Look at that list…so many coins! So many wild mood swings! So much volatility!

Look at that list…so many coins! So many wild mood swings! So much volatility!

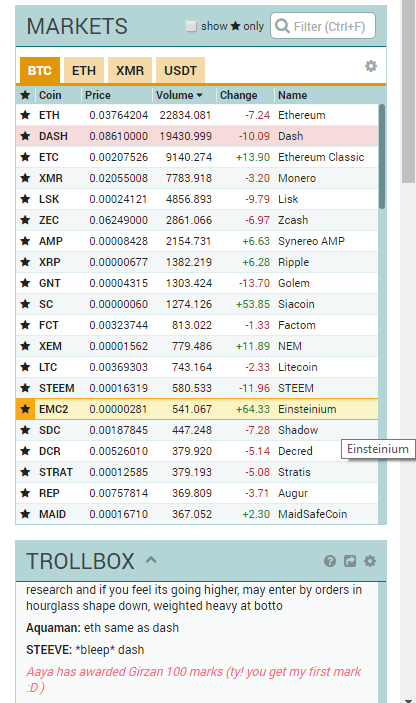

Seriously – if you’re new to trading altcoins and crypto and you want to move beyond the mainstream coins with the high market caps and the household names, you might see some of these and think: PROFIT! I can get in and out, make a quick buck, double my money, and keep doing that til I retire as a Bitcoin Millionaire!

Wait. Hold on. Just a second. You’re likely to get taken for a ride – and you might not like the ending of this roller coaster. Here’s what we mean.

ADVERTISEMENT: If you haven’t gotten started with Coinbase yet, here’s a link. Make a qualifying Bitcoin deposit, you’ll get a bonus, and we’ll get a bonus.

FOMO

Of course, “Fear Of Missing Out” is a widely used term these days. If you don’t go out to the bar, you might miss big fun. If you don’t watch the show, you might miss a cultural experience. And, if you don’t invest in the next big altcoin, you’re going to miss out on big profits.

Careful of that last one.

If we’re using the example from this screengrab, Einsteinium, we see a 64% bump in the price – which, crazy enough, is sorta kinda the norm for some of these altcoins. You don’t want to miss out on THAT ACTION, do ya?

But the FOMO danger here is that old saw about trying to time the market. Take a look at this chart, from the past couple days of EMC2.

Oh. Remember to time the market at your own peril.

FUD?

Yes, Elmer. FUD. “Fear, Uncertainty, and Doubt.”

In the top screengrab, look immediately above and immediately below the Einsteinium price: STEEM is down almost 12%, Shadow is down more than 7%. You could guess that what drove EMC2 up might be the same thing that drove STEEM and Shadow down. Fear (maybe of missing out, maybe that it’s not the greatest coin on the planet), Uncertainty – because, really, what do we know about ANY of these coins and their long-term prospects? – and Doubt because there’s likely somebody on Reddit who has you convinced that Shadow is toast.

Pump and Dump

This is a classic tactic employed by small-cap stocks; depending upon how it’s done, it’s possibly unethical, possibly illegal in the stock market. Simply put, first a group hypes a stock, creating perceived value, and, they hope, driving up the price. That’s the “Pump.” Once the group gets the stock where they want it to go, they cash out, take their profits, and leave those who bought in high holding the bag.

But this is the wild west, so anything goes in these markets, right?

Here’s where, IMHO, Poloniex does a great job with their “Trollbox,” or the chatroom that’s attached to their trading platform. Start saying things like “wow, XYZ coin is going to the moon!” or “XYZ will hit 10,000 tomorrow, better get yours now!” and you get banned for an hour or a day, depending upon how egregious your sins are.

They’re trying to keep folks from pumping and dumping – especially with thinly traded coins whose prices might be the most volatile.

Trading caveats like these might make you ask: what should I do?

Research. Investigate. Ask Questions.

We don’t give investment advice here, and past performance of any coin is not indicative of future results. But, really, are you going to base your investment on what some rando says on the chatbox?

We’d encourage you to look around, visit other sites, check out the underlying fundamentals of any of these coins. Smith and Crown is a great place to start – look at the market cap, the age of the coin, how many will be released. Visit the individual sites of these coins, too. And don’t forget chatrooms, Reddit, Slack, and the like; you’re often a quick Google search away from the answers to the questions you didn’t even know you had.