After the success of our blog post from three weeks ago — here’s a link: ChatGPT Isn’t Taking Your Job — we thought we’d experiment with the tool once again, but this time with the goal of kickstarting our own NFT collection.

So yeah, it’s self-serving as heck. (AND we’ll give you a couple disclaimers: do your own research. Don’t invest more than you can afford to lose. Also, since we created the art here at Metacoin HQ, of course we profit from any sales of the art. That’s capitalism for ya.)

But, as with everything these days, these NFTs are an experiment. Crypto is an experiment. ChatGPT is an experiment. And we put all these experiments together, and watch as it tackles the world of NFTs. How do we rate their writing? Read on…

First, the Background

The collection we asked about was the third we launched on OpenSea, which, to date, has been the leader in the NFT universe. While there have been a few competitors, OpenSea seems to be the leade rin the clubhouse.

Our collection is called “Collezione22” and the 176 pieces were created by us. (More accurately, me. At my computer.) Launched (of course) in 2022, only a few have sold — reminding me of a really off-color and rather sacrilegious Bible-related article from The Onion that I refuse to link to because reasons — so I thought “why not ask ChatGPT to create a post so I can sell more of these [expletive] NFTs?”

So I Went to ChatGPT and Asked…

“Write a 1000 word blog post as a potential investor in NFT art pieces, such as the ones at https://opensea.io/collection/collezione22 and compare their value to those that are focused on pfp or profile photos like cryptopunks and bored apes.”

Before I share the post in its entirety, a caveat: I went in and added links on any of the text where a link is appropriate. ChatGPT isn’t really great at that these days. It will get better and SEO professionals will need to ask what to do next.

Here, then, is the post:

As the world continues to embrace digitalization, the art industry is not left behind. The advent of Non-Fungible Tokens (NFTs) has revolutionized the way art is created, sold, and collected. NFTs provide a unique opportunity for artists to create digital art that is unique and exclusive to the buyer. As an investor, NFTs have caught my attention, and I am particularly interested in art pieces such as the ones found in the collezione22 collection on OpenSea. In this blog post, I will explain why I think investing in NFT art pieces is a wise decision and compare their value to those focused on PFP or profile photos like Cryptopunks and Bored Apes.

Firstly, NFTs provide a unique way to invest in art. Unlike traditional art pieces, NFTs are digital assets that exist on a blockchain. This means that they are unique and cannot be replicated or duplicated. When you buy an NFT, you own the original piece, and you can prove ownership using the blockchain. This is a significant advantage compared to traditional art pieces, which can be easily replicated, and it can be challenging to prove ownership.

NFTs also have a significant advantage in terms of liquidity. Unlike traditional art pieces, which may take time to sell, NFTs can be sold instantly on various online platforms such as OpenSea, Rarible, and Nifty Gateway. This means that if you need to cash out your investment quickly, you can do so easily without having to wait for a buyer.

Another advantage of investing in NFTs is the potential for high returns on investment. In recent months, we have seen some NFTs sell for millions of dollars. For example, the Beeple NFT sold for a record-breaking $69 million at Christie’s auction house. Although not all NFTs sell for millions, some can still provide significant returns on investment. The value of NFTs is driven by various factors, such as the rarity, the artist behind it, and the demand for the piece.

When it comes to NFT art pieces, the collezione22 collection on OpenSea is an excellent place to start. This collection features various digital art pieces from different artists, each with a unique style and theme. The art pieces in this collection range from abstract to realistic, and they are all visually appealing. This collection also provides an opportunity to invest in emerging artists who may become well-known in the future.

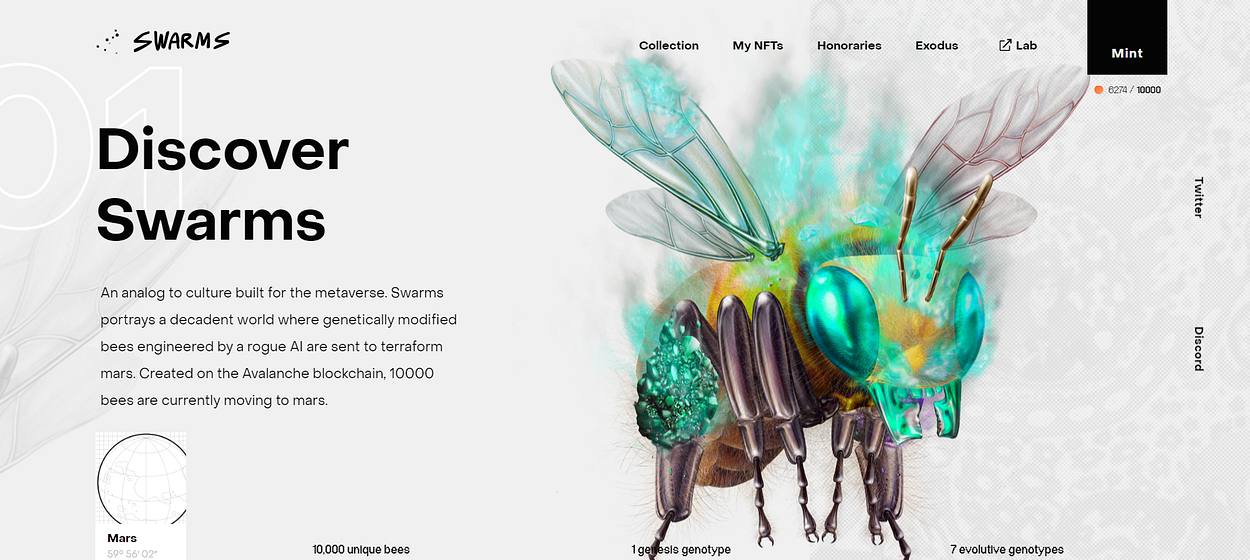

While NFT art pieces are an excellent investment opportunity, they are not the only type of NFTs available. Profile photos or PFPs have also become popular in the NFT world. PFPs are digital images that serve as a user’s profile picture on social media platforms. Some examples of PFPs that have gained significant popularity include Cryptopunks and Bored Apes.

Cryptopunks were one of the first NFT projects to gain significant attention. They feature 10,000 unique 8-bit characters that were randomly generated and sold for a fraction of an ether in 2017. Since then, their value has skyrocketed, with some selling for millions of dollars. Bored Apes, on the other hand, feature 10,000 unique digital apes that come with various accessories such as hats, glasses, and jewelry. Bored Apes have also gained significant popularity, with some selling for over $1 million.

While PFPs have gained significant attention, they have a few disadvantages compared to NFT art pieces. Firstly, PFPs lack the uniqueness and exclusivity that NFT art pieces provide. While each PFP may be unique, they do not provide the same level of creativity and originality that NFT art pieces offer. Secondly, PFPs may not have the

Wait, What?

Time to grade this piece. All 594 words of it.

Accuracy: B+

That was actually a pretty good piece in the grand scheme, as it talks about a few of the likely suspects — e.g. OpenSea, Nifty Gateway, Rarible — and whether it makes sense to invest in PFPs (where each is a different character) or artistic NFTs (such as the ones we created) that aren’t unique characters.

It falls short of an “A” rating, though, because it really doesn’t accurately talk about the collection I have on OpenSea. They’re all mine. I guess if someone reached out and said “I have some art!” then we’d talk.

Prose: C

It’s well-written but not too much better than what I could create myself. If I had the time.

So if “average” writing is your thing, then…that’s fine.

Following the Instructions: D-

I asked for 1000 words. I got 594. But this is passable writing, so I can’t give it an “F” grade.

Overall Grade: C

However, let’s think about this holistically. I went to a FREE website and typed in a question and got a response. And it’s good enough to put on the blog. And it might put *some* writers out of business.

But…didn’t you say that ChatGPT isn’t taking my job? What’s a writer to do?

Read My Last Post on the Topic…

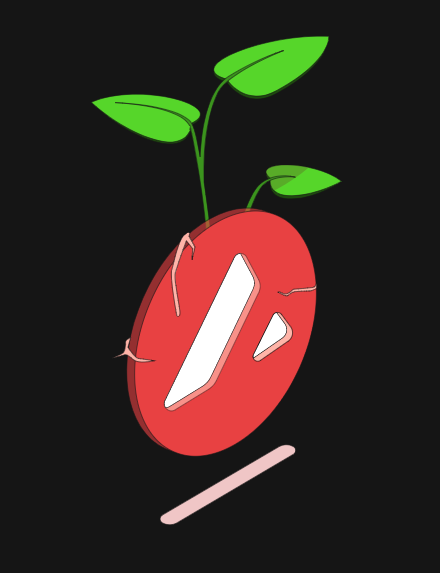

Above is image #165 in the series. Art is subjective: you may find that to be a cool image, you may think it’s kinda just there. In the case of ChatGPT, it appears it didn’t think about the image at all.

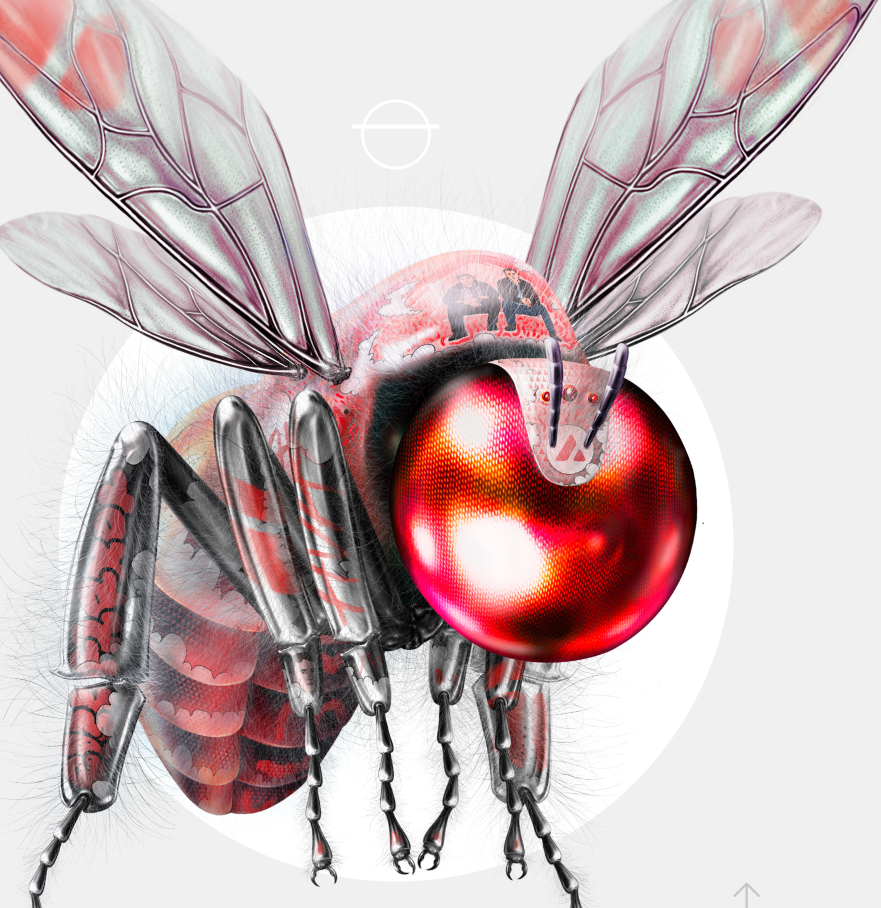

The next image is #164, the original piece upon which #165 is based. 165 was created by digitally manipulating the original just enough so that it’s different, but still follows the same general color scheme and uses the original flow.

There’s very little room for nuance on ChatGPT, it appears. It does a casual glance based on the text it can find, but you’re not going to get a critique of the artwork.

So where does that leave us?

As we told you before, Google allowed us to outsource our thinking in some respects, and ChatGPT is doing the same. Does that free you up to create? Does it free you up to do a deeper dive on a subject that just cannot be explained by the chatbots?

Yeah, that’s what we think.