“In these uncertain times, count on Bitcoin. It’s there for you.”

Well, if Bitcoin could advertise during the pandemic, it would probably say something like that. It would also be total BS: nobody knows where the price of it, and its crypto brethren, will be tomorrow — when the unprecedented unemployment numbers send another jolt into the market –or a year from now, or at the end of 2021.

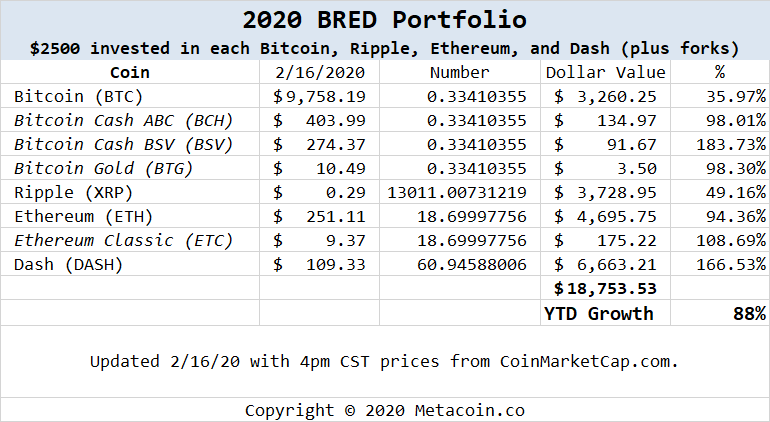

One of our goals here at Metacoin HQ is to at least introduce you to some of the coins that can potentially help diversify your portfolio. This is why we created something called the BRED portfolio in 2017, and why this year we came up with another idea: the Crypto Balance Portfolio.

Let’s Check in on the Balance Portfolio

If you’ve heard the phrase “every once in a while, a blind squirrel finds a nut,” you’ll see why we gave this blog post its name. A little dart throwing could have yielded similar results; as long as you have some Bitcoin in your portfolio, you’ll probably do okay.

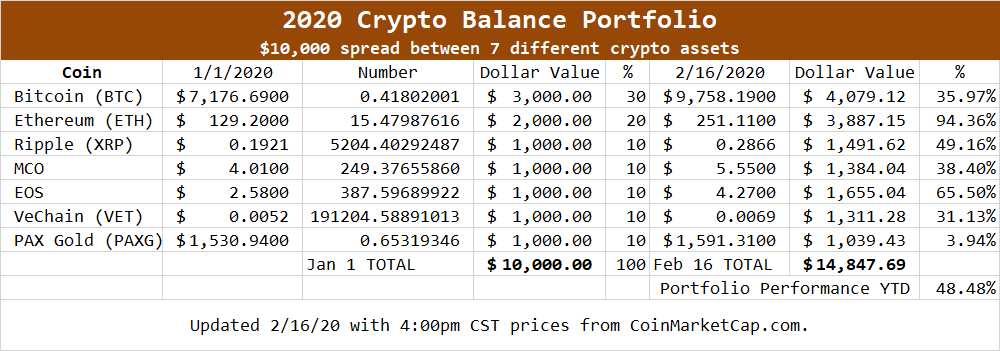

When we launched this portfolio, it was weighted as follows:

- 30% Bitcoin

- 20% Ethereum

- 10% each of Ripple’s XRP, MCO, EOS, VeChain, and PAX Gold.

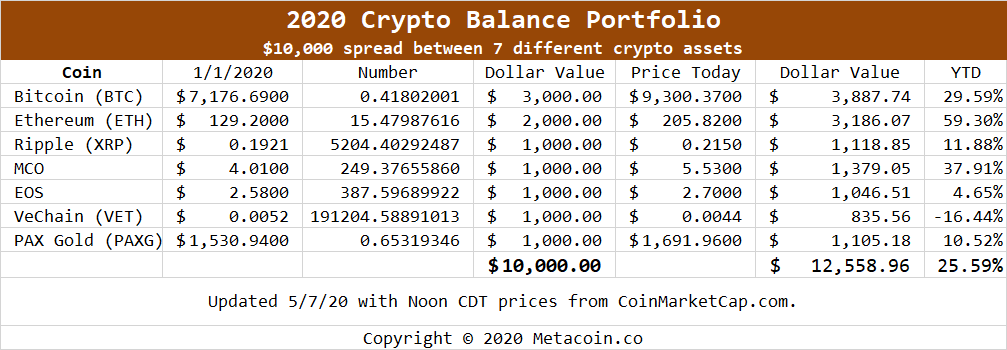

Turns out that this weighting helped us quite a bit, since half of the portfolio was invested in assets that appreciated almost 30% (Bitcoin) and 59% (Ethereum). And that helped make up for some of the “meh” performance, like that of VET (VeChain), which is the only loser so far in 2020.

What’s Next?

Every four years, Bitcoin does something called “halving:” cutting in half the reward given to miners. This is scheduled for May 11 — you can look at a nifty countdown clock here — and the block reward drops to 6.25 bitcoins.

So that means what? Good question: some people think the current price factors in that reward, while others think that the supply and demand equation can only mean that, with fewer bitcoins available over time, we’re strapping in for a rocket ride.

The answer is probably somewhere in the middle: volatility, followed by a bull market, followed by more volatility.

In other words, maybe a balanced portfolio can help you hedge your bets.

NOTE: This isn’t investment advice, do your own research, and we’re not responsible for your success or failure.

FINALLY…

Here’s a CLEARLY MARKED AFFILIATE LINK: if you want to pick up some coins, you can use our link at Crypto.com or Coinbase and we’ll both get compensated with a qualifying purchase.