It’s time to update our Bitcoin Hedge Fund, which we told you about back in May. Before we do that, though, this reminder: we DO have a Facebook page, we ARE on Twitter, and we’ve been spending a ton of time over on Steemit. We’d love to have you join in on the conversation in any or all of the three.

It’s time to update our Bitcoin Hedge Fund, which we told you about back in May. Before we do that, though, this reminder: we DO have a Facebook page, we ARE on Twitter, and we’ve been spending a ton of time over on Steemit. We’d love to have you join in on the conversation in any or all of the three.

And away we go…

Hedge Fund Background

First of all, the typical standard disclaimer: do your own research. We’re not responsible for gains or losses. Get legal, tax, and accounting advice. Don’t invest more than you can lose. These are volatile-as-f markets, y’all. Really volatile, especially the past several days, where there was at least a little bloodletting and panic.

Anyway, our original post said we’d park a small amount – in our hypothetical fund, we chose a guy named “Herbie” and his hedge fund (“Herbie’s Hedge Fund”) had $10,000 to invest. We chose this amount as ten percent of his investment capital. Is that a good amount? A bad amount? Too high? Too low?

Heck, that’s for you to decide. If you’re Wences Cesares, you’d put 1% of your net worth in Bitcoin and leave it there for several years. That may turn out to be good advice, or it may turn out to completely fizzle.

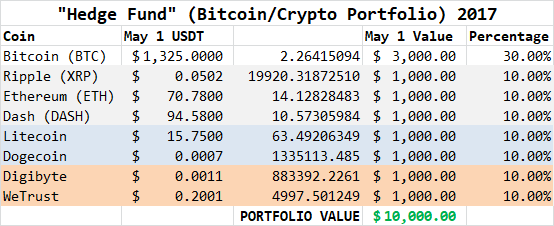

What We Started With

Our hedge fund had a nice mix of established coins – the BRED portfolio, of course – as well as some emerging coins and a recent ICO. Here’s what it looked like then:

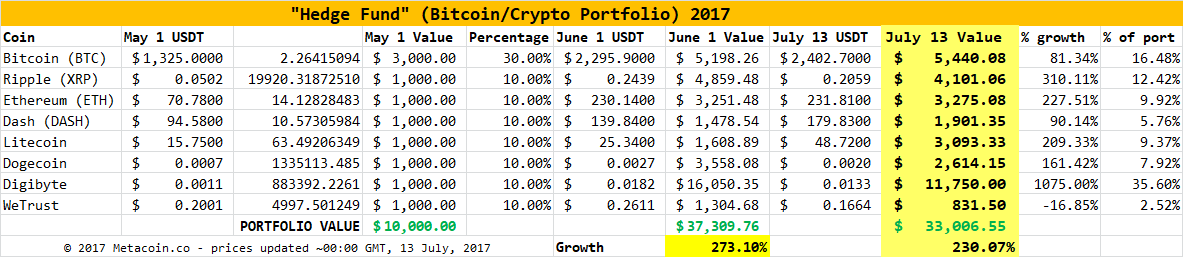

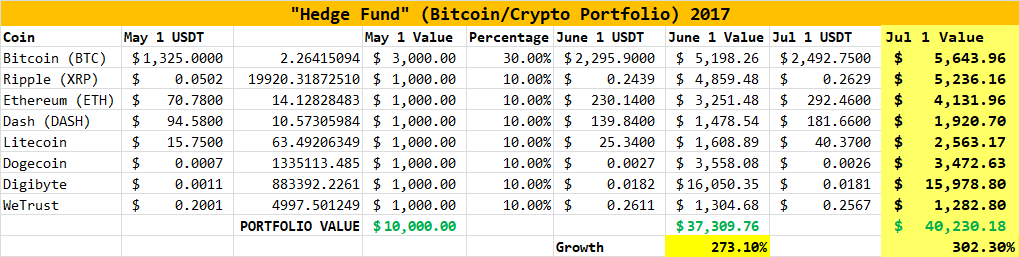

If you have more than a passing understanding of the markets we’re in, you might think every one of those coins has gone up since May 1. And you’d be almost 100% right: using today’s prices, grabbed from CoinMarketCap.com, here’s what you’d have:

Some notes on what we see here:

Bitcoin: Holding Steady

Bitcoin is doing well enough, and it started as 30% of the portfolio – for reasons detailed in May, but, if it’s becoming the reserve cryptocurrency, then yeah, you want a good chunk of it.

What will be interesting, though, is where it goes in the next 20 days or so. Hard Fork, Soft Fork, stuff that even we admit we’re paying attention to but not studying THAT closely – the August 1 deadline date for Segwit-related movement on the part of the BTC-hemoth will mean movement in price not only of BTC, but perhaps of others in the BRED portfolio…and LTC, too.

Timing on LTC, DGB, XRP: Not Bad!

From the “blind squirrel” department, all three have done well. Litecoin was, indeed, a defensive play – you could argue that it belonged in our BRED portfolio – some folks have told us so – but it’s (in our eyes) a bit like Bitcoin and a bit like Dash. But it’s also seen as a Bitcoin alternative, so that’s why it’s here. And it has nearly doubled in the past five weeks.

And some of our success is a little bit of luck – we thought we could be too late to get into Ripple’s XRP token, but it turns out that quadrupled for us.

Digibyte went on a tear, then pulled back and is now back down to Earth – if Earth is an 11x growth in its price.

And, About Our Laggard

Win some, lose some. WeTrust is still a good product/coin/token/system/platform. And we’ll keep it here because we do think that it has tremendous potential.

But two things do jump out at us here at Metacoin HQ:

- We picked the wrong ICO.

- We are also missing out on a number of these ICOs because we’re in the USA.

A Word on ICOs

Initial Coin Offerings used to be all the rage a couple weeks ago. Then Ethereum pulled back and cries of bubble were everywhere.

THEY’RE BACK.

Tezos $XTZ pic.twitter.com/zswITrHUiY

— BambouClub (@BambouClub) July 13, 2017

That’s one we missed out on entirely because we’re in the USA and these will not let Americans get involved. You have to wait until they are traded on an exchange…

That could actually be a good thing – if an ICO is oversold, overblown, and overhyped, it will more than likely fizzle once it hits the markets, creating a buying opportunity for mere mortals, er, Americans.

But, and this is a message for Congress as they look at tax reform, and maybe, too, a message for the SEC: as long as there’s a ton of caveat emptor attached, what really *IS* the problem with these ICOs being open to American investors? How are they any different from, say, my deciding that Blue Apron is awesome and I want to bet my IRA on the Blue Apron IPO?

Food for thought.

Two More Things

One – our hedge fund actually looks a bit different today than it did on July 1.

Yeah, $7,000 down since July 1. This is why we updated the numbers on July 13 – it’s a more accurate picture of what’s happened over the past 12 days.

Two – your own hedge fund. We told you before that this is a hypothetical experiment and you can use this as a guide for creating your own. However, we like the basic principles here: some big coins, some smaller coins, maybe an ICO or post-ICO coin or token or two. The general idea, as always, with a hedge fund is that you want to hedge your bets.

Overall markets – stocks, bonds, mutual funds, precious metals, pork bellies – those could tank tomorrow, or explode tomorrow, or trudge along. If you have all of your eggs in one basket, you’re likely going to have trouble someday. And if you have all of eggs in the wrong basket, that could spell trouble, too.

Love to hear your ideas! Tell us on Twitter, or in the comments below.

Oh, if you HAVEN’T gotten some coins to get started, pop on over to Coinbase, use this Affiliate Link, and you’ll get a Bitcoin Bonus with a qualifying purchase.

Leave a Reply