Really, #DeFi developers, do all of these things HAVE TO BE NAMED AFTER FOOD?

Well, they don’t HAVE to be, but it appears that some of the more interesting concepts in DeFi (Decentralized Finance) actually are named after food. Like $TACO, a platform that we learned about when we were trading $SHRIMP and $SUSHI.

More Than a Cute Logo and a Clever Name

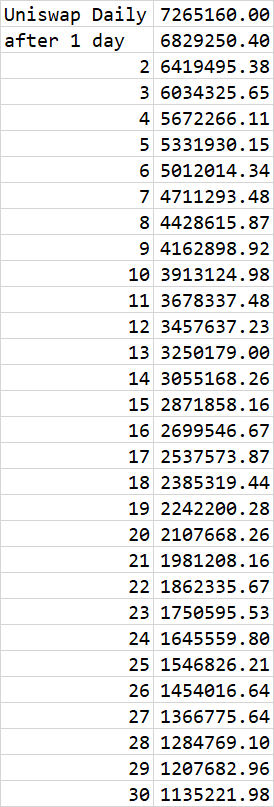

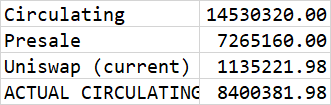

TACOs has turned their brand of deflationary token launch into a game. They have set aside a large chunk of the token supply to be burned: 6 percent of the Uniswap pool gets torched daily.

(Nobody likes to eat burned tacos, but…)

Hey, this does appear to be sorta clever: no more TACOs can be created, and the supply gets “crunched” so that your TACOs become more valuable over time.

It works like this, and we were able to confirm through a couple of “trades” of our own yesterday:

- You decide if you want to “crunch” the outstanding tokens and claim 10 percent of the amount being crunched;

- You pay the gas — we paid $3.12 on one of our transactions yesterday — and have to calculate whether the gas makes up for the value of the tokens;

- You make the transaction and see the 10 percent in your wallet.

But here’s where it gets interesting: you may decide that the gas price is totally worth it, despite only getting (in the above scenario) 42 tokens added to your balance. Given the recent price of just short of 7 cents per token, you’re paying a little more than $3 to get 42 tokens. SO you’ve covered your costs.

In another case, when we decided to say “what the heck?,” we paid 10 cents a token for another 60. We think there’s potential with this platform — in fact, we did the math and the burn rate — or “crunch rate,” even “crunch rate supreme” — might mean that supply gets tremendously sliced over the next month.

This means that on Day 30, $TACO has nearly half of its coins destroyed.

OR…if you check the contract, you realize it’s not moving THAT quickly…

It’s still early and there are some kinks to work out — and the website itself is a little murky on details. BUT, if you’re willing to play a game, and don’t mind the potential that you could be playing a game that could be worthless, spend a little time with a plate full of TACOs.

Leave a Reply