We originally wanted to call this post “Night of the Living Crypto.” And that may have made sense given the fact that this is October 1 and we are entering Halloween season and the industry is a little sorta kinda zombie-esque.

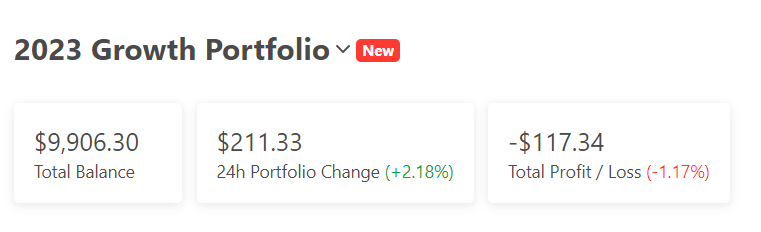

To wit, here’s the YTD 2023 performance of the assets in our hypothetical “Growth Portfolio,” which took $10,000 and put it equally on 1/1/23 into 10 different crypto assets:

To paraphrase a former colleague, “That’s not too freaking bad.” (Of course — and I’m paraphrasing another former colleague — “It’s not bad, but it’s not good.”)

BUT…it’s not…DEAD.

We wrote about the Growth Portfolio here earlier this year; who would have thought that, in these modern times, somehow you’d be only down a little more than one percent entering the 4th quarter of the year?

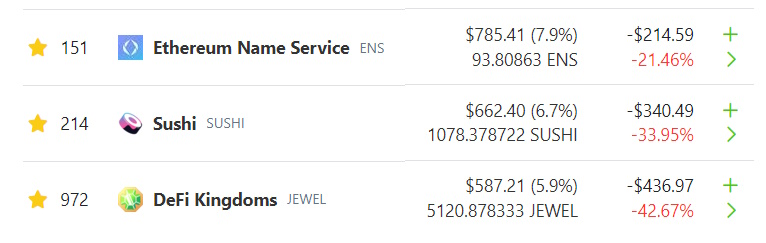

And, also, without the dead weight at the bottom of that list, you would have — theoretically, since you would have had to time the market exactly on 1/1/23 — done really well.

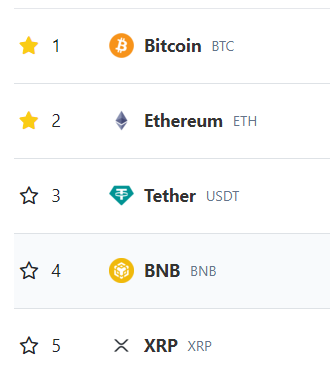

The Big…Three? Two? Five?

We’re gonna go with the Big Two. Tether is an asset that is supposed to mirror the US Dollar in that it trades 99% of the time at $1.00. Binance has had its issues (read more about those here: The Street Binance Story) and XRP has just re-emerged as something you can trade in the US (Learn more about that here: Investopedia XRP).

First up, Bitcoin. BTC is…A-OK.

It does help that 1/1/23 was the bottom. Note to self: always buy at the bottom.

But what about Ethereum? ETH is, also, A-OK.

So it’s the Big Two. Had you invested your $10,000 stack into just those two coins, BTC and ETH, you’d have a tidy $15,313.50.

What Next? Who Knows, But…

First of all, that bottom three? Yikes.

That’s not incredibly bad — not down 99% like some defunct coins — but it’s not great.

Maybe the names are the ones that are gonna survive long-term? Or maybe having access to some of these $JEWEL or $SUSHI coins will give you access to potential 10-baggers?

However, what we *are* seeing here is that it’s really really REALLY tough to call the bottom; you would have been right predicting that 1/1 was the bottom for $BTC and $ETH and dead wrong for the bottom three.

In any event, the Big Two are doing just fine this year.

And Crypto Isn’t Dead.