If you slept through 2023, you might have missed what amounted to a #CryptoComeback.

We thought we’d head to the “Crypto Flavorizing Machine,” otherwise known as ChatGPT, and ask about our 2023 Growth Portfolio — which you can read about at this non-ChatGPT post from Dave — and whether it’s got the goods going forward.

Also, this was a good chance to check on the abilities of the machine. Here goes:

The Evolution and Future of a Diverse Crypto Portfolio

As 2023 unfolds, the cryptocurrency market remains as dynamic as ever. Investors who equally diversified their portfolio at the year’s start with ten notable assets — Bitcoin ($BTC), Ethereum ($ETH), DeFi Kingdoms ($JEWEL), Avalanche ($AVAX), Crypto.com Coin ($CRO), Treasure ($MAGIC), SushiSwap ($SUSHI), Shiba Inu ($SHIB), Spell Token ($SPELL), and Ethereum Name Service ($ENS) — have witnessed a rollercoaster of trends and shifts.

Bitcoin ($BTC) and Ethereum ($ETH): These giants continue to dominate the market. BTC, as the pioneer, often dictates market sentiment, while ETH’s transition to Ethereum 2.0 has kept investors on their toes.

DeFi Tokens ($JEWEL, $SUSHI, $SPELL): These assets, linked to decentralized finance platforms, have seen varied performances, heavily influenced by the broader DeFi market trends and technological advancements.

Layer 1 Networks ($AVAX, $ENS): Avalanche and Ethereum Name Service represent the growing interest in alternative layer 1 solutions. They’ve been pivotal in discussions about scalability and blockchain utility.

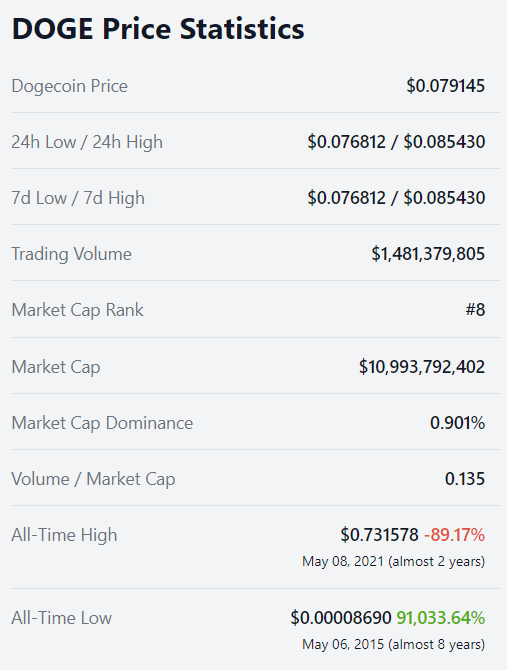

Meme Coins ($SHIB): Shiba Inu, despite its meme coin status, has a dedicated community. Its value often moves on social media sentiment rather than fundamental analysis.

Niche Picks ($CRO, $MAGIC): Crypto.com Coin and Treasure have carved their niches — CRO in the crypto exchange space and MAGIC in the NFT and gaming sectors.

Looking ahead to the next year, several factors could influence these assets:

- Regulatory Environment: Increasing regulatory scrutiny, especially in major economies, could significantly impact these assets’ performance.

- Technological Advancements: For Ethereum and Avalanche, how they scale and improve will be crucial.

- Market Sentiment: Overall investor sentiment, often swayed by macroeconomic factors like inflation rates and geopolitical tensions, will continue to be a key driver.

- Community and Ecosystem Developments: For coins like SHIB, JEWEL, and MAGIC, the strength and engagement of their respective communities and ecosystems will be pivotal.

- Global Adoption: The pace of crypto adoption by mainstream finance and the general public could bring more stability and growth.

Disclaimer: Cryptocurrency investments are highly speculative and volatile. This analysis is for informational purposes only and should not be considered financial advice. Investors should do their due diligence and consider their risk tolerance before investing in cryptocurrencies.

This analysis provides an overview of each asset’s current standing and potential future directions, considering various market dynamics. Remember, the crypto market is unpredictable, and past performance is not indicative of future results.

Now, Back to the Human Analysis

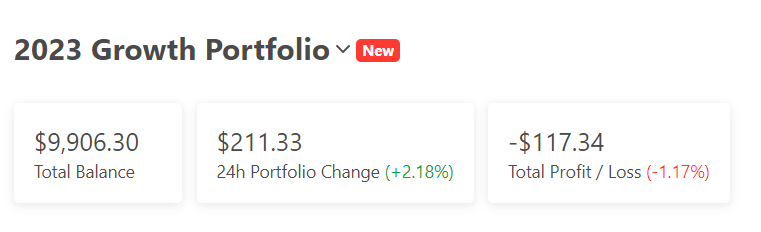

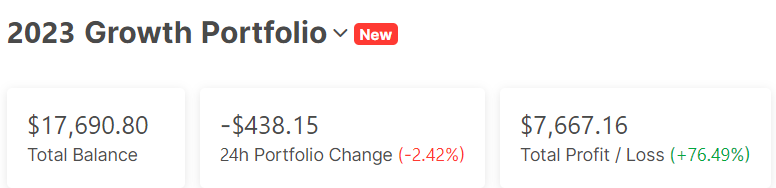

“Past performance is not indicative of future results” but the past performance of our 10 picks in the Growth Portfolio has been pretty strong. To wit:

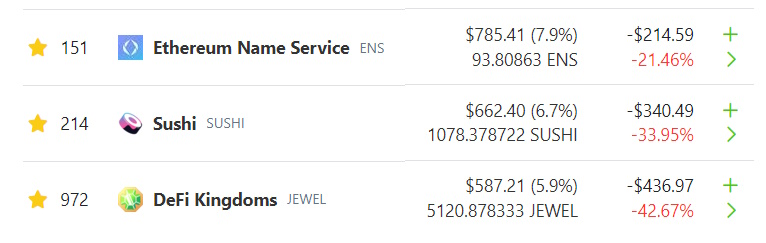

Those three are the top performers. Avalanche has tripled. Bitcoin is up 2 1/2 times, and DeFi Kingdoms has doubled. (Okay, they all dropped crazy amounts toward the end of 2022.)

The whole thing? Up 76 percent in 2023.

The message? Well, diversify might be part of it.

And the answer to the above question: “Could You Have Doubled Your Money?” Yes, had you bought Bitcoin. Or Avalanche. Or DeFi Kingdoms.

Funny thing, this crypto.