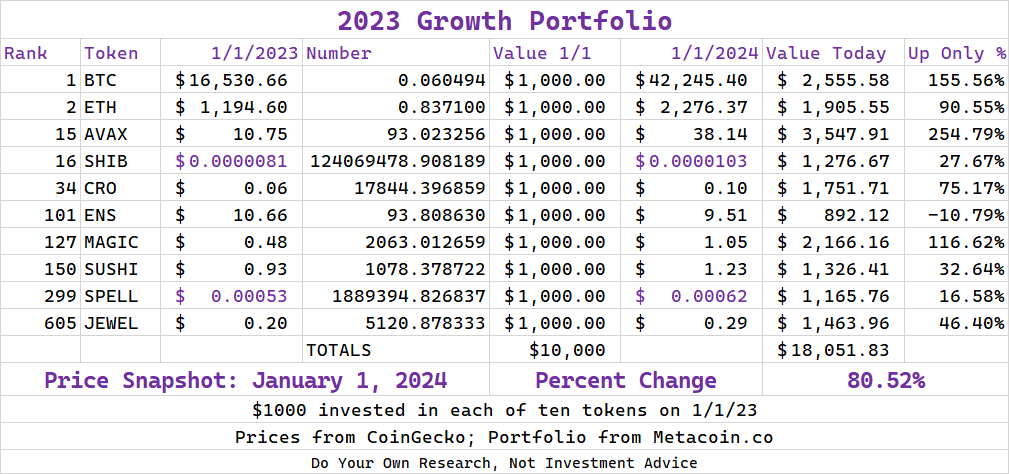

There was news this past week about a Bitcoin ETF. And now they’re everywhere, it seems. Alas, you could call up your people and get some Bitcoin ETF action in your IRA or investment account. Or you could just build what we call a “Growth Portfolio.”

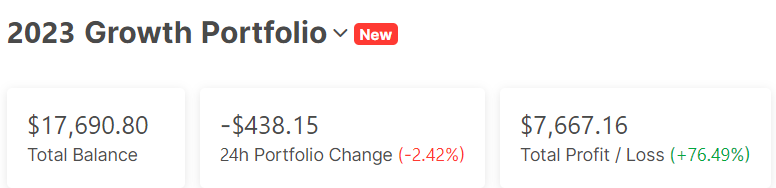

So with this post, we’ve decided to take a look at the 2023 Growth Portfolio and get a sense of how it did.

Some thoughts on the above:

Bitcoin Is Halving a Moment

Deliberate play on words there. More on that in a second, but first, here’s as close as we can come to the 2023 chart.

In late October, BTC went above $30,000 — something it had done earlier in the year, too — and has yet to fall below that level. The ETF played a role in that, as rumors were rampant all year that the SEC would say it was okay.

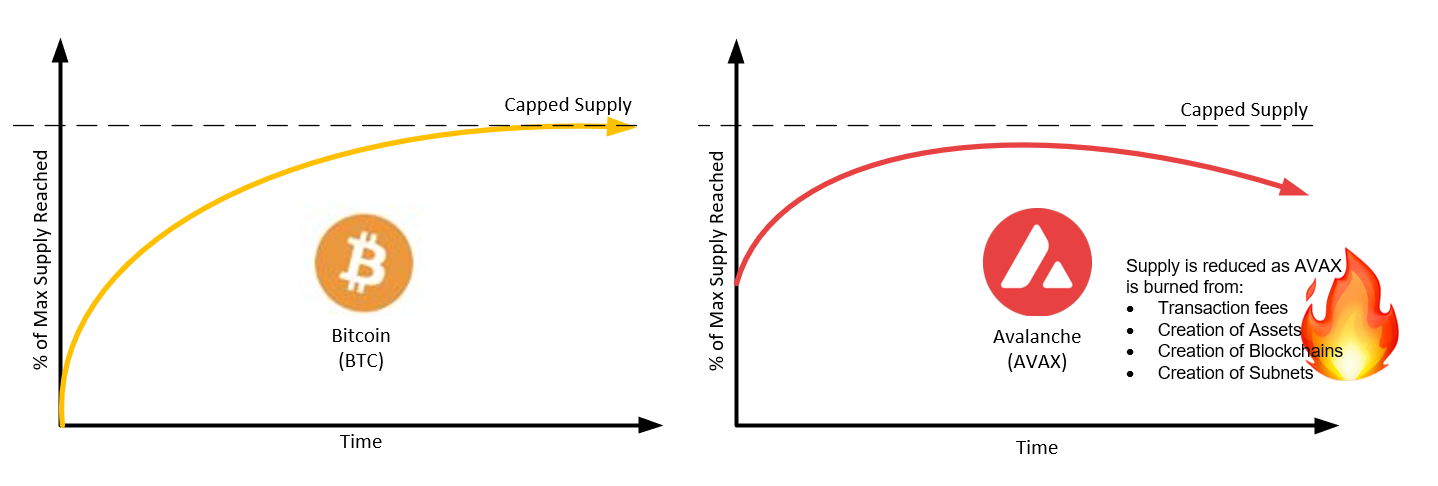

But the “halving,” when the block rewards drop — they’re cut “in half” — is most likely the reason. Estimated to begin in April, if you wanted to bet on Bitcoin before it becomes less lucrative to mine, this is as good a time as any.

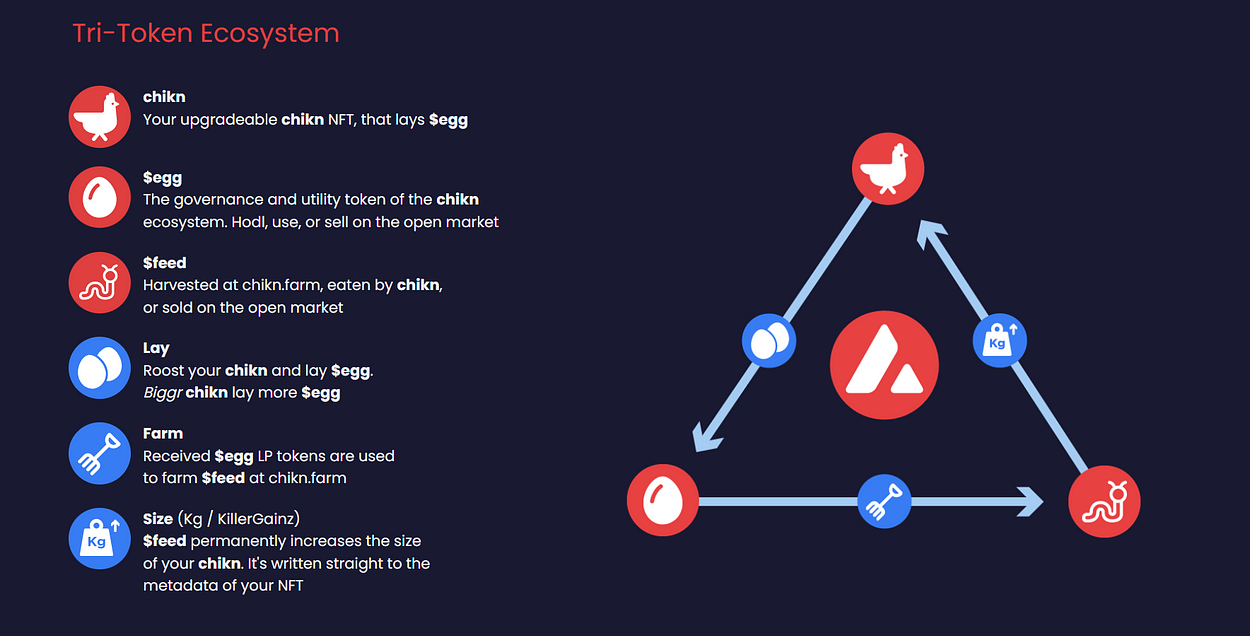

An Avalanche Snowball

Or, AVAX had a year, eh? Around the same time BTC was heading above 30K for good (at least for good for now), Avalanche was stuck below 10 bucks a piece. But then, an explosion of sorts…

Yes, that is darn near $50 each right around Christmas.

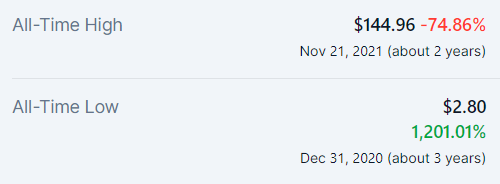

But here’s a caveat: all of these coins have a lot of ground to make back up. (Remember the ol’ axiom: If it drops 80%, it needs to go back up 5 times to get you back where you were.)

The Worst 2023 Performer? It’s Having a Moment in 2024

ENS is Ethereum Name Service. It’s the only coin in our portfolio that finished the year down (by 10.79%) but that was so 2023.

To be honest, we’re not sure why the above 2024 chart shows so much explosion for ENS, but we’ll take it.

What’s Next for the Growth Portfolio?

In the next week, we’ll update the portfolio with some ideas for 2024; probably a tweak or two (maybe with some help from AI). Stay tuned.