When the first Financial Crisis hit, we discovered the brilliant Australian satirists Clarke & Dawe. Their take on the European Debt Crisis is worth a watch.

The perspective from Clarke’s character is a propos for today’s post: only losing 13% on a portfolio of crypto assets is, with all that is going on, not too bad.

The Balance Portfolio is Kinda Sorta Hanging in There

We created our Balance Portfolio as an alternative to the BRED Portfolio (more on the 2020 version of that below). We didn’t create it as a panacea to cure market woes from the Coronavirus, though; as we discussed yesterday, we think it may very well get worse before it gets better.

Given all of what is going on, 13 percent isn’t bad, right?

Balance Portfolio as of Today

Granted, lots of green numbers appear on the screen today, so had we done this yesterday, it would possibly have looked 5 to 7 percent worse.

(One of my personal faves is VeChain (VET); note that it’s also the worst performer in our portfolio. Still bullish on this one, though.)

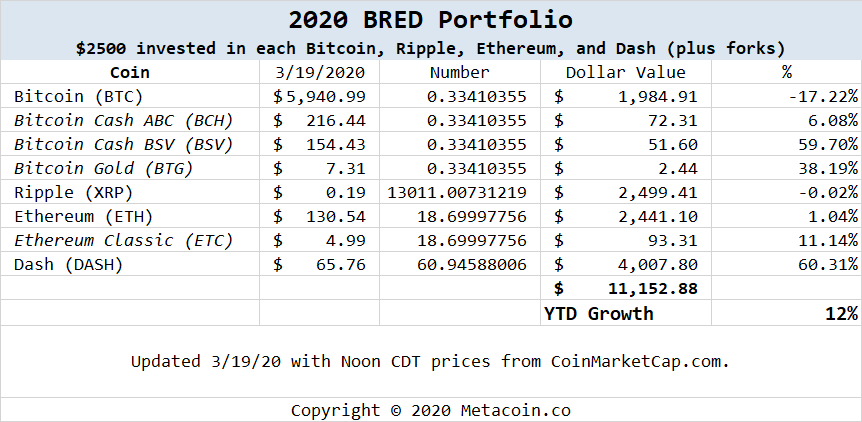

But, for a pleasant surprise, check the BRED performance so far this year:

BRED Portfolio as of Today

DASH is slightly ahead of BSV as the winner here; though, with all of the noise that accompanied BSV and its founder — who claims that he’s Satoshi or something — BSV could drop any second now. Plus, the percentage at stake is tiny when compared to DASH, which started at 25% of the portfolio and is now more than one-third.

What Can We Make of This?

Probably not too much, yet. There’s a chance for more of a pullback, or there’s that possibility that the “flight to safety” will happen, still.

The question that remains: are crypto investors whistling past the graveyard, or — like the guy who did the webinar I watched who thinks he can make you rich; maybe he can, maybe he can’t, we don’t know — are there gems that will still pop (just not immediately)?

If You’re Bullish, Here Are a Couple Picks

We made the bearish case yesterday — just for Bitcoin which, possibly, will drag the rest of the market downward with it — and it’s time to make a bullish case for a couple coins that we’ve picked up recently.

- We still like VeChain. In fact, we *think* it was one of the “high market cap/under a penny each” coins that was touted by the same investor guru referenced above;

- We also like Harmony — ONE is its ticker — and this one has a low market cap (around $10m at last check).

- Don’t forget about PAXG, which is tied to the price of gold; each coin is backed by an ounce of gold. (AFFILIATE LINK: You can get it on Crypto.com and we may be compensated if you make a qualifying purchase.)

Leave a Reply