Editor’s Note: Like a good chunk of the world, we got an invite to try “Bard,” Google’s LLM AI writer thingy. We assigned it an article on “how to invest $1000 to prepare for a financial crisis.”

The article follows. Again, not investment advice, and do your own research.

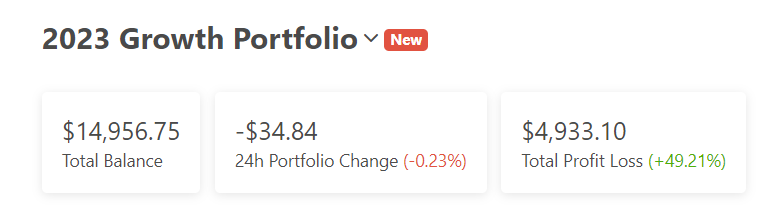

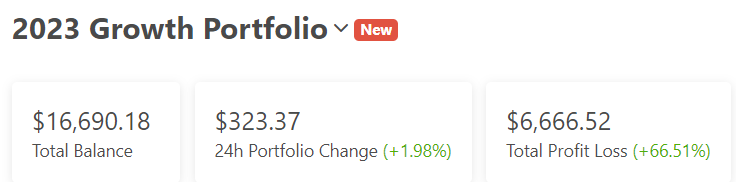

THIS IS A BLATANTLY SPONSORED POST: Here’s a link to Crypto.com.

Here are some tips on how to invest $1000 to prepare for a financial crisis:

1. Build an emergency fund.

An emergency fund is a savings account that you can use to cover unexpected expenses, such as a job loss, medical bill, or car repair. It is important to have an emergency fund in place before a financial crisis hits, so that you don’t have to go into debt or sell your assets. A good goal to aim for is to have at least 3-6 months of living expenses saved up in your emergency fund.

2. Invest in assets that are likely to hold their value or appreciate in a financial crisis.

Some assets that are considered to be safe havens during a financial crisis include gold, silver, and bonds. You can also invest in stocks of companies that are considered to be essential services, such as utilities and healthcare companies.

3. Diversify your investments.

By investing in a variety of different assets, you can reduce your risk of losing money if one particular asset class crashes. A good way to diversify your investments is to invest in a mix of stocks, bonds, and cash.

4. Rebalance your portfolio regularly.

As the market changes, your portfolio should also change. This means selling some assets that have gone up in value and buying assets that have gone down in value. Rebalancing your portfolio regularly can help you stay on track with your financial goals and reduce your risk of losses.

5. Be patient and stay calm.

Financial crises can be scary, but it is important to remember that they are temporary. If you stay calm and stick to your investment plan, you will be more likely to come out ahead in the long run.