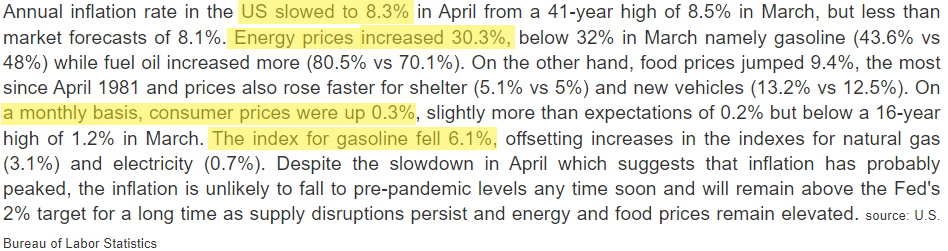

In an increasingly uncertain world, it’s wise to prepare for financial survival. Whether you’re concerned about economic collapse, inflation, or other financial emergencies, there are several steps you can take to safeguard your wealth and ensure your survival.

Here are five ideas for becoming a financial survivalist:

1. Invest in Gold and Silver

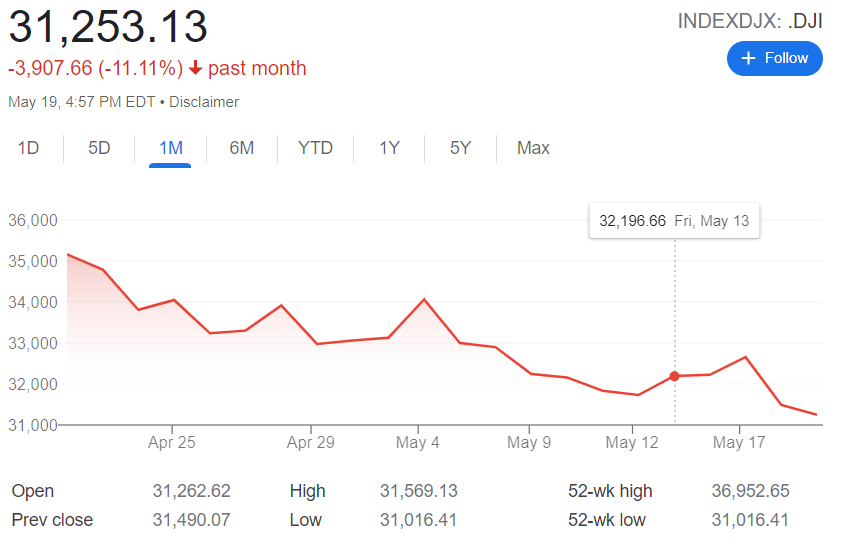

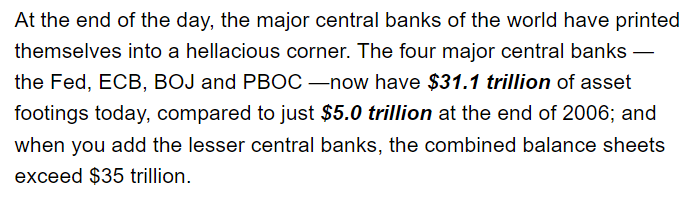

Gold and silver have been used as a form of currency for thousands of years, and they continue to be a popular investment for those concerned about financial survival. One of the reasons gold and silver are so valuable is that they are physical assets that can’t be created out of thin air like paper currency or digital assets. They are also a hedge against inflation, as their value tends to rise as the value of paper currency falls.

There are several ways to invest in gold and silver, including buying physical coins or bars, investing in exchange-traded funds (ETFs) that track the price of gold or silver, or investing in mining companies that extract precious metals from the ground. Keep in mind that the price of gold and silver can be volatile, so it’s important to do your research and understand the risks before investing.

2. Consider Bitcoin and Other Cryptocurrencies

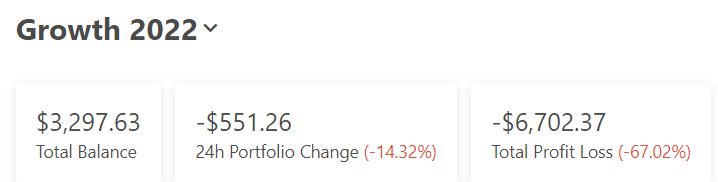

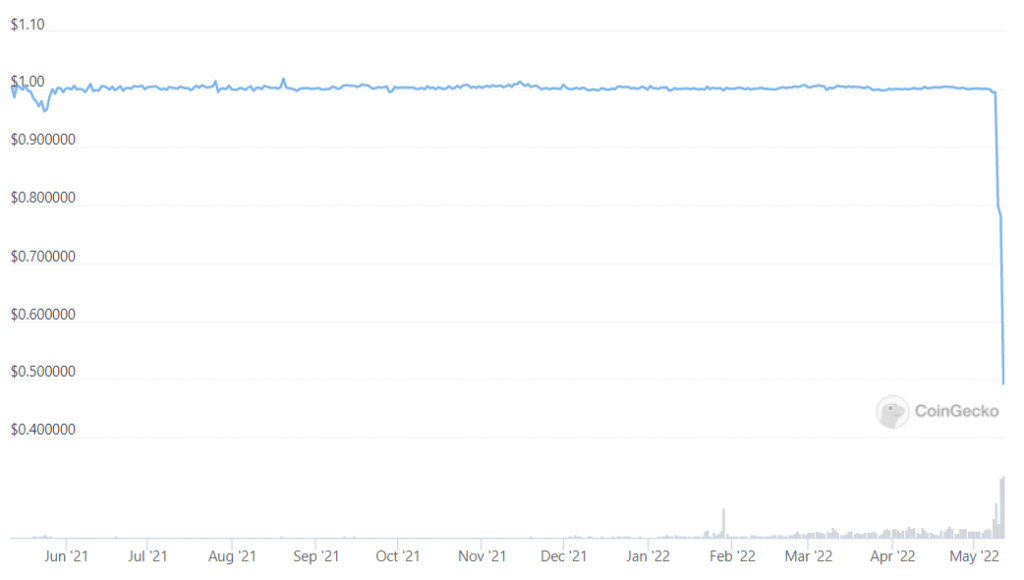

Bitcoin and other cryptocurrencies are digital assets that are decentralized, meaning they are not controlled by any government or financial institution. They offer several advantages over traditional currency, including lower transaction fees, faster transaction times, and greater privacy.

One of the reasons bitcoin and other cryptocurrencies are popular with financial survivalists is that they are not tied to the traditional banking system, which can be vulnerable to economic instability or government intervention. However, it’s important to note that the value of cryptocurrencies can be highly volatile, so it’s important to invest only what you can afford to lose.

CLEARLY MARKED AFFILIATE LINK: Get some crypto with crypto.com.

3. Keep Some Cash on Hand

While gold, silver, and cryptocurrencies offer advantages over paper currency, it’s still important to keep some cash on hand for emergencies. In the event of a natural disaster, power outage, or other emergency, ATMs and credit card machines may not be available, making it difficult to access your funds.

Keeping some cash on hand can also be useful in the event of a bank run or other financial crisis. However, it’s important to keep the cash in a secure location, such as a fireproof safe, and to rotate it regularly to avoid deterioration or damage.

4. Learn to Live Frugally

One of the best ways to ensure financial survival is to learn to live frugally. This means living within your means, avoiding debt, and finding ways to save money on everyday expenses.

There are many ways to live frugally, such as shopping for bargains, cooking at home instead of eating out, and cutting back on unnecessary expenses like cable TV or expensive hobbies. By living frugally, you can build up a financial cushion that can help you weather financial emergencies and avoid being caught in a cycle of debt.

5. Invest in Self-Sufficiency

Finally, investing in self-sufficiency can be a valuable tool for financial survival. This means learning skills like gardening, canning, and food preservation, as well as basic DIY skills like carpentry and plumbing.

By investing in self-sufficiency, you can reduce your dependence on outside sources for food, water, and other essentials. This can be especially valuable in the event of a natural disaster or other emergency that disrupts supply chains and makes it difficult to access basic necessities.

In conclusion, becoming a financial survivalist requires a combination of investment in tangible assets like gold and silver, digital assets like bitcoin and other cryptocurrencies, and cash, as well as learning to live frugally and investing in self-sufficiency. By taking these steps, you can increase your chances of surviving and thriving in an uncertain financial future.

DISCLAIMER: THIS IS NOT INVESTMENT ADVICE. DO YOUR OWN RESEARCH.