We like the concept of diversification here – so we’re never going to say to put all your eggs in one basket. In that spirit, we launched our own “Bitcoin Hedge Fund,” which aims to provide a combination of established and emerging cryptocurrencies that can act at least a little like your own index fund.

We like the concept of diversification here – so we’re never going to say to put all your eggs in one basket. In that spirit, we launched our own “Bitcoin Hedge Fund,” which aims to provide a combination of established and emerging cryptocurrencies that can act at least a little like your own index fund.

You can read more about our Hedge Fund here – it’s hypothetical, of course, and you should certainly get professional advice and counsel when coming up with something of your own.

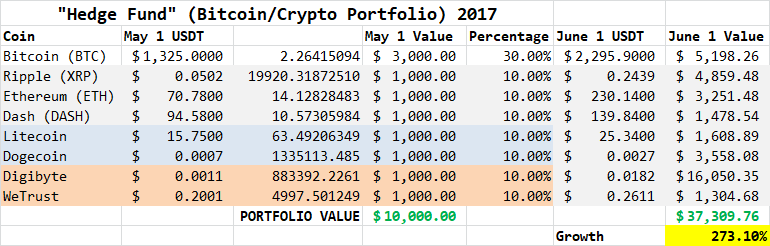

Yesterday, we shared the June 1 update of our BRED Portfolio, which is on fire this year. It had a four-month head start, so of course its results – up 19 times – will be better than our one-month-old Hedge Fund.

Hedge Fund Investment Recap

Here’s what the numbers looked like on May 1.

Now, here are the numbers from June 1, with Coinmarketcap.com‘s prices at around midnight GMT.

The fund tripled – and then some – in just a month!

This leaves us with a few questions:

- Can Digibyte keep rolling? Obviously, a 16x multiple is not really sustainable, is it? (If you compare it to, say, Ripple, whose YTD multiple is 36, it looks paltry by comparison. However, Ripple has kept chugging along.)

- Ripple, Dogecoin, and Ethereum – not bad one-month performance for each, right? The worst of the three tripled. Can those continue, too, or are we in a bubble?

- If even the laggards like WeTrust and Dash are up 30-plus percent, ARE WE IN A BUBBLE?

And that’s the point behind this “Hedge Fund”

The idea is that it’s NOT your entire investment portfolio. Is it 1%? 10% 25% or more? That’s up to you…but, really, the point of any hedge fund is to hedge your bets. One asset class goes up, another goes down, and your overall portfolio weathers the storm.

We’ll keep tracking this, and our BRED Portfolio, and there’s much more coming. For now, though, if you haven’t gotten some Bitcoin, what are you waiting for? Visit our Coinbase AFFILIATE LINK and you’ll get a bonus with a qualifying purchase (and you can buy Bitcoin, Ethereum, and Litecoin there).

Leave a Reply