(Editor’s Note: we’ve let our friend Anthony take the reins for this guest post.)

When FUD is at maximum and the bubble seems to have been thoroughly popped already, learn why the future of crypto looks bright for artists, developers, and users. I’m super bullish on Avax for at least three reasons: subnets, a talented artist community, and the best tokenomics project I have ever seen: Chikn.

As of this writing, the markets have taken mega hits around the world. Fear, uncertainty, and doubt — better known to crypto enthusiasts as FUD — is a term that gets thrown around a lot but it’s representative of how emotionally-driven many crypto investors are and how incredibly wary most are of scams and the completely insane price volatility that crypto is known for. And they have a right to be hesitant since a reported $2.2 billion was stolen via crypto scams only in 2021 — and anyone trading NFTs can tell you that it’s like navigating a minefield sometimes. Those looking for easy money without any due diligence or attention were getting rekt by outrageous APR pump and dump scams, elaborate cash grabs, extreme volatility, and even the recent top 10 coin, Luna, getting obliterated due to a massive exploit with the UST algorithmic stablecoin.

Putting down their bloodshot eyes from their screens for a minute after 48 hours of staring at red candles, the crypto trader of 2022 is a battle-hardened veteran that is being told to go outside and take their minds off the market for a while before they go looney. Not too long ago, they were the green rookies getting into the degenerate world of NFTs and crypto trading. They have seen firsthand just how difficult trading can be — it’s said that 95% of traders lose money.

Often, people have no idea what they’re getting into as their nephew or third cousin or whoever told them to buy a dog coin back in 2017 and maybe they should have (nephew, is it too late to buy the dog coin?) and then wonder why their wallet went to 0 after plugging their metamask seed phrase into a phishing website (wait, I can’t email customer support or the SEC to get my money back?). These stories are far too common, unfortunately, and I barely scratched the surface here.

It’s not just noobs getting destroyed also, but experienced vets that have been scammed and phished by professional, anonymous criminals taking advantage of the wild west unregulated DeFi space. But it’s all quite interesting, isn’t it? We are still here digging in our trenches.

*Insert my affiliate link to a hardware wallet here*. Just kidding, but seriously, look into getting a hardware wallet such as Ledger Nano X. Nobody will be able to make transactions without you physically using your device to approve it, which can prevent malicious code from emptying your wallet of your crypto and NFTs–it is happening all the time.

This is just the tip of the fudding iceberg, and even experienced veterans can get fooled by a professional scammer. Fortunately, there is a light at the end of the tunnel and silver lining to all of this. That light is the limitless ingenuity of the human spirit and how the cooperation of developers and artists on the Avalanche Network are redefining how NFTs are utilized, including pioneering art, tokenomics, community, and Avax Subnets. The silver lining may be that all these shenanigans and growing pains are happening now while crypto is still in its infancy — like my mom said, it’s better to get chickenpox when you’re a kid than when you’re an adult. The future looks good as we learn from expensive lessons and mistakes and build and grow into a more inclusive and safer Web 3.0 experience. Avax is leading the way on this development and I’ll briefly explain why I think this.

Three reasons why I’m bullish on AVAX

1. Avax Subnets

Scaling is a major problem for the most popular networks. Ethereum could be said to be a victim of its own success — with more people using it come the insane eth gas fees we have reluctantly grown accustomed to, with many people using some kind of app to track gas prices and only do their business on off-peak hours — which could still be way too expensive for practical, transactional use. Not to mention that claiming rewards from the node projects right now costs more in Ethereum than they are actually making in claims, effectively killing even the “best” node projects such as Strong Nodes.

Avalanche is helping to solve this problem by building the foundations that create attractive opportunities for project developers. Subnets allow devs to build their own custom chains using their own custom native token as the gas fee. These networks can be optimized based on the needs of the organization or project. At least a few DeFi projects have already utilized subnets, namely DeFi Kingdoms and Crabada, and I know at least DFK is still under constant development despite some recent horrible price action with their token (but I could say that about literally every token right now including Bitcoin — although I shalt not fud as I’m still bullish in the long term). On those projects, gas fees are paid not in Avax, but in that project’s own native token, which basically means the gas is ridiculously cheap.

Avax subnets are still in the baby stages and there’s so much potential for this tech. Entire blockchains could even be ported over to Avax subnets. You can look here for a “subnet demo” filled with lots of neat statistics and links.

Read the official website for more info about Subnets and why there is such massive potential for this technology.

2. Artists are pioneering the use cases and utility of NFT on Avalanche, with very affordable prices (unlike Eth)

Artists are wisely utilizing the NFT as another primary sales avenue, and for good reason because it is allowing independent artists — especially independent female artists — a chance at making revenue. Historically, artists have always had clients or benefactors and so this is a continuation of that.

However, artists collaborating on NFT projects are changing the game. These are high-powered NFTs that are sometimes breaking technological limitations and changing the idea of what an NFT is and can do.

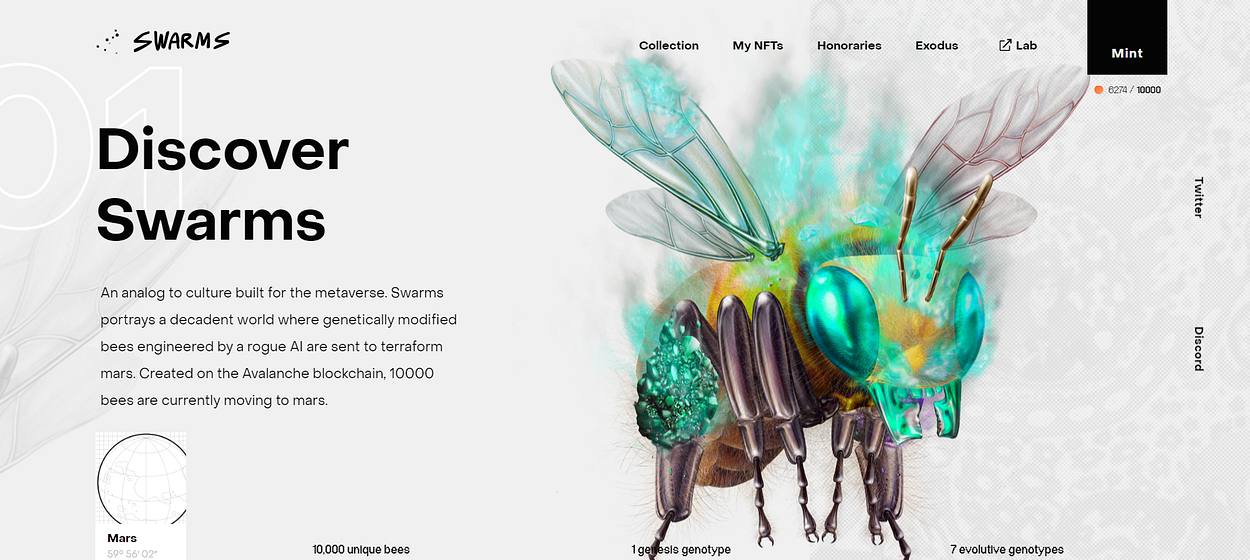

For example, Swarms is a brilliant art project that gives super-detailed 4K HD bee art as part of an imaginative world that is an analog to our own world and culture, inviting the NFT owner to be a part an interactive artistic experience. There are seven different bee variations, called genotypes, and each bee has six body parts of varying rarity. You can evolve your bee by sacrificing another bee, which levels up your current NFT to “GEN II”. The NFT metadata changes as well as the artwork, giving you a brand new NFT that is based on the “genetic material” of the previous NFTs. It is an awesome blend of tech and co-creative storytelling. Swarms develops collaboratively with the Swarms NFT community, dubbed the Beekeepers.

The awesome lore gives context to the art and makes ownership fun and exciting. The project is clearly just in the early stages with a long and exciting roadmap. You can check out some of the articles I wrote about Swarms for more info — it’s awesome.

Metropius is a new multimedia Dieselpunk project which just launched their first NFT collection a few weeks ago. Minting a Metropius NFT allows one to claim an actual hard copy comic book for each NFT they mint. Years in development, Metropius is an award-winning animation that has expanded to include comic books, GameFi, a board game, merch, four NFT collectables, Augmented Reality (AR) and other perks. It has a long roadmap with neat rewards for holders. The metaverse will eventually be fueled by the $DIESEL native token which will be exchangeable with Avax. You can see my article about it here. There’s lots of active development going on with it.

There’s a lot more going on in the Avax art department, but these two are my favorite art projects right now, and it would be a good introduction to the type of creativity happening on Avalanche. It’s a great blend of pioneering tech and artistic ingenuity.

For the general user, Avax NFTs are also way more affordable – most NFTs are minting for only 1 or 2 Avax. Avax had an all time high of $134, which is considerably less than Ethereum’s high of $4732, with most NFTs minting for a bare minimum of a few hundred dollars and often trading for much more. Right now, you can buy a Swarms NFT for just under $60.

Avax also has a super great community, mostly through Twitter and Discord, and there are often Twitter spaces with giveaways and talks and lots of developments being shared by not only the artists but also developers and other community members such as myself.

3. Stake-to-Earn Tokenomics: Featuring Chikn

When I buy an NFT now, I’m wondering if I will get any benefit from it. Sometimes, sure, I buy one just to support an artist I like, and that’s it. However, more and more NFTs — whether to compete or whatever — are offering various utility and the most popular of this is probably the stake-to-earn tokenomics model, where ‘staking’ your NFT will generate tokens which are then useable within the project’s ecosystem to upgrade the NFT. The token can also be traded for Avax/USDC/other coins (which is the real end game for these projects — people are looking to earn).

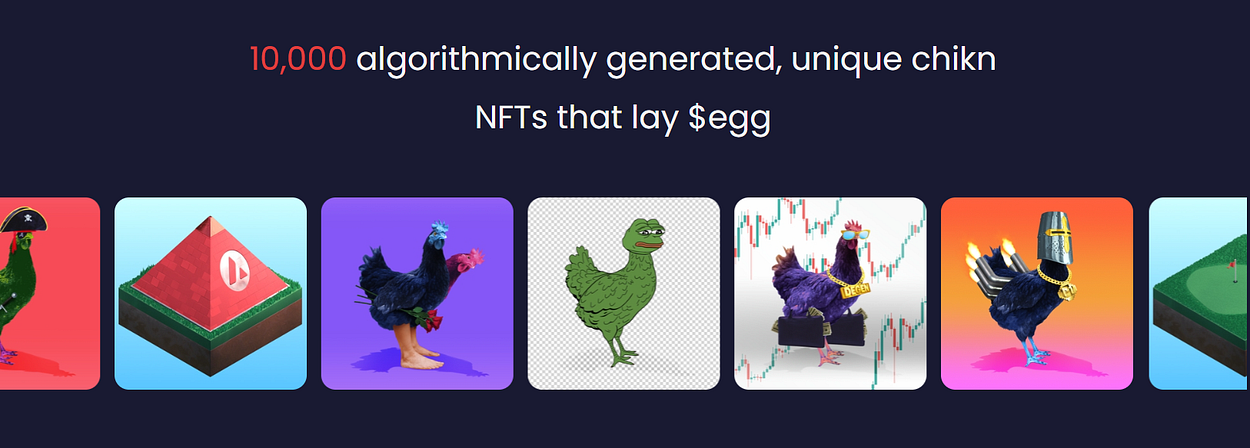

One project definitely worth looking into is Chikn.Farm.

Out of every NFT project I’ve encountered that offers utility or earning potential, Chikn is by far my favorite.

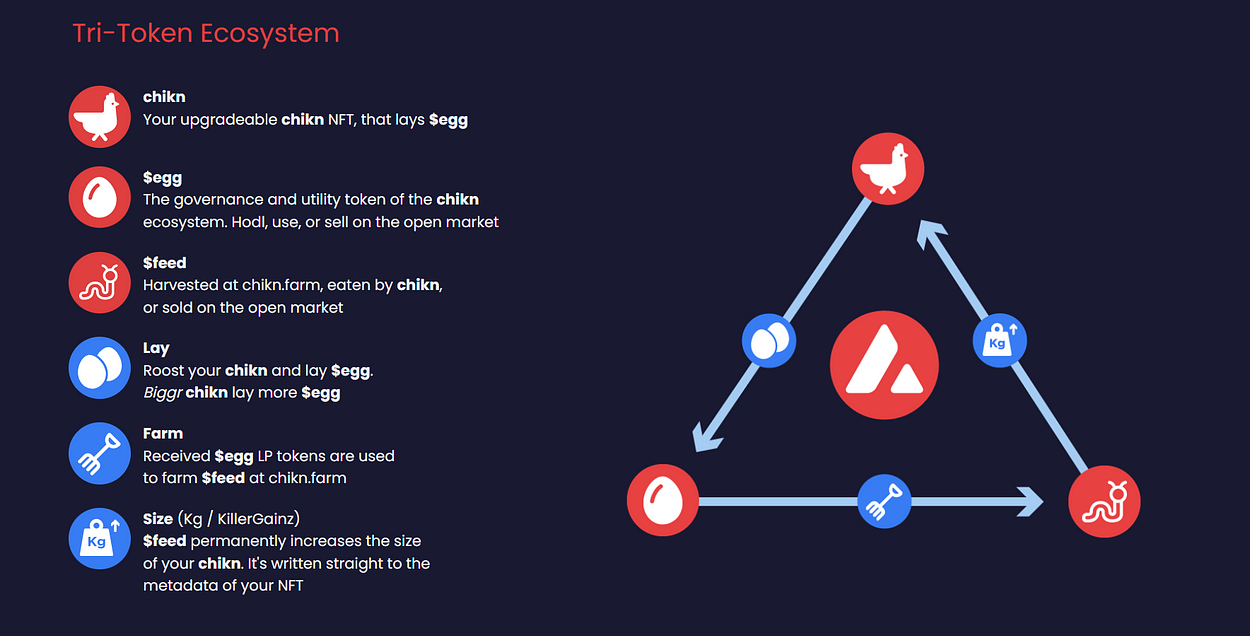

It’s really quite simple which makes it so smart and compelling. Chikn NFTs lay $EGG which can then be used to upgrade the Chikn, but EGG is also used for other NFTs in the system including the Farm and Roostr NFT, which all work together to create a neat little game where you can choose to upgrade your NFTs, thereby generating more tokens in the future, or just selling them immediately on a decentralized exchange, or DEX, such as Trader Joe which is the best and most popular Avalanche DEX.

Anyway, super smart projects like Chikn have proven that NFT stake-to-earn projects can have both very interesting art as well as profitable and sustainable Tokenomics. And what’s really great about it is that they are basically passive income nodes that are MUCH easier to liquidate, since the NFT itself is generating daily tokens and there’s no need to lock anything up for long term-if markets go south, you can sell (and in a successful project like Chikn, you will find a buyer — Chikn NFT floor price is currently 32 Avax as of this writing –it minted for 1 Avax each last November).

Bullish on Crypto and Super Bullish on Avax

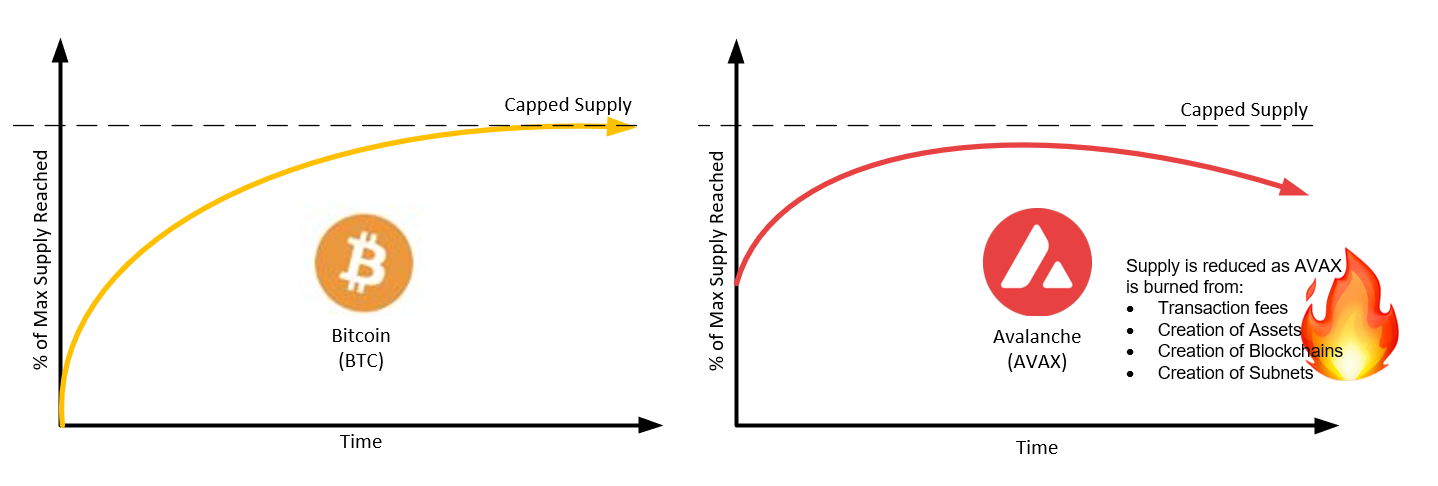

Although I barely want to glance at my portfolio right now as I’ve been pretty unskilled at catching bottoms recently, I do believe that just buying and holding Avax for the next few years will end up being a profitable investment, regardless of any short term fluctuations. It seems the general sentiment is bullish but we are just being subjected to macroeconomics that takes its toll on everything. In any case, it’s a very interesting space to be involved with. I think once the real potential of subnets are realized, we are going to see a price explosion on Avax similar to Ethereum. If Avax had even just half the market cap of Eth, the price would be around $400–500. As of today we are about $22–25. And remember when Ethereum dipped to $80 and you wished you emptied your savings into it then? NFA at all but just saying….

~ AntCat

Did we mention Segwit above? We did. Here’s a link to the latest on

Did we mention Segwit above? We did. Here’s a link to the latest on  Didn’t see THAT one coming, did ya?

Didn’t see THAT one coming, did ya? We must admit: the first thing that got us interested in

We must admit: the first thing that got us interested in  If you read the mission statement, you get the sense that the goal is to bridge the traditional and the digital, maybe serving as “

If you read the mission statement, you get the sense that the goal is to bridge the traditional and the digital, maybe serving as “

“Love me a good manifesto.” Actually, we’re struck by how many altcoins HAVE manifestos – and why they feel the need AND they choose the word “manifesto” in the first place.

“Love me a good manifesto.” Actually, we’re struck by how many altcoins HAVE manifestos – and why they feel the need AND they choose the word “manifesto” in the first place.

Look at that list…so many coins! So many wild mood swings! So much volatility!

Look at that list…so many coins! So many wild mood swings! So much volatility!