If only it were that easy.

Spending 48 hours watching the Bitcoin market (and the other crypto markets, too) was enough to elicit trips to the store for industrial-strength antacids. You had a weird week – China news ping-ponging throughout the market, Jamie Dimon saying that Bitcoin was headed to zero (or something like that) – and the price craziness did cause quite a few “hold my manbun while I vomit” moments.

However, now that all that’s in the rear view mirror (because we’ll never have a price drop ever again, right?) it’s time to talk about how you can avoid getting rekt.

However, now that all that’s in the rear view mirror (because we’ll never have a price drop ever again, right?) it’s time to talk about how you can avoid getting rekt.

We’ve got four parts to this approach – four pillars of risk management that you can consider. Those four pillars: The Ratio, The Basket Theory, Passive Income Platforms, and ICOs. We’ll explain it all below.

Again, Do Your Own Research. Here goes…

Risk Management, Part One – The Ratio

Traders – the hardcore type – talk about “risk/reward” ratios in a very simple way: expressed as a ratio with a colon between the numbers (giving us an opportunity to maximize the use of various punctuation marks in one glorious sentence; we are big fans of glorious sentences here at Metacoin HQ) and it looks something like the below image.

In this situation, you are advised – by the hardcore traders, not by Metacoin, since this site does not offer individualized trading advice and you should do your own research and you and you alone are responsible for gains or losses and don’t invest more than you can afford to lose – to risk 1 to potentially make 5.

A trader would say, for instance, that they see the potential for a profit of 50% on a trade. If that’s the case, you’re setting a stop loss at 10%. Applying it to the above Bitcoin price, if you listened to this trader’s hypothetical advice when Bitcoin was at $3000, you’d have stop losses to sell your holdings at $2700, and you’d have a sell order at $4500. (And you might actually see both of those prices in the next couple weeks, at least given the volatility in the marketplace.) Neither have been triggered, but, if the price hits either level, you’ll either sell and cut your losses, or sell and take some profits.

But you can also apply a different sort of risk management concept, which I’ll call the “Basket Theory.”

Risk Management, Part Two – The Basket Theory

Andrew Carnegie famously said “Put all your eggs in one basket, then watch that basket.” The general premise for Carnegie started with steel, which he used as a fulcrum to get into all sorts of other things; so maybe his basket of steel gave birth to other baskets (bonds, oil, general finance, etc.) and you could use his theory to some extent with crypto. In other words, you need to know a lot about cryptocurrency if you’re going to have a basket of crypto, but you need to diversify that basket itself.

Carnegie’s advice could be boiled down to this: you’re getting into eggs, but that doesn’t mean you shouldn’t have a variety of eggs, either.

Bringing us to the other old adage: don’t put all your eggs in one basket.

Basic risk management in any sort of trading involves a diversified portfolio. You could call the BRED Portfolio we talk about as diversified, but, in all honesty, it’s not diversified enough.

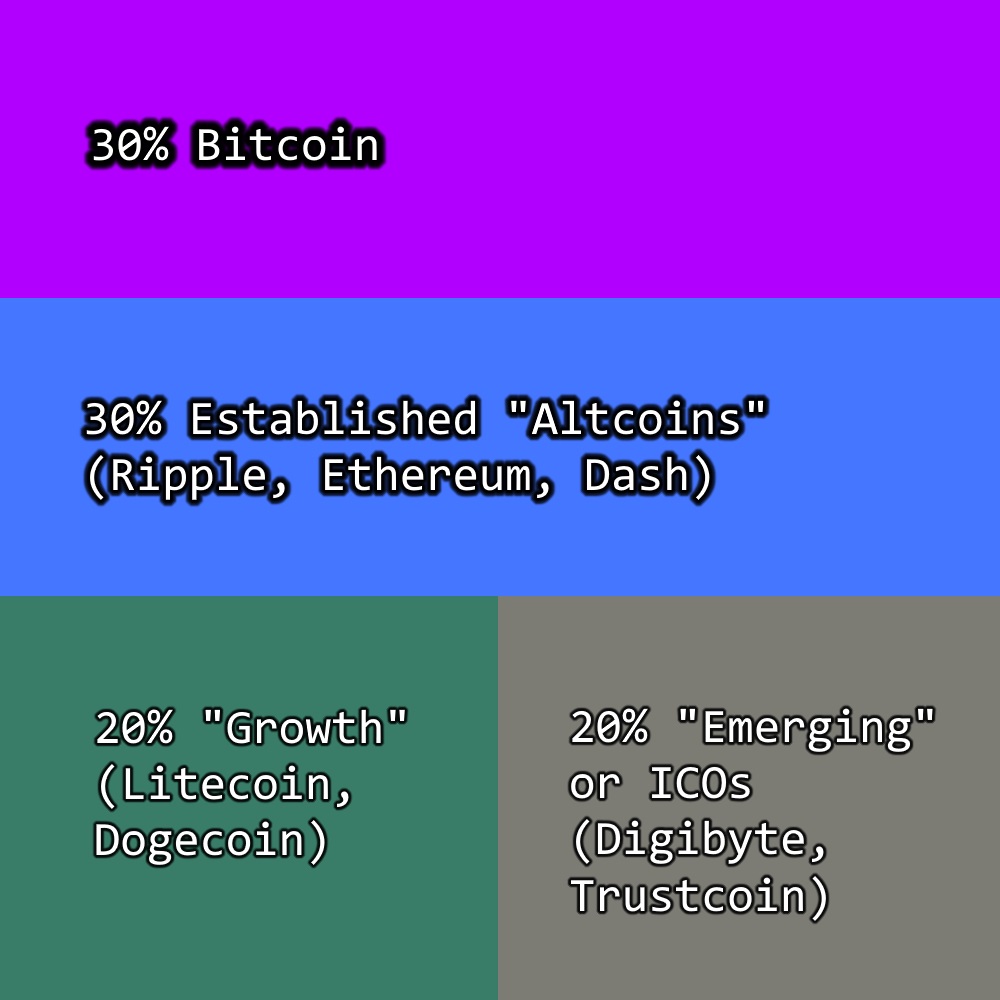

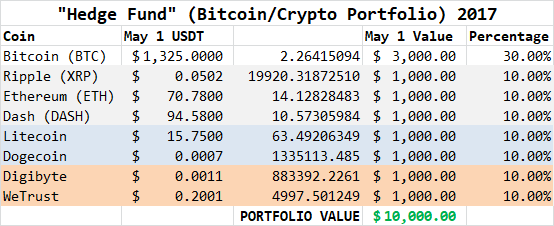

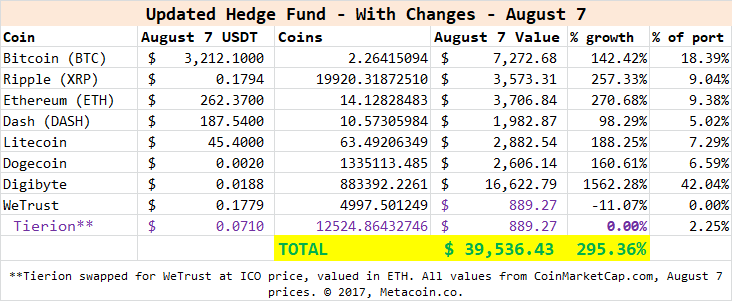

Our own Hedge Fund is probably a better choice for this – a basket of a variety of currencies, chosen for their diversity. If one goes way up, there may be others that don’t do as well – and that’s okay, because the basket itself gets bigger and is more diversified than betting on just one crypto.

But there’s one other angle to our own recommended approach to risk management: Passive Income Platforms.

Risk Management, Part Three – Passive Income Platforms

We have talked at length about some of these platforms, and we are really only scratching the surface. There’s money to be made if you know where to look – and we cannot stress the following point enough:

Spread out your risk in Passive Income Platforms, or you will regret it.

This part of our crypto journey began in July with a Bitconnect investment. (AFFILIATE LINK over there.) Bitconnect (which we explain more on the Passive Income page, which includes some running totals and updates from our various experiments) has the potential to be the best long-term passive income platform in cryptocurrency. This is because the platform is backed by a coin that has a market capitalization of $700-plus million.

We couldn’t go crazy with Bitconnect, though, because we have to keep banging the drum on diversification and risk management and egg-watching. This led us to more platforms worth trying out: Bitpetite (AFFILIATE LINK; Bitpetite “borrows” your Bitcoin, Ethereum, or Litecoin to profit from transaction fees, they pay you, but it’s a lease, like Genesis Mining, and you won’t get your original principal back) and Bithaul (AFFILIATE LINK; brand new, we’ve pulled some BTC out of it, but it’s a test and we’re not sold yet).

But, our research also led us to three additional platforms that went belly up: Ambis, Microhash, and Control Finance.

Affiliate commissions and referral fees can offset some losses, and some of these programs are potentially pretty lucrative. Plus, if you don’t like the “multi-level marketing” component of some of these (Bitconnect and Bitpetite both have tiers of affiliate commissions, so you can potentially profit from introducing others who introduce others), you can just sign up for trading platforms that are launching – like Altcoin Exchange, or WCX – and potentially profit from trading that happens down the road. (Those are REFERRAL LINKS.)

We’ve got one more in our four-part guide…And it’s one that American blokes like us are often kept from taking advantage of. But you…if you’re not in the US or one of the other verboten countries, should totally look at ICOs.

Risk Management, Part Four – ICOs

Initial Coin Offerings – ICOs – are the new Initial Public Offerings – IPOs. We’ve gotten into two ICOs; that number is only two because of the following:

- We’ve been skeptical of the product and/or

- We’ve been slow to the draw and/or

- We’re American.

That last point is uncool, in our opinion. Because of the lack of clarity around regulation, many ICOs are deciding that they just don’t want to muck with American involvement. Some of the cooler ones (Presearch, for instance) asks you at the front page whether or not you are a US citizen or US resident. Answer yes and they’ll thank you for playing and send you on your way; you can’t even register because you aren’t worth the hassle.

You have to wait, in those cases, until the coins trade on an exchange. If it’s a project worth investing in in the first place, its price will pop on the exchange. If it’s not worth investing in at ICO levels, you can possibly get coins on the cheap once they trade – but once they do trade, if they’re trading at a discount, there’s a reason.

We’ll use baseball vernacular to explain our two investments: we’re 1-for-2 – a hit and we reached on a fielder’s choice.

- Tierion – this is a base hit, maybe could be a double. We’ll probably score a run with this one. Great project, and it’s right now trading 80 percent higher than its ICO price.

- Exscudo – if you’re not a baseball person, a fielder’s choice is when you get on base thanks to hitting the ball, but a fielder makes a play elsewhere, allowing you to reach base. It’s not a hit. It’s not an out. You’re on base. You could eventually score a run, or you could be stranded there after the third out.

With Exscudo, it remains to be seen how successful it will be – if it’s successful at all. Unlike Tierion (which trades on HitBTC, a market for post-ICO coins that aren’t found on regular exchanges, like Poloniex or Cryptopia), Exscudo hasn’t traded anywhere yet – the project is forthcoming. We’re planning, honestly, to get stranded on base (or, even worse, to get picked off daydreaming after wandering off first base). They launch their “test net” on October 4, and the entire project has been delayed.

(We participated in their “Bounty Program,” giving us the chance for pretty substantial gains – but we’re preparing for the worst.)

Is there more to Risk Management? Sure!

We haven’t talked about mining and staking yet – I guess we could talk about those, and we might update this guide down the road. But, for now, we think that these four pillars could help you figure out how best to manage your own crypto risk.

Hang in there, friends. It’s just starting to get interesting.