Ages ago, we created a crypto investment plan we called the “BRED Portfolio.” Then, this year, we added a different one that we called the “Balance Portfolio.” It’s time again to look at the tale of the tape: which one is performing better so far?

BRED: The OG of “Set it and forget it”

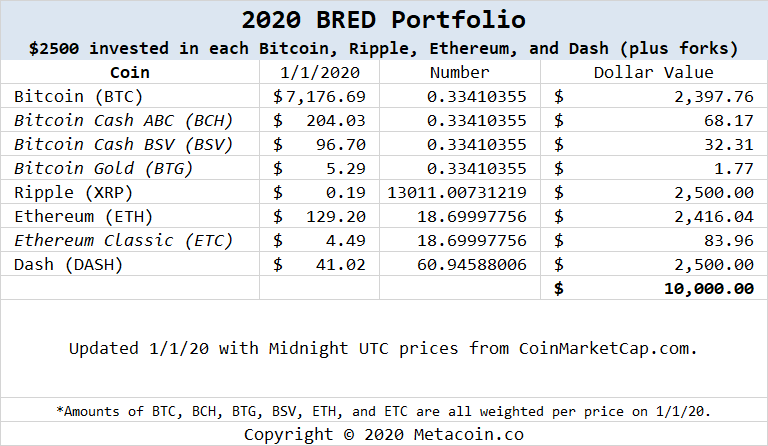

Here, as background, is what it looked like at the beginning of 2020:

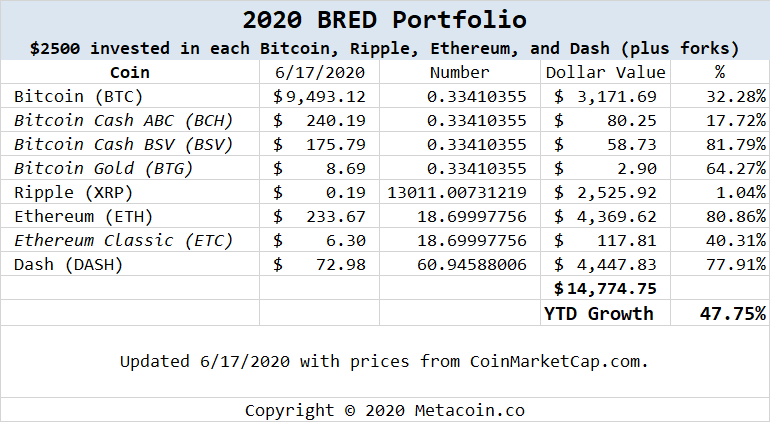

Flash forward to this morning and here is the YTD scorecard:

Of note when looking at the above percentages: since we factored in the forks at the beginning of the year (with the value of each “class” including a percentage based on the January 1 price), the percentages for the BTC and ETH class on the whole is a little lower than the percentage growth for the “big guns” in the class. BTC is up 32.54% as a class; ETH up 79.50%.

This leads us to ask whether or not we should incorporate the forks next year. We’ll keep an eye on that.

The BRED Portfolio is designed to be a hedge, of sorts; if BTC and XRP don’t move in lockstep with each other, that’s a good thing for you. They haven’t so far this year.

Bottom-lining this for ya: if you had put $10,000 into this portfolio at the beginning of the year, you’d have close to $15,000 today. So how does that compare to the “Balance” portfolio?

Balance 2020: Not too shabby, either

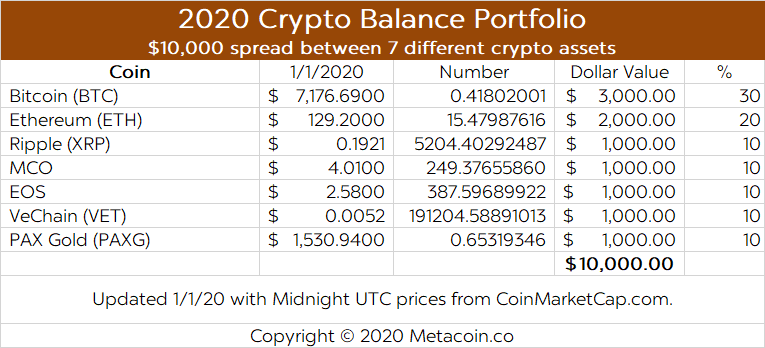

Before we look at the YTD performance here, let’s see how we set this up to start the year:

With half with big guns BTC and ETH (no forks) and the other half in five different assets that provide an interesting variety, this portfolio is designed to be more of a hedge than the BRED portfolio.

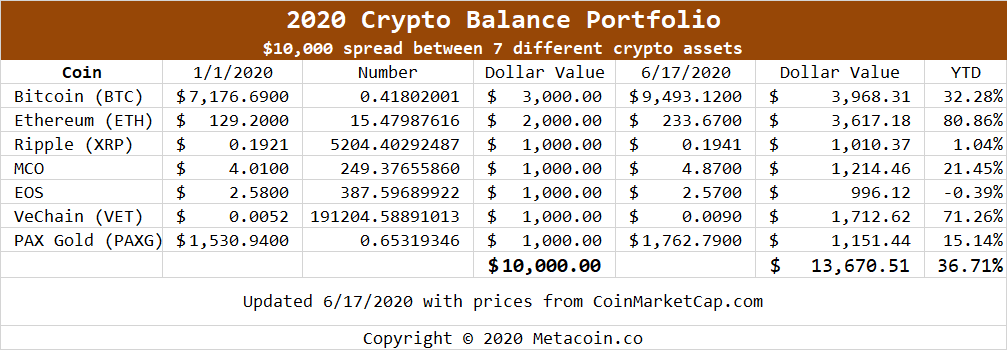

And…how is it actually doing?

N.B. We’re in love with VET; we think VeChain is inking the right kinds of “Blockchain as a Service” deals and our own personal crypto holdings have a decent chunk in VET.

PAX Gold is another interesting one, in that it aims to mirror the price of gold. Gold isn’t having a moment, yet, but 15% YTD is, again, nothing to sneeze at.

Reminder: none of what you find here is meant to be investment advice. Do Your Own Research, consult with professionals and, especially with crypto, don’t invest more than you are prepared to lose.

AFFILIATE LINK: If you’re interested in getting started with crypto, one really compelling way right now is with Crypto.com. They’re offering cash back on a crypto-based debit card with certain qualifying purchases.

Leave a Reply