It started with a tweet, shared in response to an epic Twitter thread.

First, the thread:

Then, my tweet:

The thread from Adam is LONG, so you’ll need to devote some serious time to studying it, or you’ll want to keep referring back to it a little at a time (that’s my plan; Adam shares some great info but it wasn’t until one of my Twitter friends referred to a specific recommendation when I started reading chunks in detail).

My tweet, however, was meant to start some conversations around a simpler potential portfolio you could put together to play this new new new NEW economy of web3 and whatever else is going on.

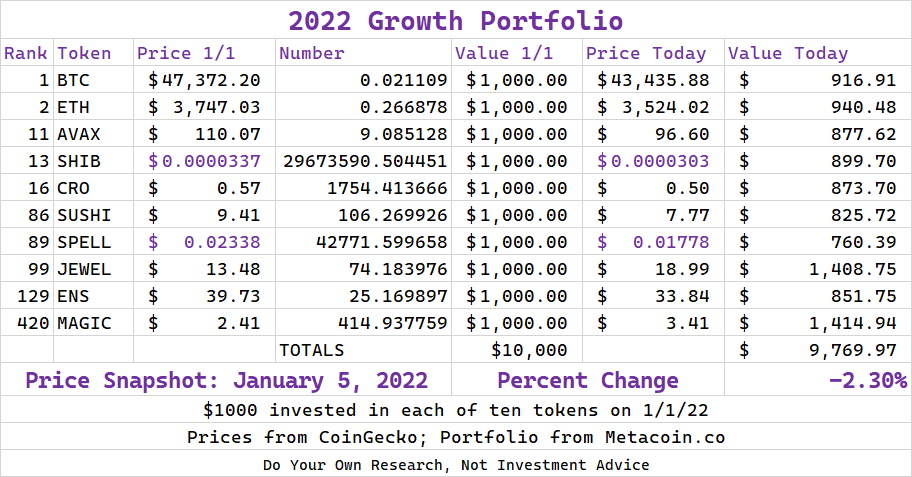

We present our 2022 Growth Portfolio in the same spirit as past HYPOTHETICAL portfolios: Do Your Own Research, Not Investment Advice, and, well, here’s an interesting way to track what’s going on in Crypto.

What’s Here (vs. What Was in the Tweet)

Caveats first: I made a couple changes to the December 30 post; I decided, to be direct, that $UNI and $CRV didn’t fit with the portfolio. So $AVAX and $SUSHI were inserted instead. The “Rank” column on the left-hand side is taken from this morning and all prices (both 1/1/22 and 1/5/22) were from CoinGecko.com.

Also, I created the list, did the whole price thing, and then…”#BitcoinCrash” or whatever, the afternoon of January 5. So I had to recalibrate based on pricing the afternoon of the 5th. (Hopefully the bloodbath is over.)

The idea goes like this: take a hypothetical $10,000 investment and divide it equally among ten coins. Past portfolios used fewer coins (BRED used just 4) but this might be the best way to spread the risk.

Bitcoin and Ethereum

The first two choices may be obvious: Bitcoin ($BTC) at nearly $900m at this writing and Ethereum ($ETH) at $400+m right now are the Big Two; third-place (by market cap) coin $BNB is 1/4 the size of $ETH. Bitcoin may or may not BE the crypto market, but a coin that is 1/3 the size (roughly) of Apple is probably a force to be reckoned with.

Ethereum is rather formidable in its own right, and, for the purposes of having an entry point into the rest of the coins through something like Metamask, you want some $ETH.

(SIDEBAR: Metamask has ONLY 21 million users? You want to get some $ETH and start using Metamask *if only* for the possibility of an airdrop, a la $ENS.)

Avalanche

Avalanche ($AVAX) traded at (GASP) $3.67 on January 1, 2021. So it’s up nearly 30x in one calendar year. Is it done?

We don’t think so; of course we’re kicking ourselves for being late to the party but it, as a platform, is pretty stellar and may have plenty of room to grow. (Could it pull back? Yes. $24B market cap might seem a little pricey. But $100B isn’t out of the realm and, let’s be honest, if you could 4x a piece of your portfolio, you’d probably be willing to risk a little.

Shiba Inu

Yes, we’ve seen the stories about the kid somewhere who invested a few hundred dollars in Shiba Inu ($SHIB) and now owns his own island. This one, for us, is the last of the famous international meme coins. You’re speculating that there’s a chance the $SHIB community can get this thing to a tenth of a penny, which would mean roughly 30x growth from here. (It would also mean that its value dwarfs the current value of $ETH, so yeah that’s a tall order.)

Realistically, though, expect a couple more bullish cycles of this highly volatile meme coin. Worth taking a chance on.

Crypto.com

You can’t go anywhere without seeing BRAND SPONSORSHIPS IN CRYPTO. FTX has an arena, as does Crypto.com; Crypto.com has Matt Damon, so advantage $CRO, its coin.

AND HERE’S A CLEARLY MARKED AFFILIATE LINK: We can both get a little something if you use this link and sign up and make a qualifying purchase.

This is probably the best way to play “pure retail crypto,” if that’s what you call a brand that pays big bucks to have Matt Damon on board.

Sushi

We pulled out Uniswap specifically and replaced it with Sushi ($SUSHI). We like the platform better and, while Sushi has ebbed and flowed and zigged and zagged — $3.32 on 1/1/21, then a high of $23.38 in March of 2021, and today at $7.76 — its one-stop-shop of Pooling and Staking and Farming is pretty nifty.

DeFi Kingdoms

$JEWEL is the token behind DeFi Kingdoms, which our buddy @TxdoHawk on Twitter talked about yesterday.

If you’re playing the DeFi-meets-Gaming-meets-NFTs space, there are worse places to do so.

Ethereum Name Service

$ENS is the governance token behind the Ethereum Name Service, and it was airdropped in November to users; we did a deeper dive on the site a couple weeks back. We still like it a ton.

Treasure

We talked about this one yesterday, too; $MAGIC is the coin and it is on a roller coaster this year already. (And today, dropping from an all-time high of $4.75 to its current level at $3.61 a token.)

The part above about DeFi Kingdoms playing the intersection of a couple of categories applies here: $MAGIC could very well be a ten-bagger this year (and that would put it just above $1B market cap).

What’s Next?

We plan, as we did in past years with the BRED Portfolio, to keep tabs on this one, with an update at least at the beginning of each quarter. It should be fascinating to see unfold.

Leave a Reply