Once again, the team at Metacoin is likely “taking one for the team.” We “invested” a little into the Bithaul platform and, while the site is still operational, what’s going on is really not a good sign.

We revisited our own Bithaul dashboard this morning, saw that we were racking up the Satoshis, and waited until 24 hours after our last withdrawal to take out more Bitcoins. (Or fractions of Bitcoins; we’re experimenting but not going crazy.)

However, our attempt to withdraw was met with an “ERROR” message, followed by another. And another.

We’ve been trying all morning and we’re not alone…

Seems like the folks at MakeBitGrow had the same problem; only, to their credit, they thought they’d test the following theory…”If they’ll take deposits, they’re likely a scam.”

Sigh.

What’s Next?

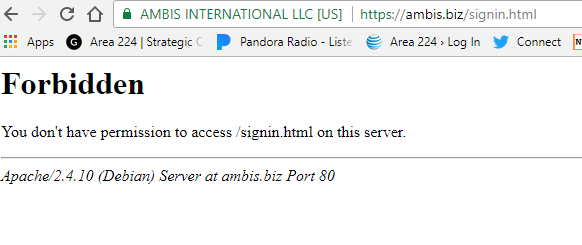

We’ve reached out via email AND we’ve even Tweeted at the company. However, the odds of anyone seeing their money again are pretty slim.

While we wait for any response, it probably makes sense to go back to a couple old saws:

- A fool and his Bitcoins are soon parted;

- If it sounds too good to be true, it probably is;

- Returns that sound unsustainable in the long-term will end up crippling any platform in the short-term.

By that last one: sure, platforms are throwing off interest and you can withdraw, so everything seems hunky dory. Until it isn’t.

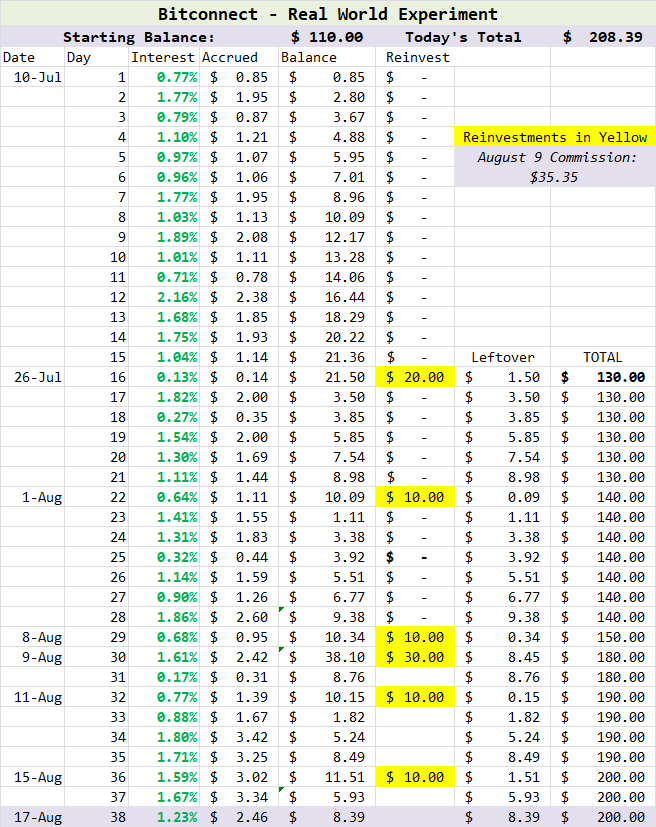

We had our own strategy worked out with this site – we were going to be in for a little while, adding some and taking some profits, and then we were going to just take profits and stop adding. This way we could offset any long-term issues with a short-term win or two. But, sadly, it doesn’t appear that we’ll be able to get back what we put in.

Our Recommendations…

We’re doing our best to try out these platforms and to recommend the ones that are paying out and are legitimate. Right now, only two in this category (passive income investment/lending platforms; separate from mining pools like Genesis) still get the green light from Metacoin:

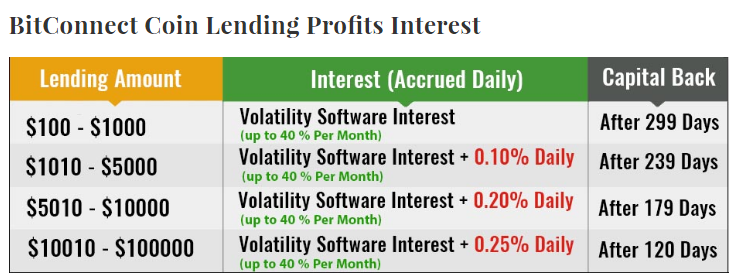

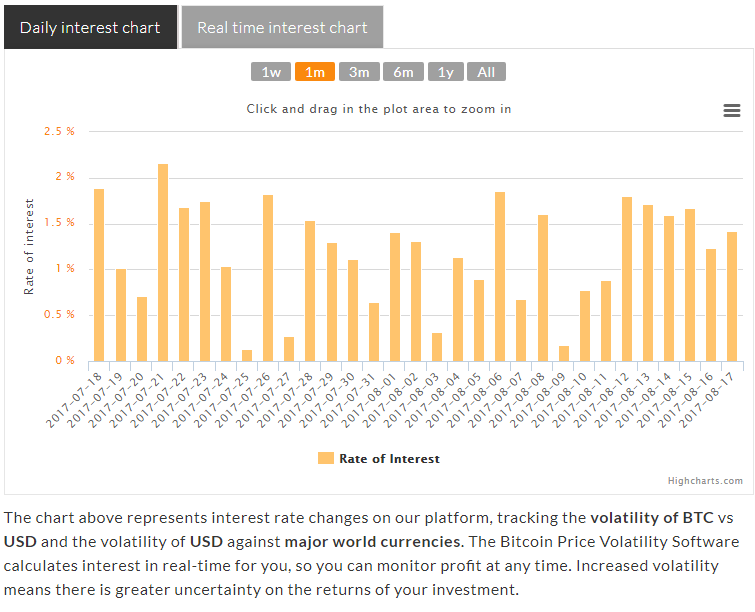

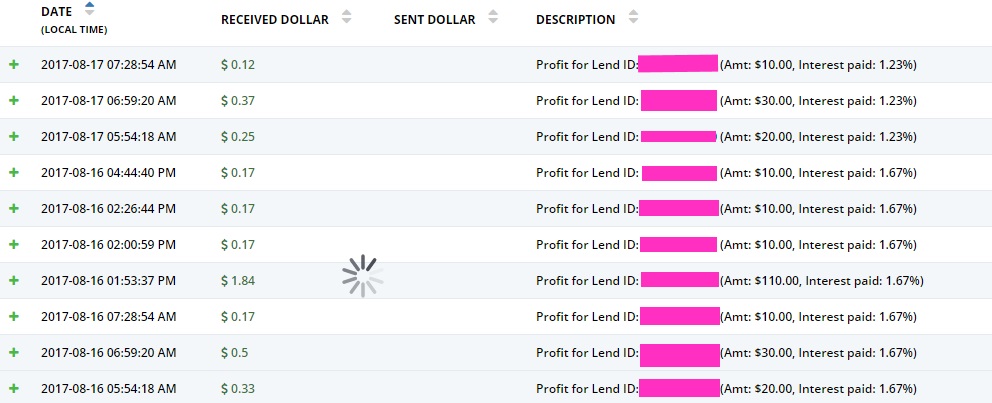

- Bitconnect – that’s an AFFILIATE LINK – which is backed by a the Bitconnect coin;

- and Bitpetite – another AFFILIATE LINK – which we actually wrote about in a head-to-head vs. Bithaul last week.

We have not tried a big chunk of these…give us time.

Right now, we can only tell you the ones that we’ve tried that have gone belly up:

- Ambis

- Microhash

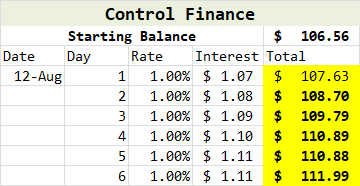

- Control Finance (which we actually wrote about earlier today).

One Other Note…

We would suggest pulling down as many records as you can from any platform you use, and make a habit of doing so on a regular basis. This way, you can best account for what you did actually invest in – and, sadly, you can account for any losses – come tax time.