If you follow the cryptocurrency space, you might have noticed some wild growth from an altcoin called Dash. On the surface, it might look like the growth stems mostly from hype – why else would a coin’s price go (in USD) from $22 to $115 in less than a month?

If you follow the cryptocurrency space, you might have noticed some wild growth from an altcoin called Dash. On the surface, it might look like the growth stems mostly from hype – why else would a coin’s price go (in USD) from $22 to $115 in less than a month?

But beneath the surface, and beneath the FOMO and FUD, lies a rather sophisticated plan: Dash wants to actually become the everyday “Digital Cash” in your wallet.

“Dash is Digital Cash”

Well, if the website itself leads with that message, then it’s likely that’s what they’re going with: “Digital Cash.” And if you look at some of the places you can spend it and even the debit cards you can get that are tied to your Dash wallet, they’re onto something.

So, generally speaking, it’s just like all the other coins – same concept as Bitcoin, up there near the top of the largest market cap currencies with Ethereum and Monero – leading us to wonder…what really makes it different?

So, generally speaking, it’s just like all the other coins – same concept as Bitcoin, up there near the top of the largest market cap currencies with Ethereum and Monero – leading us to wonder…what really makes it different?

“Dash is what I thought Bitcoin could be”

That quote comes from Amanda B. Johnson, who has fashioned herself as the leading expert on Dash. You can watch an entire interview with her here on something called the “Anarchast:”

If you listen to the interview, even just for a few minutes, you’ll be left with a couple very positive impressions:

- Dash is the most instantaneous of the cryptocurrencies

- Dash has a private setting that can let you remain anonymous

- Amanda is a heck of a brand ambassador for the currency.

Where is this all going? Your wallet, your local store, and the new economy…if Dash itself has anything to do with it.

Dash Evolution

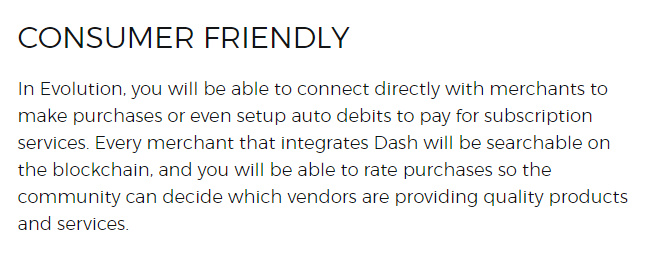

Evolution is their approach to taking digital cash mainstream, ending up on your phone, being used to pay for your latte or your parking or whatever. Don’t believe it? Here’s a screengrab:

“Connect directly with merchants” sounds like they want to cut out the banks and payment processors. (That’s intriguing.) Or there’s an Uber-like, Amazon-esque “you will be able to rate purchases so the community can decide which vendors are providing quality products and services.”

So not only will you be able to pay digitally with Dash, you can also – like Uber, or Amazon – give the merchant 5 stars. Or 1 star.

The future is now in your hands, consumer.

But…what about those merchants?

Evolution might be really bad news for…

Payment processors. Banks. But not merchants.

If you think about the way current payment processing works, you might get a migraine. There are layers and there’s a back-and-forth and everyone tries to get their cut – albeit small – before the money actually hits the merchant’s bank account. It’s that necessary evil that eats away at margins of the pizza place or coffee shop. It’s a whole bunch of “not fun.”

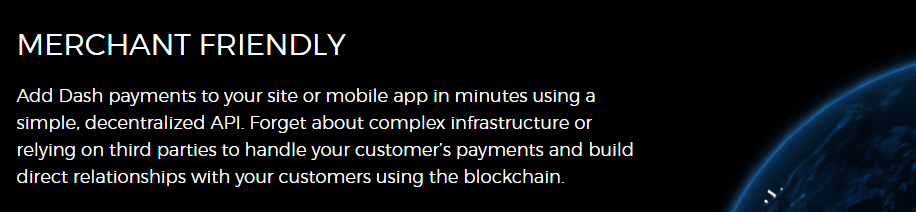

But take a look at this screener from the Dash website:

“Forget about complex infrastructure or relying on third parties to handle…payments” and “build direct relationships with your customers using the blockchain.”

Which could also have been written: “avoid those companies trying to sell you payment processing because you won’t need them.”

What Does It All Mean?

Saying it might mean good things for Dash, its users, and investors might be the understatement of the decade. You have a strong community, coupled with the infrastructure build to support use in the mainstream economy. And you have people like Amanda (really, we’re just scratching the surface, as there’s a whole host of people talking up Dash out there) stumping on the currency’s behalf.

Saying it might mean good things for Dash, its users, and investors might be the understatement of the decade. You have a strong community, coupled with the infrastructure build to support use in the mainstream economy. And you have people like Amanda (really, we’re just scratching the surface, as there’s a whole host of people talking up Dash out there) stumping on the currency’s behalf.

Might be time to give it a serious look.

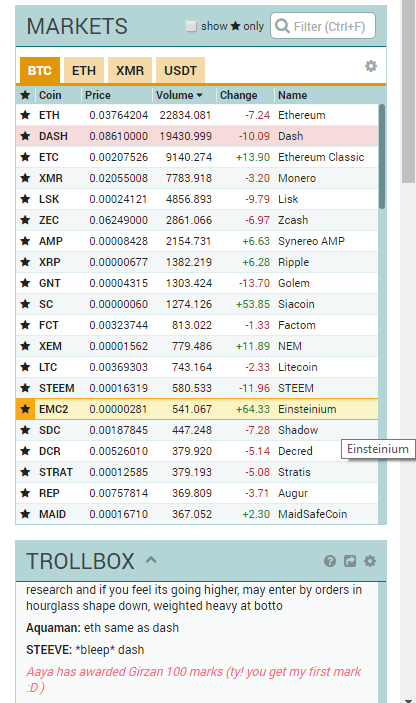

Look at that list…so many coins! So many wild mood swings! So much volatility!

Look at that list…so many coins! So many wild mood swings! So much volatility!