It’s March 15, 2020. I’m trying to answer a whole host of questions. Some are serious:

- Are we going to stay away from this virus?

- How will bloggers, writers, and entrepreneurs like me make a slowdown work financially?

Some are less than serious:

- What is the best recipe for a “Quarantini?”

While everyone should take precaution during these times we do not recommend having a ‘Quarantini’ or any alcohol if you’re feeling under the weather.

If you’re feeling fine and of legal drinking age, a little extra Vitamin C consumption doesn’t hurt.

– Aviation Gin PR https://t.co/c97ZQaxJKV— Aviation American Gin (@AviationGin) March 13, 2020

- And what about a “Cryptotini?”

But, in the spirit of this blog (“making sense of crypto” is kinda the mantra), the questions we’ll ask today — and attempt to answer — are all Bitcoin and crypto in nature. Here goes:

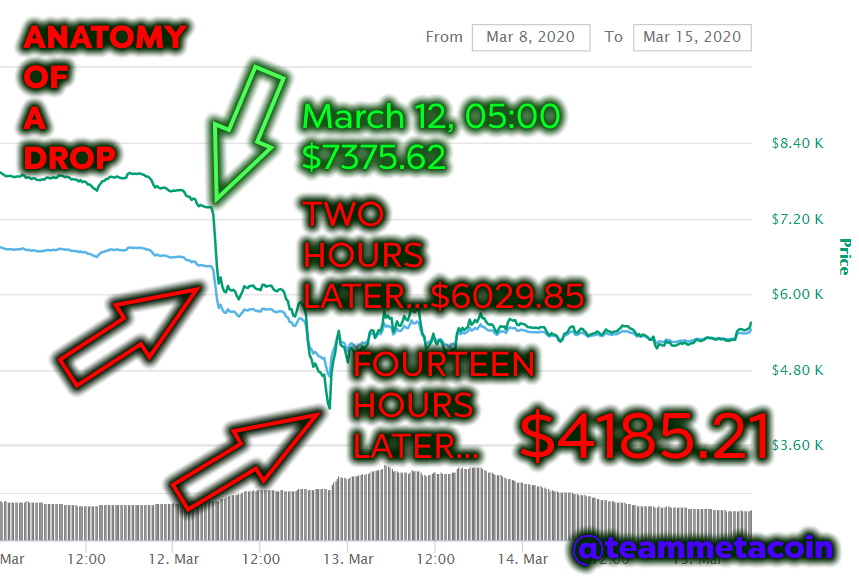

Have We Hit “Bitcoin Bottom?”

Well, to answer the question in the caption, it WAS that bad. Like REALLY bad, actually. THAT IS A 43.3% DROP.

But to answer the bigger question…

Nobody knows. $4185.21 might appear to be a bottom — FOR NOW — because, as of this writing, we’re at $5373.35. We’re bouncing around in the $5100-$5500 range for the past day. There’s some stability. But there’s also that “flight to safety” question that we asked forever ago: Is Bitcoin Digital Gold? (And yeah, forever ago was two weeks back.)

Is What’s Happening Outside Really Impacting Crypto Prices?

One theory — not my theory, had been espoused elsewhere, most notably by vagabond entrepreneur and crisis investor Doug Casey — is that prices aren’t impacted by anything other than rogue traders (Chinese? North Koreans? Both?) who are dumping their ill-gotten gains for cash.

Another theory — probably works in parallel to the above — is that whales are using the drop to dump their Bitcoin and Ethereum on unsuspecting noobs. Then they’ll buy the same coins back at lower prices, with a plan to lather, rinse, and repeat as the days go by. (And as people get less and less certain of what’s to come.)

What’s a Crypto Investor — or ANY Investor — to Do?

Hey, here’s where we can go back to the basics. And these basics make sense for ANY investment — you are entering an uncertain time. You don’t know what will happen next, none of us do, and that’s okay. Consider the following as advice that is worth the paper it is printed on.

- Remain calm. It’s a dog-eat-dog world out there — and, if you’re Norm Peterson from Cheers, you’re wearing Milk-Bone underwear — and having a steady hand is going to help a ton.

- Assess where you are and where you’re going. Some may need money immediately and don’t have time to play the game of market timing (as has been said often, nobody rings a bell when you hit the bottom). Some may have a little extra to set aside for crypto projects. It all depends on where you plan on being in a month, in six months, in six years.

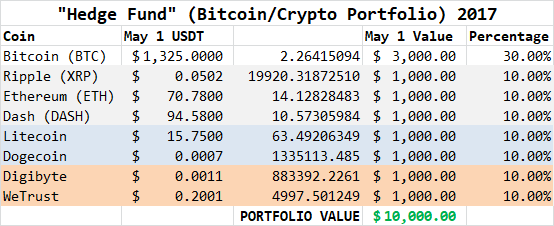

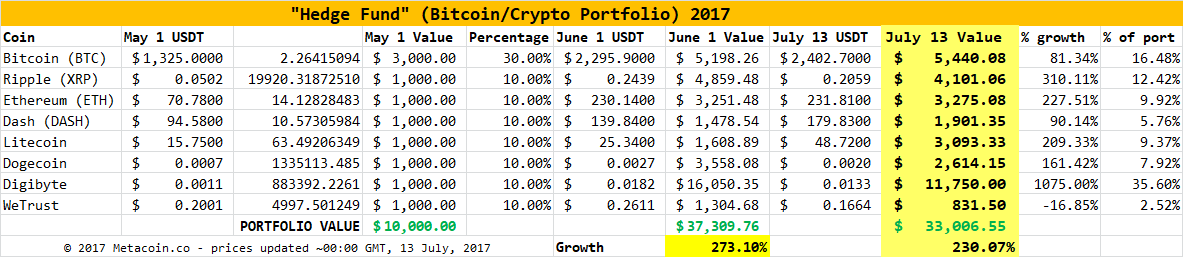

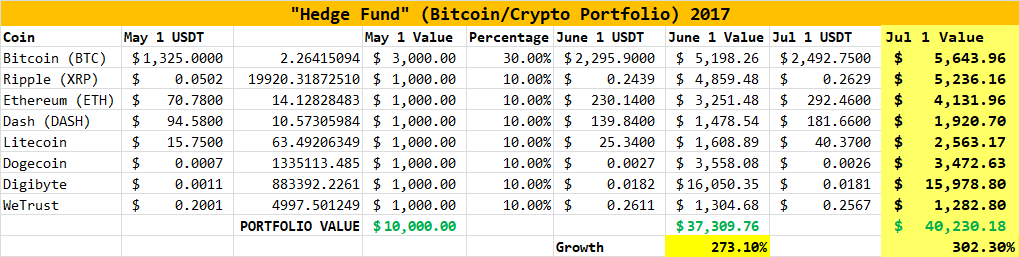

- And, if you can, play the long game. We wrote about that a while ago and we’re still there: playing the long game is going to get you farther than anything else.

Links to Help You…

These are of course AFFILIATE LINKS and if you use them to open an account and make a qualifying purchase, we’ll get a commission. But two long-game tools we’ve been using are…

- Coinbase. Dave’s Affiliate Link. They have recently started letting you make regular purchases to “dollar-cost average” your way into crypto. 50 bucks or so, a couple times a month might be all you need to get your feet wet.

- Crypto.com. Dave’s Affiliate Link. We have more in this account of late than in our Coinbase account, partly because of the nifty debit card option.

In any event — prices up, prices down, rock bottom, Moon, etc. — we’re here to help. Stay Sanitized.