In the financial markets, the headlines this week were pretty grim. The Dow had one of its worst weeks ever, falling by 10.5 percent, or 2993.57 points.

100 percent of the drop was due to fears of the spread of the Coronavirus. Traders are still uncertain, especially after China’s economy slowed to a crawl, whether this means we’re looking at a really bad situation for the global economy, or a kinda bad situation for the global economy, or even whether this is just — and not to diminish the lives lost and the impact of this virus — a bad flu season.

Isn’t Gold a Flight to Safety?

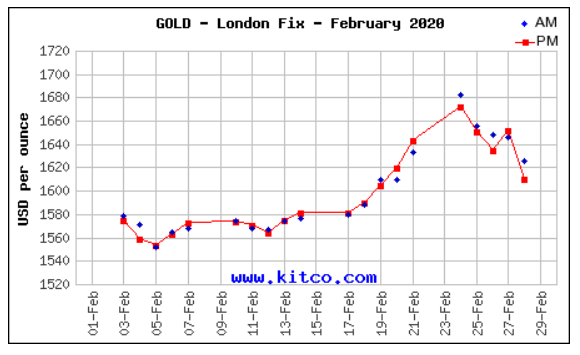

That’s a good question — you would think that folks would run towards gold. Here’s a February chart from Kitco, though, that tells you that wasn’t the case this week.

Gold is trading, according to Kitco, at $1585.50 — it appears to be right at where it was at the beginning of the month. Its week wasn’t as bad as the Dow’s week, but it was down around 5 percent. (Due to the vagaries of the precious metals markets — a London open, a New York close, and random differences between the two, we’ll just stick with around 5 percent.)

All of this leads us to the premise of this article:

If the Dow is down and gold is sorta down and sorta flat, shouldn’t the world be looking to Bitcoin and Crypto as “digital gold” in times of uncertainty?

A quick look at the week in BTC and you’d learn that wasn’t the case.

That’s a drop of $1002.57. 10.27 percent. Dropping almost as much as the Dow. Dropping more than the price of gold.

We Posit a Guess or Two

To make sense of this, I reached out to one of the smartest people I know: crypto trader and developer Von, who we heard from in our post about Playing the Long Game. Here’s what he told me through a Twitter DM:

Traders’ tastes have changed with the advent of the Coronavirus. Traders and investors are looking for alternatives, shifting the demand curve to the left. The stock trader bought Bitcoin, the crypto trader bought gold. We will see an equilibrium soon; sudden changes in tastes globally have an instant impact.

Sounds sensible: if you watch the business channels like I do, you hear a lot about trying to call the bottom, a lot about making sure you look for buying opportunities, and a lot about having a long-term view. Very little about Bitcoin.

(Except Tim Draper, who was bullish as all get-out in a recent CNBC interview, calling for a $250,000 BTC price in 2023.)

My guess about all of this is a little bit of math and a little bit of guesswork.

The math comes from Jeremy Siegel, the Wharton School professor and pundit, who reminded folks again this week that just 10 percent of a stock’s price comes from its current earnings value — the rest is long-term enterprise value. (WHAT?)

I’ll explain as best I can: Siegel says stocks could weather a lost year — an entire year’s earnings could be wiped out from something like the coronavirus — and, if they are appropriately valued, you will be okay in the long-term. So if you have stock in a company like, for example, JP Morgan Chase, and there’s a lost year due to a protracted crisis from the virus, there’s still 90 percent of the value of the business in everything else.

(Apologies to Professor Siegel if I didn’t explain this correctly.)

Bitcoin — and the rest of crypto, but let’s just talk about Bitcoin here — does not have such a luxury baked into its price. AND it really can’t be compared to gold yet either. This gives us a really interesting pricing conundrum because…

- Bitcoin doesn’t have earnings or dividends or a board of directors

- Bitcoin doesn’t have thousands of years of history as a medium of exchange or a store of value

- Heck, Bitcoin doesn’t have quarterly earnings, and doesn’t have a memory of the 1929 Crash or the 1987 Crash or the 2008 Financial Crisis.

What Next?

This reporter — who is not a financial advisor and reminds you to do your own research — is dollar-cost-averaging. Sure, I’ll have an interest in long-term projects that could pay off, but for me it’s about ensuring that this is one of the hedges in my portfolio.

Because, really, there’s a decent amount of guesswork here.

Stay safe out there!

Leave a Reply