If you look around the internet, you can find quite a few investment funds that aim to capitalize on Bitcoin and emerging blockchain technologies. However, it’s awfully tough to get into them: you’ve either got VC (venture capital) funds that rely on high-net worth investors for their capital, or you have hedge funds that are out of the reach of most mere mortals. (And they don’t really invest in Bitcoin and altcoins yet; thanks in part to the US SEC requirements around funds.)

Then there are the ETFs that we keep waiting for the SEC to approve, as well as the mutual fund industry: do you think they’ll jump into the pool yet? Probably not.

So, what’s an investor to do?

Easy: start your own Bitcoin Hedge Fund.

Okay, a few caveats first: we’re not investment advisors, we’re not registered with the SEC or FINRA. This is not individual investment advice. Use and follow at your own risk. Seek legal, accounting, and other individualized assistance before investing.

Okay, a few caveats first: we’re not investment advisors, we’re not registered with the SEC or FINRA. This is not individual investment advice. Use and follow at your own risk. Seek legal, accounting, and other individualized assistance before investing.

Now that that’s out of the way, let’s begin.

It’s not REALLY a “Hedge Fund”

That’s right…we’re not actually advocating starting your own “Hedge Fund.” We are advocating starting a fund that “hedges” against ebbs and flows in the overall markets.

This is akin to the precious metals people – the “gold bugs” – who claim that you should have somewhere between 90 and 100% of your money in gold. (That’s a joke: some experts, though, will tell you that you’ll miss out on the potential for explosive growth unless you have 10-20% of your money in gold, silver, and other tangible assets.)

AND the other important part of this equation, which the gold bugs will tell you over and over again, is that you want something outside of the US Dollar in case things hit the fan.

Bitcoin and cryptocurrencies might help you there, too: since they’re outside the US Dollar, they’re also a tremendous way to avoid having to worry about whether the dollar fares well against the Japanese Yen or the Euro.

Your Own Hedge – Gold, Crypto, Whatever – How Much?

Now we get into your own soul searching. You need to figure out what makes you comfortable. (We realize that a good chunk of this is counterculture stuff – if you walk into your investment advisor’s office and say “I want to put 10% of my retirement in Bitcoin,” they may look at you as if you have three heads.)

So we’re going to create a hypothetical character – “Herbie Hedge,” who, though conjured out of thin air, does not have three heads – and we’ll manage a hypothetical fund on Herbie’s behalf.

Hypothetical Investments

To make it easy, we’re going to say Herbie has $100,000 to invest, and the OLD Herbie – as of twenty minutes ago, before he read this post and decided to create his hedge fund – had his liquid-ish investments (stocks, bonds, mutual funds and cash – since they’re between ordinary investment accounts and IRAs, 401(k)s and the like, we’re calling them “liquid-ish”) distributed like this:

- 50% S&P 500, DJIA Index funds (or, 50% in an overall stock portfolio that looks like the overall market)

- 20% Growth, international, value, and the like

- 20% Bonds

- 5% Gold, silver, precious metals

- 5% Cash and cash equivalents.

Pretty simple, right? And he was planning on leaving it there. But now that he’s taken a look around this site, and maybe he’s learned a little bit about the “BRED Portfolio” and the “Coins that May Quadruple,” he’s ready to re-consider what he’s doing long-term. Plus, there’s FOMO to worry about: what if this Bitcoin or these other altcoins or cryptocurrencies really do take off?

Speaking of FOMO, didja see what the BRED Portfolio did over the first four months of the year? Whoa.

Herbie’s Hedge Fund

First up, let’s re-distribute his portfolio, the $100,000 he has to invest.

Let’s say Herbie is still a believer in the overall market, might think he can lessen his reliance on bonds, and wants to keep a little in gold and precious metals. BUT he’s also ready to jump in with both feet – to a certain extent – and invest in Bitcoin and its ilk.

We’ll redistribute his (hypothetical) portfolio like so:

- 40% S&P 500, etc.

- 20% Growth, etc.

- 20% Bonds

- 10% Herbie’s Hedge Fund

- 5% Gold, etc.

- 5% Cash, etc.

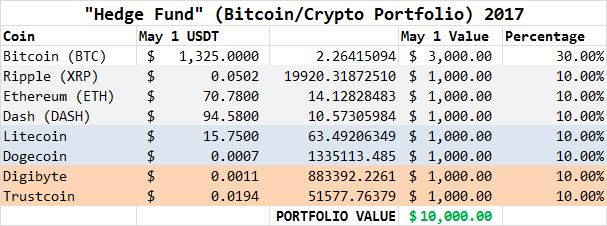

Voila, Herbie is ready to invest $10,000 in his very own hedge fund.

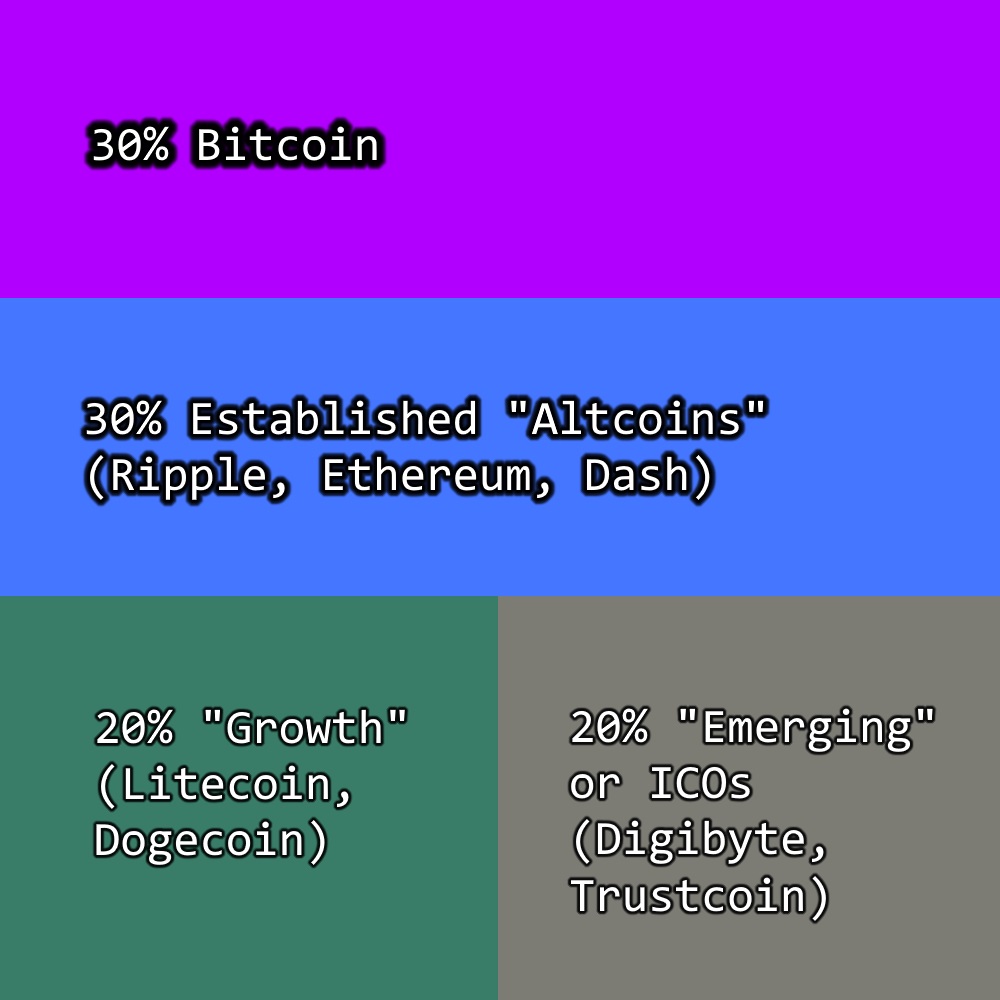

A Visual “Map” of Herbie’s Hedge Fund

The way we’d propose setting up this “hedge” fund shouldn’t be a surprise to readers of this space.

Bitcoin is there because, well, duh. It is the centerpiece of this new economy. It’s the one that started it all. And, not only do we recommend it in our BRED Portfolio, we also recommend it as one of those four coins that could quadruple. (Yes, we like linking to our own content multiple times in the same post.)

The next 30% is comprised of the other three coins in the BRED portfolio: Ripple (XRP), Ethereum (ETH) and Dash (DASH). To keep it simple, let’s do 10% of our 10K in each.

Following along, let’s aim for the mid-tier: semi-established coins with semi-large market caps. 10% each in Litecoin and Dogecoin.

Finally, there needs to be at least a little that aims to take part in the explosive growth of (some) ICOs and brand-new or new-ish coins. We’re setting aside 10% for two of those: Digibyte and Trustcoin.

Here’s the result:

We grabbed the values from Coinmarketcap, it’s denominated in US Dollars, and of course its value will fluctuate. Heck, as of this writing, Bitcoin was on a mini-tear and was trading – depending upon the market – between $1450 and $1600.

What if I don’t like these individual coins?

Here’s where we go back to the old saw that we don’t provide individual investment advice, trust the professionals in your circle, and past performance isn’t indicative of future results.

But again, let’s go back to why hedge funds were created: the market ebbs, and your hedge fund flows. And vice versa. You’re going to see results that run counter to the results in the overall market – within reason – and that’s okay. Also, within the individual fund, you will see some altcoins do well and others not so much. So if you don’t want to hedge your bets with Digibyte (which I’ll admit didn’t pop like I thought it would after the Segwit rumors and Segwit news), research another coin.

The goal is to spread your risk overall – remember, only 10% of our liquid-ish portfolio is in this fund – and to spread your risk within the fund itself.

What if I don’t have $10,000?

No problem – actually, the beauty of Bitcoin and cryptocurrency investment is that you can get started with very little. (This is a great time to remind you that you can get started over at Coinbase, and if you use this link and make a qualifying purchase, you get extra Bitcoin…and so do we. So yes, that’s an ADVERTISEMENT.)

So you can borrow liberally from our approach with whatever amount you think makes sense. $1000? $100? Test it out over time, see what happens.

What we’ll do here…

We plan on tracking the results of Herbie’s Hedge Fund over time. We’re curious to see how it does against our BRED Portfolio, and we’re also interested in how it does against the overall stock market.

Leave a Reply