EDITOR’S NOTE: With the activities of mid-January, such as the sharp pullback of pretty much all coins, plus the crash of Bitconnect, we’ve updated this post on January 17.

Anyone else feel really blessed and ready to make it a phenomenal year?

Frankly, we feel like we hit the ground sprinting in 2018. Part of it was due to a little bit of luck, part of it was due to some planning, and part of it was due to the discipline to just hang tight for a while.

For instance, we made our own luck with a couple of timely picks; we also called ourselves HODLers on at least a couple of occasions – ones where weaker hands might have folded up the tents.

But we screwed up a couple places, too: our first ever trade with DASH meant that we took profits of 25% off the table and closed out our entire interest. Let’s never speak of this again.

Starting with a Bang

My #crypto portfolio is only up 55% since 12/31.

What am I doing wrong? pic.twitter.com/BxAqbDmFeX

— Dave Van de Walle (@Area224) January 4, 2018

We’ve gone on and on about Risk Management here. And we also feel that we’ve experimented at least enough with some concepts – you can read a whole bunch more over at the Passive Income page on this site – to at least have a firm understanding of what could work, what won’t work, and what things are worth our time.

Finally, we think we’ve gotten a good chunk of knowledge from some others on the web – especially “Crypto Twitter,” which has been a wonderful world for us so far (with thanks to some characters like @BambouClub, @crazy_crypto, @haydentiff, and @BryceWeiner, who all share their approaches to coins and tokens and various crypto ecosystems – and all bring rather distinctive POVs).

It was BambouClub himself who challenged us to put a plan to paper – and stick to it. We had the plan to paper part sketched out – but we needed to formalize it and put it in writing.

And the “stick to it” thing we’re also going to TRY to do. More to come on that…

Enough Background: SHARE THE PLAN!!!

Behold, our 2018 Crypto Investment Plan. With the usual caveats:

- This is not individual advice

- Invest at your own risk

- Seek professional help for things like taxes, accounting, legal, and the like

- “DYOR” – if you learned one acronym last year, it’s that one. Do Your Own Research.

Let’s get started with the $1,250,000 question:

Should BRED Be Part of Your Plan?

How quickly can we answer that with a resounding YES?

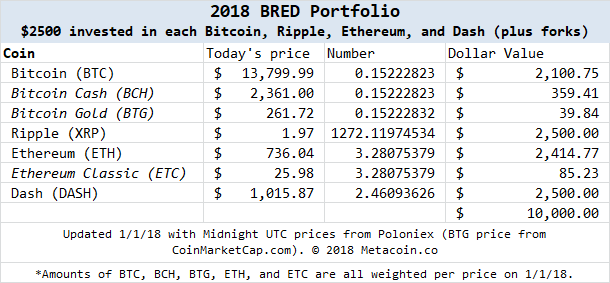

If you read our post from New Year’s Day, you know how well you would have done with BRED – that combo of Bitcoin, Ripple’s XRP token, Ethereum, and Dash – to the tune of wild, crazy, insane returns from buying and holding for one whole year.

This was, and still is, probably as close to a Bitcoin Mutual Fund as you can get. But, for 2018, it needed to be tweaked, to accommodate for a couple things, including main Bitcoin forks, the Ethereum fork from more than a year ago, and the crazy returns from Ripple (meaning that you are buying fewer XRP tokens than you had a year ago, because they’ve gone from penny stock to blue chip holding rather quickly). Hence:

We’ll answer the “how much?” question a little later; but now that the overall yes/no question on BRED is settled, we probably need to agree on an altcoin strategy, too: everything down the totem pole that could make sense to be part of the mix.

What About the Altcoins?

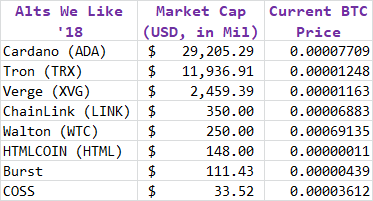

Our approach to altcoins isn’t random – we spent most of 2017 learning which sorts of projects appealed to us, and which ones had the potential to turn into something that replicates the success of the BRED portfolio. They’re somewhat diverse – big and small, different kinds of projects – and, as you can see from this chart, they also run the gamut from multi-billion-dollar projects to tiny-but-poised. Here’s a snapshot of our eight coins – but remember to DO YOUR OWN RESEARCH.

As we revisit some of the highlights and lowlights from 2017, we know that our biggest mistakes were when we chased quick returns and weren’t in love with the project. In these cases, we think these projects have tremendous potential, and it’s likely a rather diverse enough group to spread out our risk.

And we lucked out on a couple: ADA and HTML have both gone up at least 5 times since we bought in, and TRX was a gift courtesy of a Binance airdrop, so we held on and bought more.

Where we think we might see some real growth, though, is toward the bottom of the list. We’ve held COSS for long enough to be officially called #HODLers – “Hold On for Dear Life” – and our stake has allowed us to realize gains on a USD basis from Bitcoin’s price spike. And BURST has us so crazy excited: we were working on a blog post IN JUNE about the potential for that coin…before all of its developments.

There needs to be room in the portfolio for more, though. Let’s briefly address Passive Income next.

Our Changing Passive Income Approach

Well, the breaking news as we update this post goes as follows:

We took some lumps and lost some BTC (and ETH, and even some LTC) investing in passive income programs that went belly up. One saving grace: we have investigated mining and staking, and that’s where our Passive Income for 2018 will take us.

Genesis Mining will be where re reinvest in this category, and we’ll also invest in coins where there’s passive interest that pays – like HTMLCoin, for instance – and also check out inexpensive mining for coins like BURST.

There’s one more bucket, but what do we call it and what do we use it for?

Take A Flier, Please

We were able to confirm on Investopedia that we’re using the term correctly, so we’re calling this category “Fliers.” This includes:

- Coins that we invested in, lost interest in, but didn’t totally get rid of (LBRY is one)

- ICOs or other projects that are either thinly traded or haven’t fully launched (Exscudo, POW)

- Airdrops (we’re still finding coins that we were granted that…maybe might be good projects eventually)

- “Others” – serving as a catch-all term for anything else that doesn’t fit neatly into a category.

We now have four different buckets – so it’s time to figure out the right allocation for each.

Here It Is: Our 2018 Crypto Investment Plan

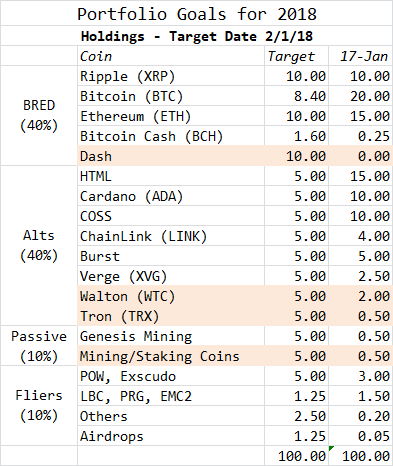

Let us explain what’s going on here. We decided to allocate in more of a “barbell strategy” – heavily weighted toward core coins on one side (40% BRED) and toward alts on the other (the 40% Alts category). The “Target” column is the amount we want to see our allocations get to – but, as you can see in the “3-Jan” column, in some respects we have a ways to go.

Coins that we specifically hope to make up ground with we’ve highlighted in pink: we will add where we can, either through profits on something like Bitconnect, or, if we end up with an extreme winner, taking some profits from that coin or token.

Right now, we need to reweight a little away from Alts (59%) and toward BRED (22%); we also know that the Fliers are not an exact science, since some of those airdrops aren’t worth much – but could be worth a ton someday – and others don’t hit the market for a bit, so pricing guesstimations are just that. (In those cases, by the way, we have simply used the value of the investments we’ve made as the value of the coin right now. Exscudo, for instance, claimed to sell at an equivalent of $2, so we calculated the BTC price and offset that for any re-distribution of tokens that occurred later.)

Why They’re “Goals”

We agreed to put this on paper, but we also didn’t want to upset the apple cart. That’s why we’re calling them goals: we aim to get our overall crypto portfolio as close to the weighting as we can by February 1.

But we also give ourselves the leeway to make changes as we see fit. For instance, TRX cannot possibly sustain its run, can it? XRP can’t have anywhere near the run it had last year, could it? And so on, and so forth: while we don’t think we’ll deviate from BRED, we might make a change or two to the Alt portion of the portfolio.

And we can’t be held to a strict “40-40-10-10” formula. (If, in theory, we did that in 2017 with BRED but decided to reallocate each quarter, who’s to say what that would have done to our approach?)

Our Suggestion For You…

Again, this is not individual advice, and seek the counsel of those wise folks in your spheres of influence.

However, this has been a great exercise for us, the act of getting things on paper. We’ve questioned a couple of our own assumptions, and we’ve also had to ask ourselves just how much risk we want to shoulder.

In this vein, we think we’re prepared for 2018, come what may.

We’d love to hear your thoughts.