We keep talking about the “BRED Portfolio,” a basket of four cryptocurrencies – Bitcoin, Ripple, Ethereum, and Dash – and there’s a reason why: it’s on fire.

We keep talking about the “BRED Portfolio,” a basket of four cryptocurrencies – Bitcoin, Ripple, Ethereum, and Dash – and there’s a reason why: it’s on fire.

BRED: The Background

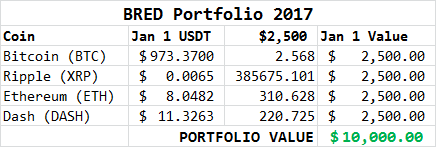

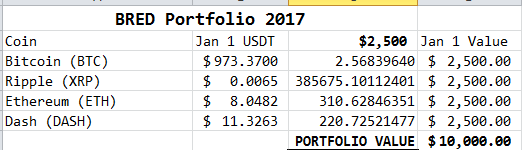

Last month on this site, we thought we’d do a little “backtesting,” with our theory that four of the most prevalent cryptos might just be four coins that could line your pocketbook rather nicely. So we did just that, and you can see the original post here: Quadruple your money with the BRED Portfolio.

Similar to what the tech people talk about with “FANG” – Facebook, Amazon, Netflix, and Google – you’re buying a basket that’s supposed to sorta kinda (technical term) replicate the market; as FANG goes, you’ll have a rather good sense of how other tech stocks are going. And with BRED, you’ll have a good sense of how digital currencies (or crypto or altcoins or whatever you want to call these things) are doing.

Did We Mention BRED = FIRE?

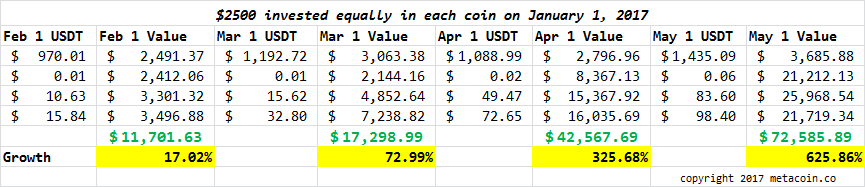

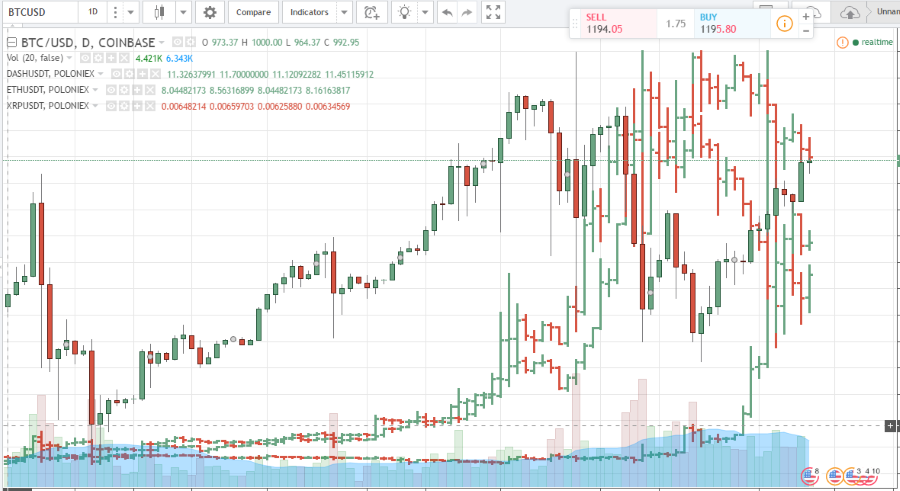

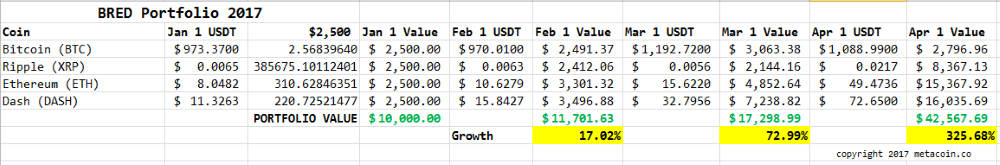

Here’s what the portfolio has looked like over the past four months:

(Prices are from Poloniex and reflect market prices at 00:00 GMT. Note that, in the case of Ripple, the price is rounded in the above chart, but is carried out to eight decimal points.)

$10,000 invested equally in Bitcoin, Ripple, Ethereum, and Dash on January 1, 2017 would be worth $72,585.89 today.

What If…You Started on April 1?

To say April was a great month for the portfolio – and for the crypto industry – is an understatement: The portfolio grew 70.5% from April 1 ($42,567.69) to today.

Or, if you just had $10,000 to invest on April Fool’s Day, AND you went back and divided your $10,000 equally and used April 1 prices to buy coins, you would not have been a fool – you would now have $17,243.04.

Caveat: What Goes Up…

Yeah, we have that Blood, Sweat and Tears song in our heads, too.

Listen to the lyrics and proceed with caution.

But still, BRED is on FIRE.