Gabriel Garcia Marquez wrote Love in the Time of Cholera in 1985; it’s a book whose title format will be used and overused during the next several months. We shall do the same here, in the interest of being clever, of course, but also because it does lead us to a question that needs to be asked.

(It should also be noted that I have never read this book but I do remember that it figured prominently in the film “Serendipity.”)

Here, the question at hand:

“Should you love Bitcoin with *everything* that’s going on?”

And that leads us to another question:

“Why love an asset now if it’s probably going to drop by 50% or more in the next couple months anyway?”

Good questions, these. Let’s dive in.

ONE THING BEFORE WE PROCEED: Sites like these rely in no small part on AFFILIATE LINKS — and, given the goofiness that’s out there, if you’re so inclined, folks like us appreciate the assistance.

- Here’s an AFFILIATE LINK to Crypto.com <— we can get compensated if you sign up for an account and make a qualifying purchase.

- And here’s an AFFILIATE LINK for Coinbase, same deal there.

- 3HqMK9T2Xzy6CnLeJ5sx1xDgGcqz4Qtmj6 <— that’s our BTC address if you want to send a tip.

Loving Bitcoin…But at a Distance

Here’s a theory: the ride will continue to be wild as heck, based mostly on the fact that Bitcoin is an unproven asset.

Most investment professionals we’re following are looking for analogous events to try to figure out what might happen next. Two examples that come up the most often — remember the cognitive biases, though, that are driving people’s thinking here — are the Financial Crisis of 2008-09 and Sept. 11, 2001.

If you follow that financial markets got worse, then much worse, then better right after that, then you can apply this same logic to Bitcoin (which we’ll use broadly as an example of the crypto markets).

So, let’s look at the 52 weeks that just passed for some price history — this will give us at least a basis for making some sort of prediction.

Let’s assume this was an average year for Bitcoin: wild swings and a price that tripled in less than four months, then dropped back to Earth, then dropped even more, and is now at near its 52-week low. And this was with nothing really crazy going on in the world: no financial crises, no major shocking events like Sept. 11, and certainly no global pandemic.

When *I* look at the chart, and being totally honest (and paranoid) here, I look at the high from July and where we are today; then I assume that today is going to be the 52-week high for the next 52 weeks.

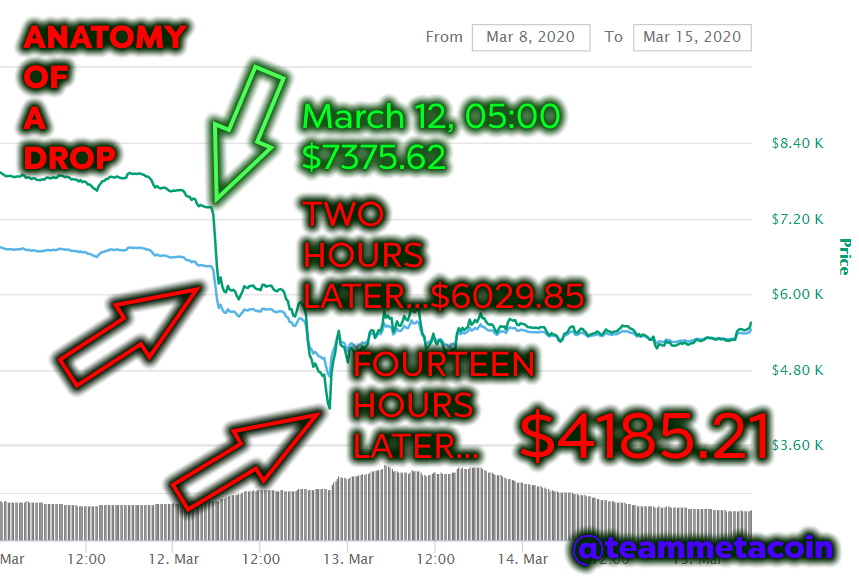

That’s Right. I Could See a Huge Drop.

If you do the math on my little theory, here’s what that means: a drop of 60.5% (from $13,073.24 to $5163.92), or all the way to $2039.75.

I’m not alone: one foreign friend who takes advantage of Bitcoin options trading has loaded up the “stink bids” that will profit from huge price drops. (I can’t trade Bitcoin options since I’m an American.)

But Why the Drop? Shouldn’t It Just Be a Bull Market from Here?

I honestly don’t think so…

- We’re in completely uncharted territory

- The US is considering sending every American adult a check for $1000

- And the average American is going to use that on things like food, the mortgage, rent, car payments, diapers…you name it.

BUT if you’re already in the game, here’s a recommendation — NOT FINANCIAL ADVICE, DO YOUR OWN RESEARCH, NOT RESPONSIBLE FOR FUTURE SUCCESS OR FAILURE — to do the dollar-cost-averaging thing.

Wait, a Bitcoin “Pundit” Saying We’ll See a Price Drop?

Yes. That’s what I think. Uncertainty, coupled with an un-tested asset that isn’t yet “digital gold,” and we’re in for a bumpy ride.