We check in on the 2024 Growth Portfolio as we get ready to wind down the year.

One of the fun things about crypto is having a Ron Popeil “set it and forget it” attitude. If you want, you can drop a little money here and there and not worry about it.

Dollar Cost Averaging — remember that? — has made some people some money; especially those who decided that a hundred bucks every month can get dropped into Bitcoin at a dirt-cheap price.

And That Brings Us to the Growth Portfolio

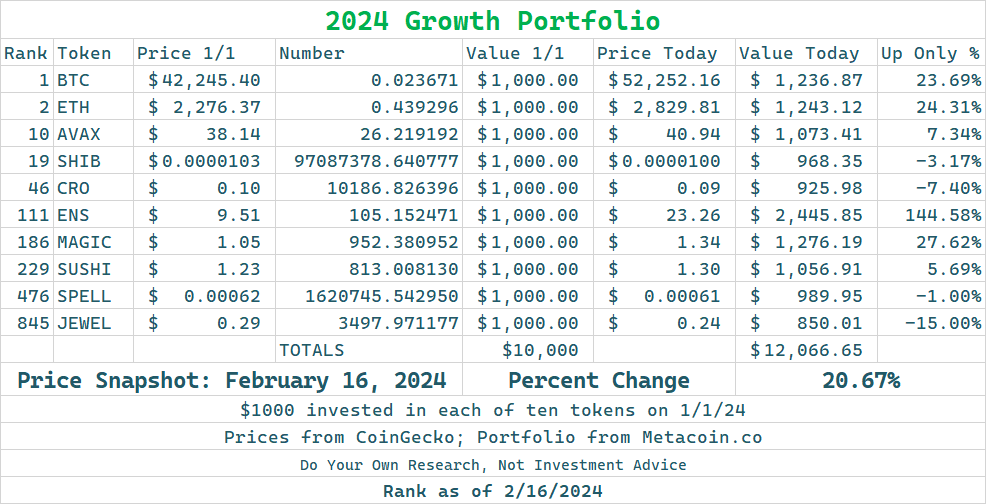

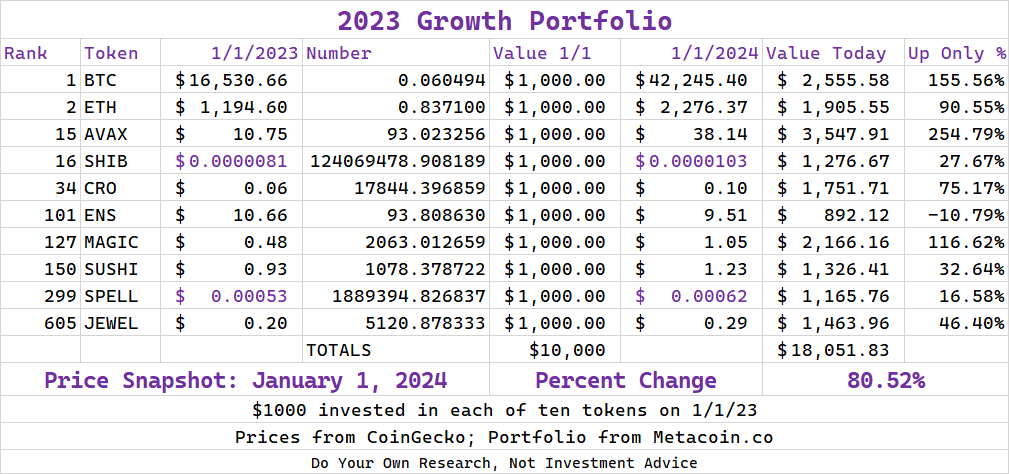

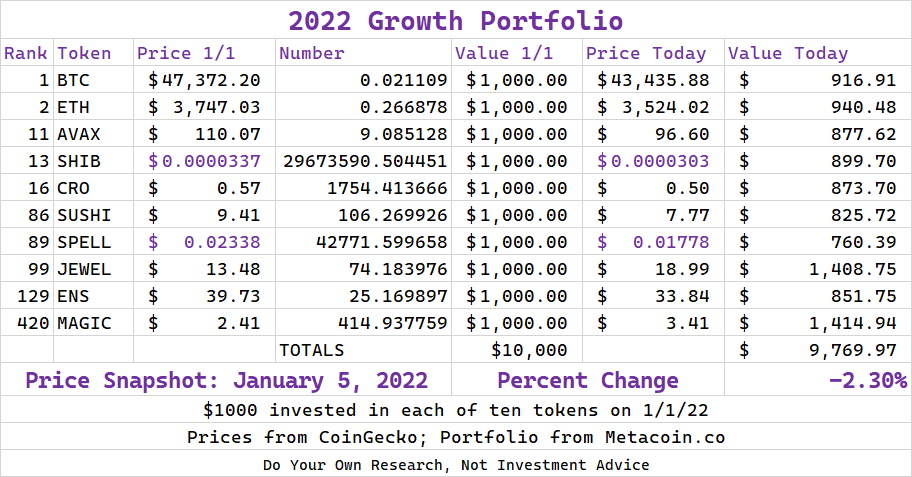

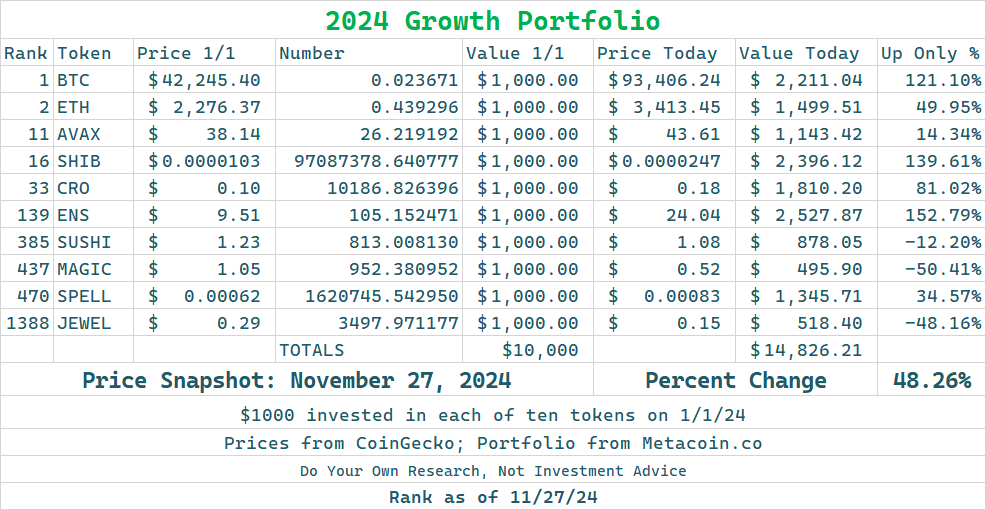

The idea behind our 2024 Growth Portfolio — and previous iterations, which you can read about here: 2023 Growth Portfolio and here: 2022 Growth Portfolio — was a mutual-fund-like approach to crypto investing. (It’s also hypothetical, so YMMV, DYOR, and don’t invest more than you can afford to lose.) Put simply, we took $10,000 and divided it equally between 10 different coins or tokens. Then, at the end of the year we can see whether we did okay, or not.

In order to actually achieve these numbers, you would have invested on exactly January 1, 2024 and you would have held all year. While it’s not the NVDA stock everyone loves, it is still not a bad sight at all.

First, ENS…

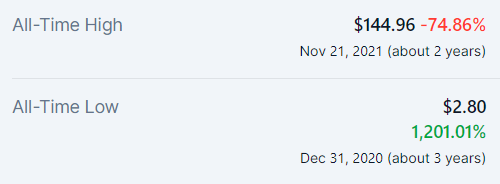

$ENS is Ethereum Name Service. It has done quite well in 2024, up 153%. Here’s a screener of its 2024 high.

However, ENS is known for a little craziness…here’s what its 2023 looked like..

And bear in mind its all time high was $83.40 in November 2021.

Next, SHIB…

Viral meme coin sensation, that $SHIB. Ups and downs. Same old song.

Some time in early 2024, it was at a low of a bunch of zeroes before the number 9, then it tripled. Like this.

Nice work if you can get it. $1000 is now nearly $2400.

The Big NARRATIVE Winner? Bitcoin. The Corn. BTC.

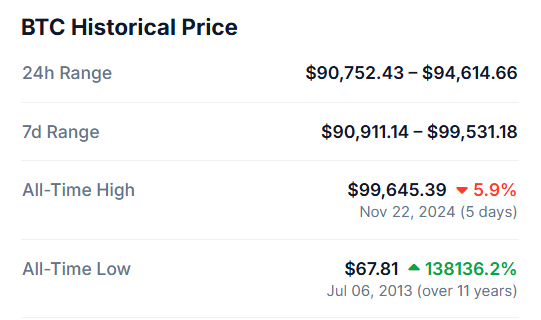

Your $1000 stake would have a little more than doubled, but the narrative win goes to BTC. Could be part the economy — no one knows (really) what’s (really) going on — could be a little of the election, could just be a general sense that now might be the time.

And it could be that psychological barrier of $100,000.

So close. So close and yet…so far.

Now, The Losers

We’re not going to focus too much on these; we’re trying to stay positive. However, after two years bringing up the rear, it’s probably time to ditch $JEWEL (DeFi Kingdoms) and $MAGIC (Treasure).

$SUSHI was the only other coin in the portfolio that was down; it remains a pretty good project and itself is a Top 400 coin.

What’s Next?

Well, we’ll keep an eye on these developments and will post again on the 2024 results in January. But, suffice it to say, some of the losers might get tossed out; there’s probably room for a couple of new entrants from near the bottom and near the top of the rankings.

As they say, stay tuned.