If you want an answer to the volatility in the financial markets, is it possible that the BRED Portfolio — our 2017 combination of Bitcoin, (Ripple’s) XRP, Ethereum, and Dash — could be just the thing?

Well, maybe and maybe not. However, if you are looking for a hedge against a big chunk of other assets, maybe BRED is the answer to your questions. Let’s take a look at how it is faring in 2020, how a couple other things are faring, as well as how BRED would have fared if you had bought in 2017 and left it alone. (The Ultimate HODLer Portfolio.)

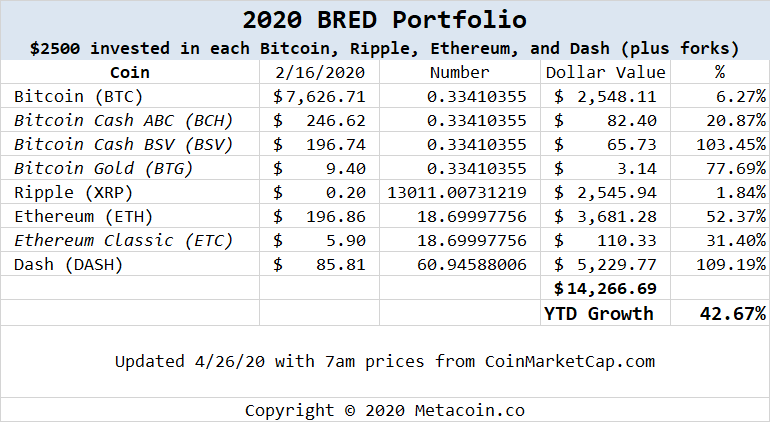

First, Here’s the 2020 BRED Portfolio This Morning

You would have a tough time to find a YTD asset class with a 42.67 percent growth so far this year. Right?

A quick Google search yields this result, where the US Long Treasury Index yields the best result. (There’s a feeble attempt at a yield pun in that sentence, since it’s an index that tracks the yield of US Treasurys.) 20-plus percent for that one.

What about precious metals? Didn’t they do okay?

Remind me to further study the palladium market later.

TL;DR — Bitcoin and its Ilk Win So Far in 2020

Whether or not it’s the ultimate Ron Popeil portfolio — “Set It and Forget It” — remains to be seen. But you could have done a heck of a lot worse with other assets in 2020.

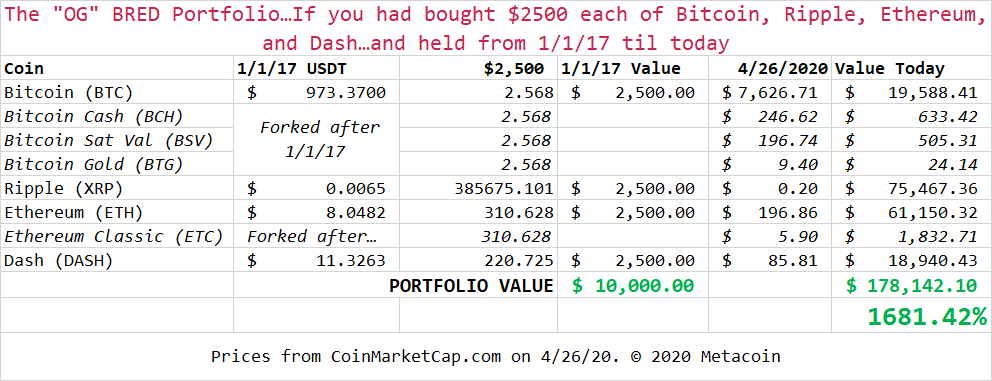

Which lead us to the question about the OGs, the ones who have HODLed their BTC (and ETH, XRP, and DASH) and are just kicking back. How would they have done?

Wow…

Well this is something to behold. (Not that you can find anyone who bought Bitcoin in early 2017 AND held it AND isn’t a public Bitcoin bull AND would actually tell you that they’ve bought and held.)

So there you have it…if you’re not a day trader and maybe an investor and have some cash to set aside, a portfolio that you pretty much ignore might do the trick.

Of course, we should tell you that you’re on your own and we aren’t responsible for your successes or failures.

Happy investing!

Leave a Reply