You could actively manage cryptocurrency trades. You could chase ICOs. Or, you could just take a chunk of money, invest it equally in four of the biggest – yet also four diverse – coins, and see what happens.

You could actively manage cryptocurrency trades. You could chase ICOs. Or, you could just take a chunk of money, invest it equally in four of the biggest – yet also four diverse – coins, and see what happens.

In the case of the #BRED Portfolio, which we started tracking earlier this year, you would have done pretty well, thanks.

How It Works

Step one of our BRED Portfolio was to take four coins and invest $2,500 into each. The coins were selected, we’ll admit, with the value of hindsight and because they fit an acronym; but we also chose these because of their perceived diversity. You were getting a diversified portfolio because…

- B is for Bitcoin – and let’s face it, the word “Flippening” hadn’t even entered the equation until last month;

- R is for Ripple – sorry if the XRP ticker symbol would have made this “BXED,” but Ripple, the company behind the coin, is taking on SWIFT and has a shot at actually winning;

- E is for Ethereum – “smart contracts” as an alternative network/platform onto which ICOs seem to be launched everywhere;

- D is for Dash – we credit folks like Amanda B. Johnson for actually showcasing the consumer value AND the community value of Dash.

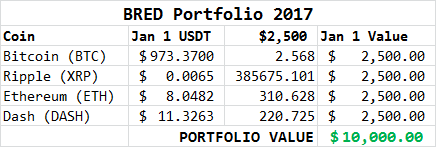

We “backtested” this portfolio in that we just went back to January 1 at midnight GMT and checked the USDT value of each coin. The result was a portfolio that started like this:

We decided early on that we weren’t going to rebalance the portfolio. We weren’t going to take profits, we weren’t going to cut losses.

We decided early on that we weren’t going to rebalance the portfolio. We weren’t going to take profits, we weren’t going to cut losses.

Since it was a hypothetical portfolio, we can do that – we can also ignore things like psychology, ebbs and flows, actually need for income that people might have, etc.

We mentioned above the value of hindsight – note that we came up with this idea in early April; had we chosen a different date, Ripple may not have been on the collective radar just yet, and Dash wasn’t yet a top five coin (which it was when we launched the portfolio).

Nevertheless, our experiment was underway. Now that we’re six months in, let’s check the results.

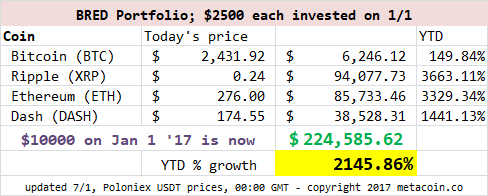

Oh. My. Goodness.

So, you’re telling me, a “set it and forget it” portfolio, of just four coins, equally weighted and left alone, would have grown to 22 TIMES ITS ORIGINAL SIZE???

Yes. Yes it would have.

What if I waited and started April 1?

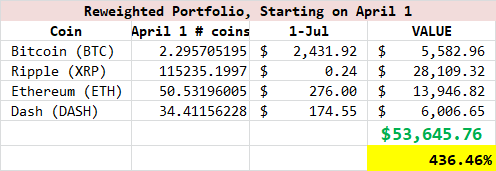

That portfolio would have looked a little different, obviously, but, if you started with equally weighted amounts of each coin on April 1 and left it alone, you’d be looking at the following:

In other words, had you waited until April 1, then invested and left your coins alone for three months, you would have gone 5x. FIVE TIMES YOUR MONEY.

What we can learn…

Not sure – all these coins have grown, some are more on fire than others, and the whole space remains all sorts of volatile.

What we’ll do in the days to come is this:

- Keep watching these coins, sharing updates as we can over on Twitter (where you should totally follow us)

- Share the results of the other hypothetical portfolio we’re tracking – our own “Hedge Fund” – and see how it is doing

- And, of course, make changes to our own holdings as we see fit.

We’ll also encourage you, dear reader, to get in the game if you aren’t already: it’s easy and, if you use our Coinbase affiliate link, you can potentially get a bonus of $10 with a qualifying purchase.

Final Note!

Of course, your experience may vary. This is a hypothetical portfolio – making 24x your money is rather unprecedented.

In other words, invest in cryptocurrency at your own risk. And don’t invest more than you can afford to lose. You could end up with 24x returns, or your entire portfolio could get wiped out. Neither is out of the realm of possibility.

Leave a Reply