Well, this has been an interesting few weeks, huh?

It seems, at least to this reporter, that every time you look up someone is saying “this is the LAST TIME you’ll see Bitcoin under $10,000! BUY NOW! HODL!”

Well, then…this *is* quite the development, in that the $10,000 resistance level is something that CT (“Crypto Twitter”) will tell you is really really important for short-term price spikes. So maybe there is something to be said for the fact that once BTC goes above $10,000, it holds for a little and then swings downward and then who knows what happens next?

But What Does That MEAN???

As you know, we’re less about trading crypto and more about investing in crypto. It’s about long-term projects — you can find a whole host of others who will tell you about short-term gains — and we did what we thought was a pretty decent post called Playing the Long Game a few months ago.

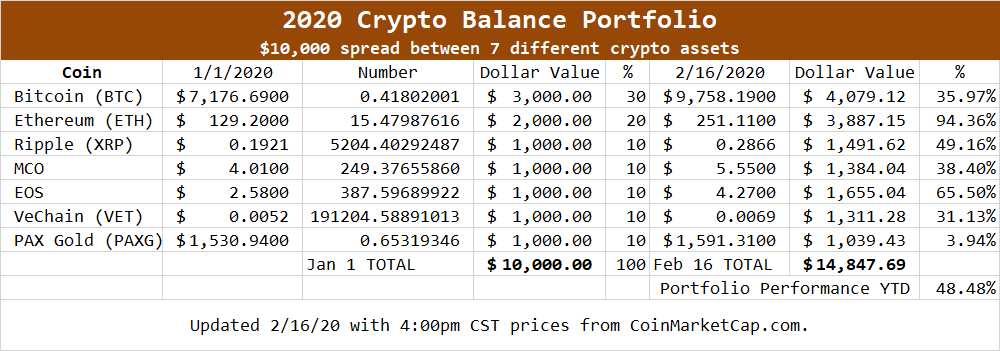

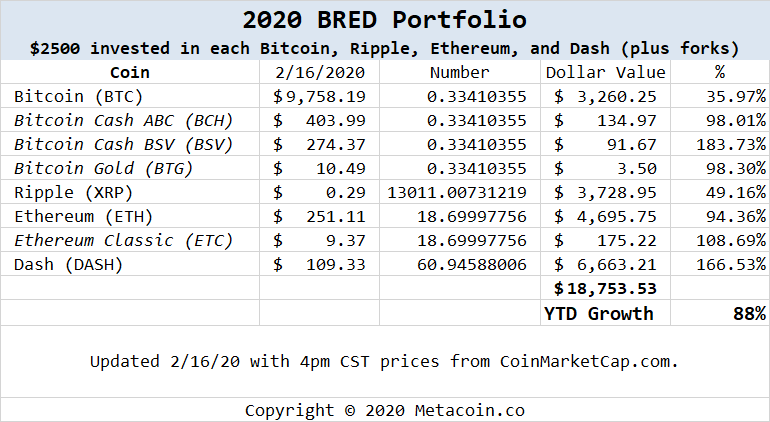

In the interest of talking about those long-term investments, we told you a few weeks back about the 2020 Balance Portfolio. Today, we’re curious about that portfolio, how it’s doing, and whether or not it stacks up against BRED, the stalwart we started tracking in 2017.

Let’s Go to the (Crypto) Videotape

Actually, before we do that, two things. ONE: THIS IS NOT INVESTMENT ADVICE. DYOR = DO YOUR OWN RESEARCH. We’re not responsible for your success or failure or anything in between. TWO: HERE IS A SPONSORED LINK: If you haven’t gotten yourself some crypto, we highly recommend Crypto.com. That’s our affiliate link and you can get a bonus by using it if you make a qualifying purchase.

A little foreshadowing: when we wrote the post on the Balance Portfolio a couple weeks back, we didn’t think we’d see the results that we’re seeing. We thought both would be up a little — but we didn’t think we’d see the winner that we saw.

First, the 2020 Crypto Balance Portfolio:

Two rather pleasant surprises here: ONE is that ETH has nearly doubled. (And, if you were following over the weekend, it had more than doubled before pulling back; prices were north of $280 a couple of times.) TWO is a big wow around EOS. That’s a little crazy, right?

So yeah, if you had invested $10,000 in this Balance Portfolio, you’d have nearly $15,000.

And you would have lost this little contest to the BRED Portfolio.

This one popped because of two factors: ETH (nearly doubled) and Dash (nearly tripled).

Another “Wait, WHAT?” moment was the fact that a $10,000 investment would have given you an 88 percent ROI.

Evidence It’s a Bull Market?

Not one asset in either portfolio is down Year To Date. Not one.

The worst performer of any of the assets was PAXG, which is tied to the price of gold.

What can we learn from all this? Not much, actually — it’s a Bull Market and stuff is up six weeks into the year. Some of the stuff is way up.

Might be time for the “Crypto Dartboard Portfolio:” we’re not going to tell ourselves we’re any better at this than someone randomly selecting crypto projects — but maybe there’s SOMETHING to picking a few potential winners, sticking with some old stalwarts, and hoping for a positive outcome?

As always, maybe staying interested in long-haul opportunities is really the way to go.

Leave a Reply