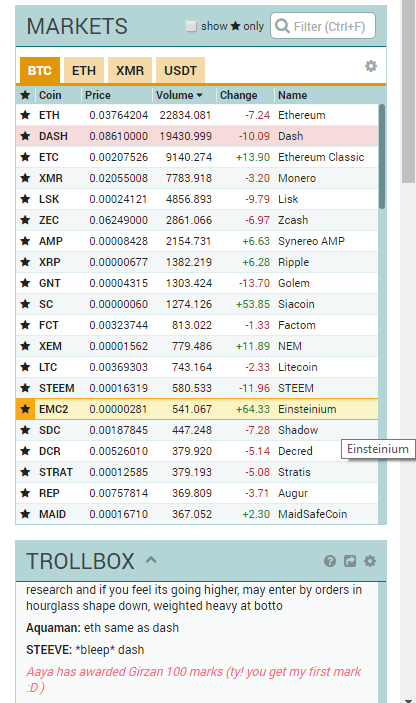

Only three cryptocurrencies now own a market cap of $1B (USD) or higher:

Only three cryptocurrencies now own a market cap of $1B (USD) or higher:  Look at that list…so many coins! So many wild mood swings! So much volatility!

Look at that list…so many coins! So many wild mood swings! So much volatility!