Timing is everything in just about everything everywhere.

Case in point: the cryptocurrency markets of the past 48 hours. A bloodletting of epic proportions? Or just a slight pullback?

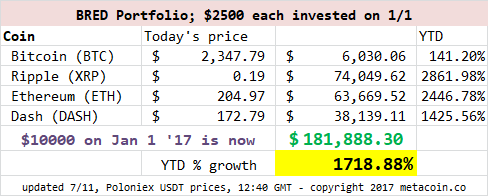

If your timing was such that you bought into the BRED Portfolio at the beginning of the year, and you didn’t sell, you would still be up 1718%.

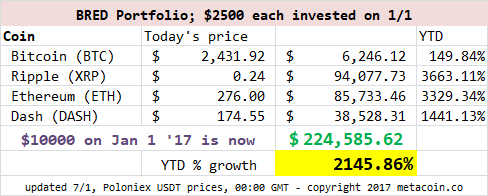

So, if you did do that – and congratulations to you for doing that – you would not have paid any attention to the numbers from July 1.

Just ten days ago. The ones we link to in the blog post above.

These numbers.

Perspective, playas. One person’s OMG is another person’s $63,000 pullback.

Which brings us to the point of this post – as well as a music video.

Catch Me, I’m Falling

One man’s overrated pop tune from 1987 is another’s evocative trip down memory lane.

Pretty Poison was the band, and I don’t think they did much after this (and, considering I’m in the 99th percentile when it comes to 80s pop music knowledge, it’s a safe bet your trip to Wikipedia for the Pretty Poison discography won’t yield anything of note).

Story time: I worked at a mall clothing store, back when both were things, in the late 80s. I was successful enough to keep the job for most of a year, and I think part of the reason was that I kept things moving. I also kept the Top 40 station on and, during the holiday rush, that helped a ton. Dance-ish poppy music played on 2-hour rotation started to stick in your head, so even the bad songs became okay.

We kept busy because we had customers and there was merchandise that had to be moved and because the manager liked to joke “If you’ve got time to lean, you’ve got time to clean.”

There was one point, though, when…whatever you were doing at the time, you had to stop doing and pretend to scratch a record like a DJ. That point was at 2:21 of this song.

I queued it up for you there.

To this day, hearing that song takes me back, and the 2:21 mark gets me pretending to scratch records.

Timing is Everything

I’m watching the markets closely because I’m ready to move in at such a point where I think it might be safe. But I won’t know exactly – and neither will you, and neither will the experts.

So all you can really do is guess, right?

Yes, and no.

Yes, you’re guessing that whatever coin you’re going in on won’t continue falling – the proverbial attempt to catch a falling knife. If you catch the handle, you’re okay, but anywhere else and you start bleeding.

Some picks – DYOR*

So we went live with a few potential bargains the other day and…they’re all still bargains. Even moreso than they were when we posted.

Siacoin is up 3x and then some this year, but it has dropped precipitously over the past couple weeks. Floor may have been 253 Satoshis yesterday. We actually took some coins back. But we’re still HODLers.*

Stratis dropped a bit, too, and it’s below the “hey you should buy up to 200k Sat” level that we talked about – let’s be honest, it’s WELL BELOW that number, and sitting at 130k Sats. (HODLing that coin, too.)

We’re long on those two, but we took back SC – actually made a profit, if you believe that – and moved that into Bitconnect. It’s a lending platform coin thing and we’re watching it rather closely – even if our coins/funds are locked up for a whole ten months. [THAT’S AN AFFILIATE LINK. So if you try it out, we might get compensated. To be honest, we set up an account there two months ago, and kept watching the action. Yesterday was when we pulled the trigger.]

* DYOR = Do Your Own Research; HODL = Hold On (for) Dear Life. A HODLer is one who exhibits HODL-type behavior.

Next?

Well, that’s the other point – we don’t know what’s next, really. We keep watching ICOs, we take a look at some of those coins we invested in that we’re waiting to see trade – like Exscudo, for instance – and we’ve got one eye on the August 1 Segwit hubbub that we honestly don’t totally understand.

This knife-catching stuff is tough.

And this market? Well, it’s like…pretty poison.