One note before we dive in: we’ve actually made one minor tweak to the “Hedge Fund,” which you’ll see below. We’ll also explain why, but suffice it to say that this is a space that’s always shifting, and we thought this shift was important.

Hi! How was your weekend in Cryptoland? Oh, you didn’t visit?

Wait, you don’t know how to find Cryptoland? You must be new here.

Wait, you don’t know how to find Cryptoland? You must be new here.

Anyway, sit back and relax. Let’s take you on a little journey to the small corner of Cryptoland we call the DIY Hedge Fund.

***DISCLOSURE: As always, do your own research. This is not investment advice or financial advice. We aren’t responsible for gains or losses. Don’t invest more than you can afford to lose.***

Why We Invested In What We Invested In

The main reason behind the hedge fund was…well, to act as a hedge against other things happening in the world economy. As we mentioned back when we launched this fund, this was (1) hypothetical and (2) based on an assumption that someone has net investment funds of $100,000. That’s how we arrived at the $10,000 figure – 10% of the overall funds.

We gave it variety – didn’t want it all in Bitcoin, and we needed to have a couple emerging coins, too.

Plus, we wanted at least one recent ICO, leading us to WeTrust – which we’re actually getting out of in this hypothetical fund.

So we’ll have to change that fun graphic. But that’s not as important as telling you about the results…

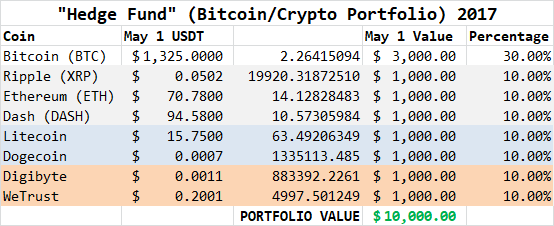

First, where we started

Here’s how the initial investment, made on May 1, broke down.

Simple enough, right? 30% in BTC, and the rest split between those categories – “Established,” “Growth,” and “Emerging”) we talked about above.

(You could argue whether Litecoin should move into the second category of “Established” altcoins – it’s not a Growth coin anymore, and it’s one of the Crytpo Unicorns now, with greater than $2B in market cap – but let’s keep these categories as is for now.)

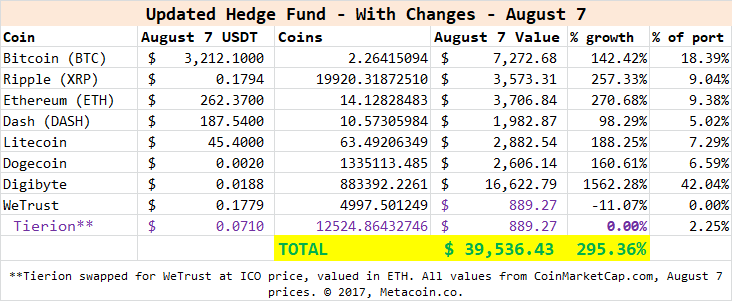

Now that we see where we started, let’s see what it looks like today, August 7, with the prices from this morning (as close to midnight as we could find, GMT, pulled from CoinMarketCap.com).

Not too shabby, right?

Actually, if you could get those sorts of returns from any asset, you should probably take them; any time you take $10,000 and turn it into nearly $40,000 inside of three months, it’s nothing short of staggering.

But We Had to Make a Tweak

That’s right, we ditched WeTrust, since we didn’t like the fact that it was our only negative return. We replaced it with Tierion, which is an ICO that – full disclosure – Dave personally invested in.

We simply swapped the dollar value of the WeTrust coin for an equal amount of Tierion, which was priced at $0.071 by the coin’s management team.

And we are now off to the races…again.

We’ll keep tracking this fund – as we do our BRED Portfolio – and we’ll let you know what happens as we continue our journey through Cryptoland.

BTW…

We’ve also been telling you about Bitconnect – the lending platform backed by the Bitconnect coin. Click on the banner ad below to get started; it’s our affiliate link but, if you join and get others on board, you can share in referral fees, too.

Leave a Reply