We’re going back to basics today. And we thought we’d use this opportunity to share our Coinbase link – so, in the interest of full disclosure, we could be compensated if you sign up with this link. But, once you spend $100 worth on Bitcoin or Ethereum, you’ll get $10 worth of Bitcoin, too. Win-win.

Basics: What is Coinbase?

Veterans of this space might be surprised when they realize that Coinbase has been around since June 2012. Here’s how they describe themselves.

Founded in June of 2012, Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like Bitcoin and Ethereum. We’re based in San Francisco, California.

And, oh my goodness do they have a foothold on this digital wallet space, having raised more than $117m from leading tech investors and venture capital firms. You can see a complete writeup on Crunchbase, one of our favorite tech info sites.

What’s a Wallet?

It might seem obvious, but it’s worth a mention nonetheless: a wallet is where you store your coins. Read this from Coindesk if you’re looking for more advanced info, but, for now, just think of the basic idea as an old school wallet, like the one you’d put in your pants pocket or purse.

In the typical American wallet, you’re likely to find cash – FIAT CURRENCY! – identification, and maybe some credit cards. Some of what’s in a physical wallet is innocuous, right? I mean, everyone holds onto a fortune from their last trip to the Chinese restaurant, don’t they? But it’s that other information that you guard carefully – your ID card is a pain to lose, and you wouldn’t just give out your credit card number or the CVC code on the back to any random stranger.

Your digital wallet can be looked at the same way – in fact, some of the information that moves Bitcoin (or Ethererum, we’ll use Bitcoin throughout this article as a catch-all for the digital currencies on the Coinbase system) back and forth is better thought of as in a safety deposit box or a safe.

The public component to your wallet is the Bitcoin address, and this is something you can give out to anyone and everyone. This is INBOUND. You can use it as a tip jar, you can ask your Uncle to send you that five bucks worth of Bitcoin he promised for your birthday (ha!).

Here’s our Bitcoin address:

1G8Ayc15sqoyGzN4DFUeheRkgFeS9t6oSW

And our Ethereum address:

0xf0940C79d93E88450aA366238ef8C298Da11EB74

Note that those two look different. Because they’re completely different languages and sets of code.

Adding to your account

Here’s where the FIAT CURRENCY comes in: you’ll need to send money to your account using one of a couple methods. One is to link a bank account, and then your Bitcoin will appear in a few days, once the banking systems talk to each other and confirm your account. The other method is to use a credit card. There’s a fee attached – as there is to the bank account method – but the upside is that your Bitcoin will appear almost instantaneously.

Using Coinbase as your “hub”

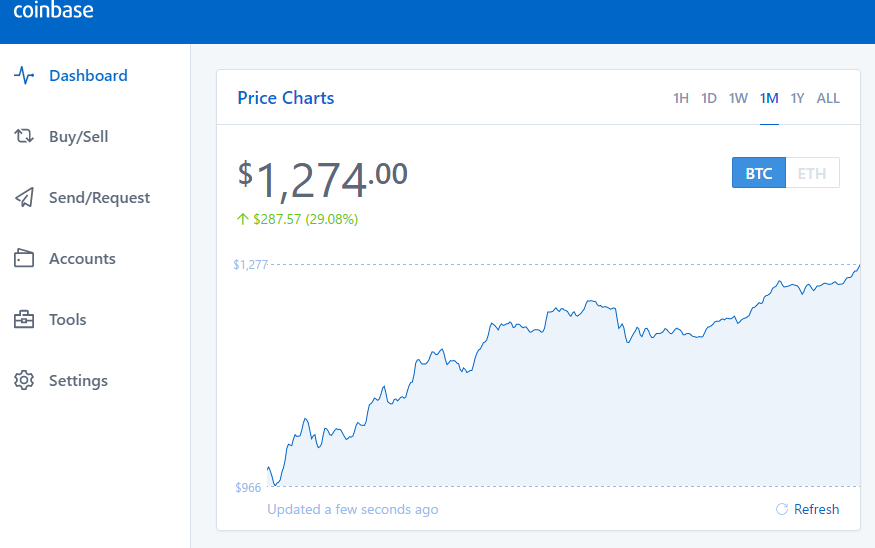

If you’re brand new to Bitcoin, you can totally use Coinbase as your online hub, your gateway to the vast world of cryptocurrency. As you see above, you can get the current price quote, you can buy and sell – trade – your Bitcoin, you can send Bitcoin to folks you owe money to, and request it from folks who owe you money.

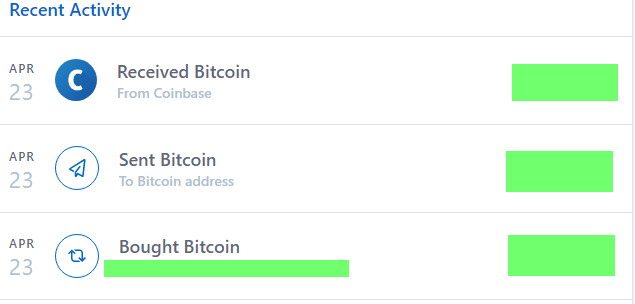

Here’s a snapshot of some of our recent activity.

But, as you might have guessed from some of our other posts here, this is only scratching the surface of our cryptocurrency activity. You can use your account to send money into one of the trading platforms, like Poloniex or Bittrex – two of the ones we use. Or you can invest in an ICO, such as the Exscudo or Sikoba coin offerings we have talked about here.

Only Two Coins?

Despite what the rumor mill might tell you, right now only two coins are on the Coinbase platform: Bitcoin and Ethereum. So if you want to get into other coins, you’ll have to convert them via a trading platform (or an ICO; Gnosis used Ethereum tokens yesterday to raise a crazy amount of capital in their auction). But that’s pretty simple to do.

Pretty simple, right?

Yes, the fine folks at Coinbase have actually made this dummy-proof. Which is one reason they’ve raised so much capital and they’re the wallet of choice here. (It’s not just from that link up there that can score you a Bitcoin bonus with a qualifying purchase, and will also score us a Bitcoin bonus with your qualifying purchase. There’s that “win/win” again.)

Other Coinbase developments

This was mentioned by leading VC Fred Wilson the other day, and, given the growth of Ethereum as the backbone of blockchain applications, it’s probably worth checking out. Token launch from Coinbase.

Last month, we covered the GDAX launch from Coinbase – it’s an important institutional investment milestone for the company.

We’ll keep an eye out for other coins added to the Coinbase site, too.